So, everyone’s obsessed with artificial intelligence. It’s driving the market, they say. Honestly, it’s just…a lot. All this talk of S&P 500 jumps…it’s like they want you to feel inadequate if your portfolio isn’t perfectly aligned with the latest algorithm-driven craze. DWS predicts 7,500. Deutsche Bank, 8,000. It’s a competition of who can be more aggressively optimistic. And it’s all based on…spending? Infrastructure? It’s just numbers. Meaningless numbers designed to induce anxiety.

Look, I’m a macro strategist. I deal with actual trends, not hyped-up projections. But fine, let’s play along. If everyone’s going to chase these AI stocks, you might as well try to pick the least offensive ones. I’ve been looking at a couple. And honestly, the whole thing is just… exhausting.

1. Applied Digital

This Applied Digital… they build data centers. Data centers! It’s like they’re trying to bring back the 90s. Apparently, they’re in high demand because of this “high-performance computing” and “AI workloads.” I mean, what does that even mean? They’ve had a good run, up 50% this year already. Of course. Everything goes up for a while. It’s the inevitable fall you have to worry about. And the revenue? A whopping 250% increase. It’s almost suspicious.

They’re working with this company called CoreWeave, apparently a “neocloud” provider. Neocloud. What is this, a science fiction convention? And they’ve got all these hyperscalers lining up to build AI data center capacity. It’s a land grab for… servers? I need a nap. They’ve got a $11 billion pipeline of potential revenue. That’s a lot of zeros. It’s just… overwhelming. And now they’re talking to another hyperscaler. It never ends. It’s like a bad infomercial.

The analysts are predicting a 61% jump in revenue this year, and 57% next year. But they could do better, apparently, if they land this new customer. It’s always “if.” “If” this, “if” that. I’m starting to suspect the entire market is held together by “ifs.” Honestly, I’m expecting this company to overpromise and underdeliver. It’s just the natural order of things.

2. SoundHound AI

SoundHound AI. The name alone is irritating. It sounds like a rejected James Bond villain. They had a terrible 2025, which, frankly, is a good sign. Anything that goes straight up is destined to crash. But now they’re up 11% this year. Of course. The cycle continues. They’re in the “voice AI” market, which, as far as I can tell, involves teaching computers to talk. Like we don’t have enough people talking already.

Apparently, 75% of new contact centers will be powered by generative AI by 2028. What does that even mean? Are the robots going to be answering the phones? Are they going to put me on hold? I shudder to think. They’re integrating their stuff into cars and restaurants. Voice commerce? I can barely operate the self-checkout lane without causing a scene. And drive-thrus? I’d rather just walk in. It’s less stressful.

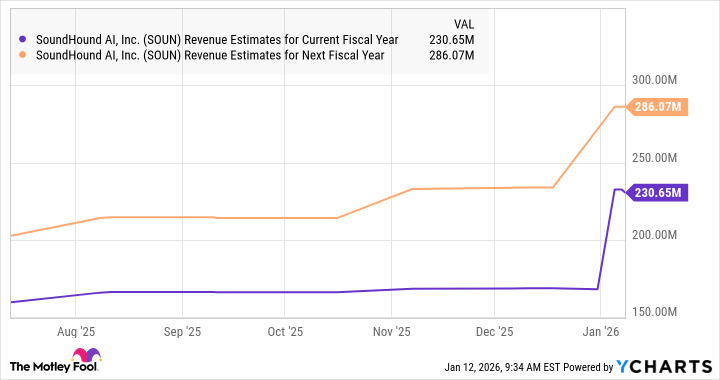

They’re clocking “remarkable growth,” according to the press release. Revenue doubled to $172.5 million. It’s all very impressive. But it’s also… unsettling. They have a $1.2 billion backlog. A backlog! It’s like they’re deliberately creating artificial scarcity. Analysts are predicting more growth. Of course. The analysts always predict more growth. It’s their job.

The median price target is $15.50, which is a 32% jump from current levels. It’s all so predictable. It’s like watching a badly written sitcom. Honestly, I wouldn’t be surprised if SoundHound does even better. They’re growing at a “phenomenal pace.” It’s exhausting just thinking about it. I need a vacation. Somewhere with no algorithms, no hyperscalers, and absolutely no voice-activated assistants.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- The Best Actors Who Have Played Hamlet, Ranked

2026-01-15 16:13