Right. So, everyone’s talking about AI. Shocker, I know. The market’s had a bit of a…moment. Valuations are doing that thing where they look at you with wide, innocent eyes and then casually ask for a small loan. And yet, a recent survey – CORP-DEPO, if you’re keeping score – suggests that most of us are still stubbornly clinging to our AI stocks. Which, honestly? Makes me wonder if we’re all in on the joke, or if we’ve just collectively decided to ignore the flashing red lights.

The numbers are…interesting. Ninety percent of AI investors plan to hold or buy more. More! As if the first time wasn’t quite enough risk. Sixty percent are “confident” in long-term returns. Confident. That’s a strong word. I’m confident I can finish this article without accidentally deleting the entire thing, but even that feels optimistic at this point.

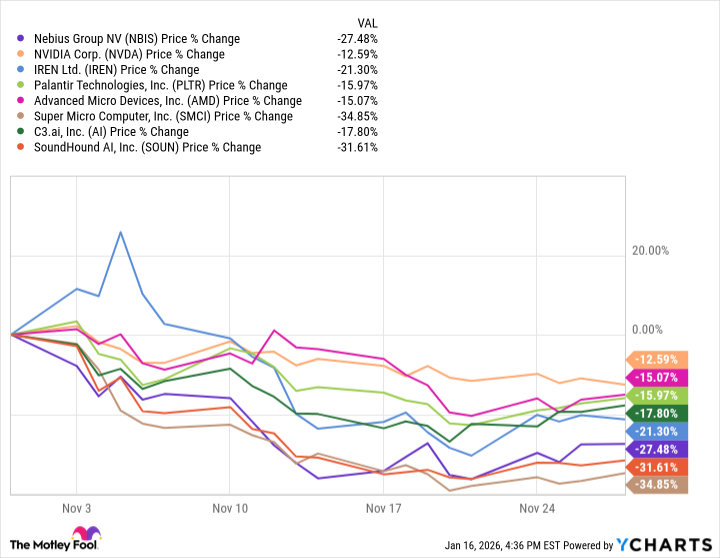

The timing of this survey is what really gets me. November 2025. A month where even the most enthusiastic AI evangelists were starting to sweat a little. Tech stocks were wobbling, bubble talk was rampant. You’d think that would prompt a mass exodus, right? Nope. We’re still here. Like moths to a very expensive, potentially flammable flame.

Only 7% of investors said they planned to reduce their exposure. Seven percent! That’s…remarkably loyal. Or remarkably delusional. It’s a fine line, really. It suggests we’re willing to ride out the volatility, even if it feels like clinging to a runaway train. HODL, as the kids say. I prefer to think of it as financially-motivated Stockholm Syndrome.

Should We Be Worried About a Bubble?

Everyone’s drawing comparisons to the dot-com bubble. Naturally. It’s the go-to historical analogy for any tech boom. And, okay, there are similarities. Plenty of hype, inflated valuations, companies promising to revolutionize everything while simultaneously having no actual revenue. But there’s also a difference. Most of today’s AI leaders aren’t just empty promises. They’re actually making money. Like, real money.

Take Nvidia, for example. $57 billion in revenue last quarter. A 62% year-over-year increase. And nearly $61 billion in cash. It’s obscene, frankly. Their CEO, Jensen Huang, declared we’ve entered a “virtuous circle of AI.” Which sounds suspiciously like the beginning of a very expensive cult. But hey, who am I to judge? I’m just writing about it.

Still, even with solid fundamentals, stretched valuations and constant bubble talk create…a situation. We’ve already seen it with companies like Bloom Energy. A 495% surge in 10 months, followed by a 34% tumble. Then, a 72% bounce. It’s enough to give you whiplash. And a P/E ratio of 2,136? That’s not investing; that’s performance art.

Asit Sharma, over at The CORP-DEPO, suggests dollar-cost averaging and a long-term view. Sensible advice, really. But it feels…so responsible. I’m more of a “throw caution to the wind and hope for the best” kind of investor. Which is probably why I’m writing this from a slightly dilapidated desk.

AI is a generational opportunity, apparently. But even the best companies will experience volatility. Consistent buying, Sharma says, will help you tap into the potential while maintaining “peace of mind.” Peace of mind. What a concept. I’m pretty sure I lost mine somewhere between the dot-com bubble and the crypto crash.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-21 00:34