As an experienced analyst, I have closely observed the cryptocurrency market over the past few years and have gained valuable insights into its volatility and trends. Based on my analysis of the year-to-date performance of Dogwifhat ($WIF) and Bonk ($BONK) against Bitcoin (BTC) and the US Dollar (USD), I believe that Bonk ($BONK) presents a better buying opportunity for the remainder of 2024.

Starting on June 18, 2024, the cryptocurrency market continues to exhibit volatility, with Dogecoin ($WIF) and Bonk ($BONK) garnering notable interest from investors. In this examination, we will explore the year-to-date (YTD) trends for $WIF/BTC, $WIF/USD, $BONK/BTC, and $BONK/USD pairs using AI predictions to ascertain which cryptocurrency offers a more promising investment opportunity as we progress deeper into 2024.

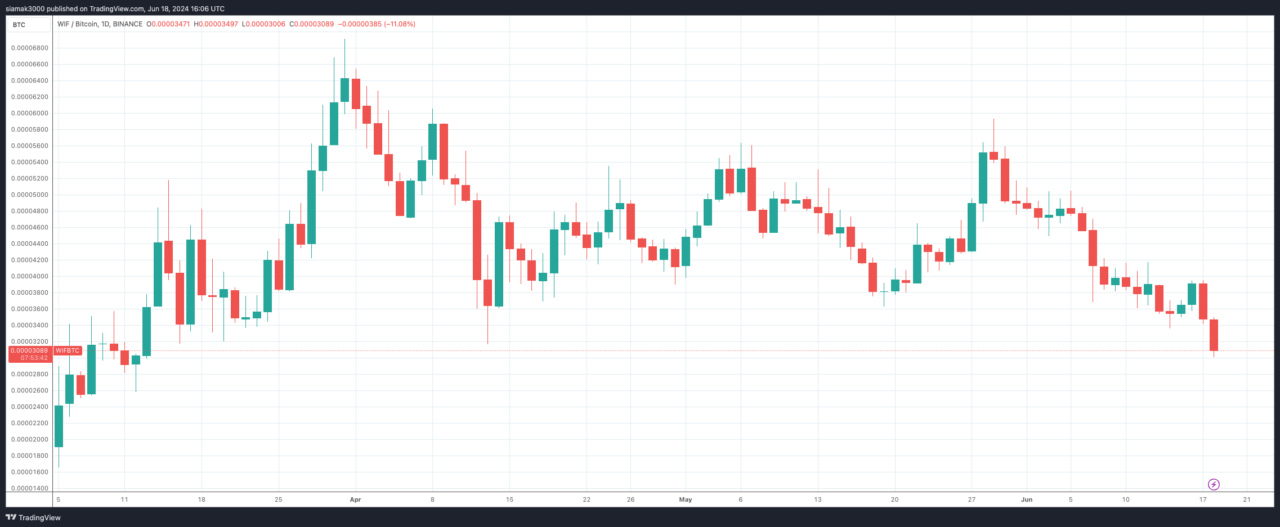

WIF-BTC Analysis

The value of Dogecoin relative to Bitcoin has shown considerable volatility throughout the year. Initially priced very low in January, Dogecoin underwent a remarkable surge in March, touching a high point before correcting once more. Currently, Dogecoin is trading at approximately 0.00000003471 Bitcoins as of mid-June.

Based on the graph, there could be potential areas of support near the current prices. However, the larger trend indicates a need for caution. For investors, it’s essential to observe if the price can consolidate above 0.0000000400 BTC before considering a possible uptrend.

WIF-USD Analysis

As a researcher examining the $WIF-USD chart, I’ve observed notable volatility that mirrors its Bitcoin counterpart. Initially starting the year at minimal levels, $WIF experienced a remarkable rise in March, peaking at approximately $4.8. However, following this surge, it corrected itself and settled around $2.00 in mid-June.

As a crypto investor, I’ve noticed that the market has experienced some corrections recently. However, the price action may indicate a possible rebound if we can hold the current support levels. It would be wise for investors to keep an eye out for a consistent price surge above $2.50 to confirm a bullish trend.

BONK-BTC Analysis

As a crypto investor, I’ve been closely monitoring the BONK–BTC chart and have noticed some considerable volatility in Bonk’s price against Bitcoin. At the beginning of the year, BONK was trading at a lower point. However, there was a remarkable surge in March that took its price to a peak before a substantial correction followed. Currently, the price hovers around 0.000000003227 BTC as of mid-June.

Based on the chart’s analysis, BONK exhibits robust backing at its present levels. However, the downward trend serves as a warning sign. A prudent approach for investors would be to keep an eye out for persistent rises surpassing 0.000000004000 BTC before considering a possible trend reversal.

BONK-USD Analysis

The chart depicting the relationship between Bonk and USD shows Bonk’s rollercoaster ride through the year. It started at roughly $0.0000008, then experienced a significant surge in March, peaking at around $0.0000035. However, this upward trend was followed by a sharp decline, causing the price to dip back down to about $0.0000021 in mid-June.

As a researcher studying the price trends of this particular asset, I’ve noticed that the chart indicates a significant level of support around the $0.0000020 mark. Additionally, the recent surge in price suggests a potential for upward movement. However, it is crucial for investors to keep an eye on the market as a sustained trading above $0.0000025 would be a clear confirmation of bullish momentum.

Conclusion

- Dogwifhat ($WIF):WIF-USD: $WIF saw dramatic gains from extremely low levels to $4.8 but corrected to around $2.00. While there is potential for a rebound, the overall trend remains volatile and uncertain without clear support levels being firmly established.WIF-BTC: Similar to the USD pair, $WIF showed significant fluctuations, with potential support around 0.00000003471 BTC. The trend remains cautious without clear consolidation above 0.0000000400 BTC.

- Bonk ($BONK):BONK-USD: BONK started the year at around $0.0000008 and experienced a significant rally to $0.0000035 in March, indicating strong bullish interest. Despite the correction, the price has found support around $0.0000020 and recently bounced back to $0.0000021. This resilience suggests that BONK has strong support at lower levels and potential for upward movement if it can sustain trading above $0.0000025.BONK-BTC: BONK showed similar patterns of volatility against Bitcoin, with a notable rally and subsequent correction. The current price around 0.000000003227 BTC suggests support at these levels, but the overall trend remains cautious unless it moves above 0.000000004000 BTC.

Based on my analysis of the current market scenario, I believe that investing in Bonk ($BONK) could be the safer and more potentially rewarding option for the rest of 2024. This assessment is derived from several factors. Firstly, BONK has demonstrated stronger support levels compared to other assets, which suggests it may be less volatile during market corrections. Secondly, its resilience in bouncing back after price drops indicates a certain level of stability and robustness. Lastly, if BONK can sustain trading above key resistance levels, there is potential for significant upward movement. Nevertheless, I strongly advise investors to carry out their own research and carefully consider their risk tolerance before making any investment decisions.

As a cautious analyst, I feel compelled to issue a vital caveat: The insights and forecasts presented here are the product of artificial intelligence. The cryptocurrency market is renowned for its volatility, making this information neither a substitute nor an endorsement for financial advice in any capacity. Prospective readers are advised to be fully aware of the substantial risks associated with investing in cryptocurrencies and perform their own research or consult with a certified financial advisor before taking any investment actions based on this analysis. In no event should decisions regarding finances be reliant solely on this analysis.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- USD ILS PREDICTION

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Everything We Know About DOCTOR WHO Season 2

- 9 Kings Early Access review: Blood for the Blood King

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

- Every Minecraft update ranked from worst to best

2024-06-18 19:29