Artificial intelligence (AI) stocks have played a central role in the broader market’s rally in the past three years. Much like a medieval knight charging into battle with a spreadsheet, the AI boom has turned tech into treasure. But let’s not forget-every kingdom needs its knights, and not all of them wear armor.

Nvidia (NVDA) is one of the biggest winners of this AI boom. Its share prices shot up 1,400% during this period, far outpacing the 81% gains clocked by the S&P 500 index. But here’s the catch: if you’re buying a horse, you don’t want to pay for the stable, the hay, and the entire farm. Nvidia’s valuation? A bit of a barn sale.

It is now trading at 28 times sales, a significant premium to the Nasdaq Composite index’s average sales multiple of 5.2. Given that Nvidia’s terrific growth is likely to taper off in the next couple of years, it may not be a good idea to buy this AI stock right now, given its expensive valuation. Or as my grandmother would say, “If the price is too high, the cake is a lie.”

However, there’s another solid alternative to Nvidia in the AI infrastructure market. This stock went public earlier this year, and it has receded nearly 27% from the highs it hit on June 20. Let’s take a closer look at this name and see why this AI stock is a screaming buy right now. (Spoiler: It’s not a typo. The stock is *actually* screaming.)

CoreWeave is set to deliver years of outstanding growth

CRWV”>

CoreWeave is a neocloud company that specializes in offering AI-focused data centers. The company has 33 data centers powered by Nvidia’s GPUs in the U.S. and Europe. It rents out its data center capacity to customers who want to train and deploy AI models. The GPU-as-a-service business model that CoreWeave operates has been a massive success. It gives customers the ability to run AI workloads without having to buy expensive hardware and also helps save on costs associated with managing that infrastructure. (Think of it as a gym membership for AI-no equipment, just results.)

The demand for CoreWeave’s AI data centers is so strong that it gets more business than it can fulfill. The company generated $1.2 billion worth of revenue in the second quarter of 2025, an increase of 207% from the year-ago period. However, it added nearly $14 billion to its revenue backlog as compared to the year-ago period. (If your backlog is bigger than your bank account, you’re doing something right.)

CoreWeave’s backlog doubled in the first six months of 2025. That’s not surprising, as companies need to get their hands on whatever AI cloud computing capacity is available. Importantly, there are no signs of a slowdown in the growth of CoreWeave’s backlog. The company recently landed multibillion-dollar contracts with OpenAI, Meta Platforms, and Nvidia. (Imagine signing a contract with a tech giant and getting a standing ovation from your spreadsheet.)

Meta gave CoreWeave a $14.2 billion five-year contract, while OpenAI signed a contract expansion worth $6.5 billion. OpenAI signed $22.4 billion worth of contracts with CoreWeave this year. Meanwhile, Nvidia struck a $6.3 billion deal with CoreWeave, which allows Nvidia to purchase any remaining AI computing capacity through 2032. (It’s like a buffet: you pay for the meal, but the chef keeps the leftovers for next week.)

These new deals suggest that its revenue backlog could now top the $50 billion mark. That’s pretty sizable for a company that has just over $3.5 billion in trailing-12-month revenue. CoreWeave will be able to convert all that backlog into revenue once it starts building up more capacity. (If you’ve ever waited in line for a concert, you know how patience pays off-just not with tickets.)

The good part is that CoreWeave is working on bringing more data center capacity online. The company had 470 megawatts (MW) of active data center power capacity at the end of Q2. However, its contracted power capacity, which refers to the amount of capacity it has already secured for future data center deployments, stands at an impressive 2.2 gigawatts (GW). (It’s like having a 100-person party in a 10-person house-just add more rooms.)

So, don’t be surprised to see CoreWeave turn its massive backlog into revenue as it brings more data center capacity online. More importantly, the anticipated shortage in AI data center capacity should ensure that whatever capacity expansion CoreWeave plans should be adopted quickly by customers. (It’s the AI equivalent of a sold-out show-everyone wants in, but the venue can’t fit them all.)

As a result, it won’t be surprising to see CoreWeave’s growth outpacing consensus expectations going forward. (Consensus? More like a group of people who still think the internet is a fad.)

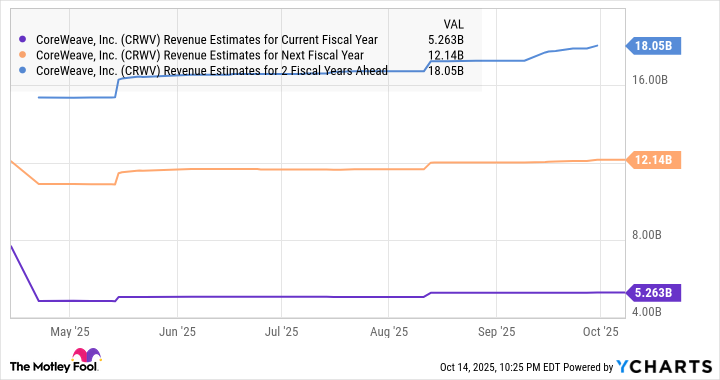

In fact, CoreWeave’s backlog is larger than the combined revenue that analysts expect from the company in the current and the next couple of fiscal years. So, there is a solid chance that it will be able to do better than consensus expectations, and that could pave the way for healthy long-term upside in the stock. (Analysts: “We expected 100, but it’s 1,000. Oh, and also, the sky is falling.”)

CoreWeave’s valuation is attractive when you take its outstanding growth potential into account

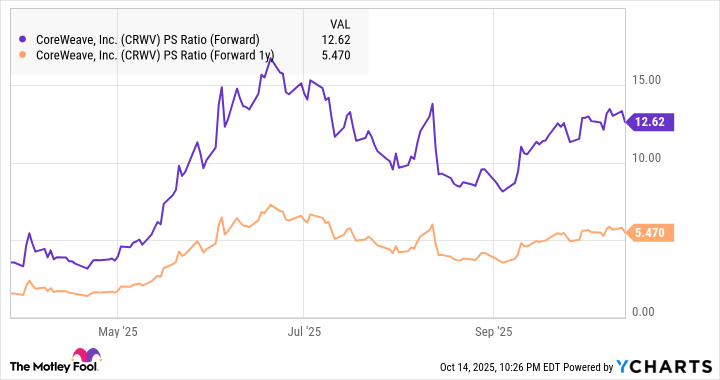

CoreWeave has a price-to-sales ratio of 19. While that’s on the expensive side, investors should note that the stock is significantly cheaper than Nvidia. What’s more, CoreWeave is growing at a faster pace than Nvidia, and it has the potential to sustain elevated levels of growth for a long time to come thanks to its huge backlog, capacity expansion, and the robust demand for AI computing capacity. (Nvidia: “I’m the king of the hill.” CoreWeave: “I’m the hill.”)

Not surprisingly, CoreWeave’s forward sales multiples are much lower.

So, investors looking to buy a top growth stock that’s capitalizing on the booming demand for AI infrastructure can consider taking advantage of the dip in CoreWeave stock as it seems on track to deliver big gains in the next five years. (Dip? More like a dance move. The stock’s got rhythm.)

🚀

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-10-17 11:30