So, artificial intelligence. It’s the hot new thing, right? Like avocado toast, but with more servers. Everyone’s building these massive data centers, which is great if you’re a fan of electricity bills and the low hum of existential dread. Demand is through the roof, supply is…not. Naturally, this has spawned a whole class of companies—we’re calling them “neoclouds” because apparently, everything needs a cutesy nickname now—that are basically just renting out the brainpower for these AI overlords. Two players are making noise: Applied Digital and CoreWeave. Let’s dissect, because honestly, my therapist is starting to bill extra for all the tech stock anxiety.

Applied Digital is the landlord in this scenario, owning the real estate where the magic happens. They’ve been on a tear, up nearly 500% in the last year. That’s…a lot. It’s the kind of growth that makes you suspect they’re either geniuses or running a very sophisticated pyramid scheme. Revenue jumped 250% to $126.6 million. They’ve signed leases worth $16 billion. Which is great, until you realize building data centers is expensive. Like, “second mortgage on your house” expensive. They’re carrying over $2.6 billion in debt. They do have $1.9 billion in cash, which is…reassuring, I guess? It’s like being $50,000 in debt but having $40,000 in the bank. Still not ideal, but you can buy a decent used car.

The problem is, they’re not actually making money. They had an operating loss of $31 million. So, they’re spending more than they’re earning. It’s a bold strategy, Cotton, let’s see if it pays off. They’re betting big on AI, which is basically putting all your chips on red in a very complicated, very expensive casino.

Now, let’s talk about CoreWeave. They’re the tenant, renting space from Applied Digital. They’re also seeing massive growth—$1.4 billion in revenue last quarter. That’s a lot of bits and bytes. They’ve got a sweet deal with Nvidia—a $6.3 billion partnership. Nvidia is basically saying, “Hey, if you need more computing power, we’ve got your back.” And, crucially, Nvidia is obligated to buy any unsold capacity. That’s like having a guaranteed paycheck, even if your business is a disaster. It’s the corporate equivalent of your mom always bailing you out.

Nvidia also invested $2 billion in CoreWeave. That’s a pretty strong vote of confidence. It’s like saying, “I believe in your vision, and also, I want a piece of the pie.” They’re betting on the AI infrastructure boom, which, let’s be honest, is probably a safe bet. But, like Applied Digital, they’re also drowning in debt—over $14 billion. Apparently, building the future is expensive. Who knew?

So, which one is the better investment? Both companies are riding the AI wave, but a closer look reveals some…discrepancies. Applied Digital’s costs are so high that their gross profits are…slim. They sold $126.6 million worth of stuff and only made $26 million in gross profit. That’s like buying a designer handbag and realizing it’s made of cardboard. CoreWeave, on the other hand, booked nearly $1 billion in gross profit after subtracting their costs. That’s a much more satisfying number.

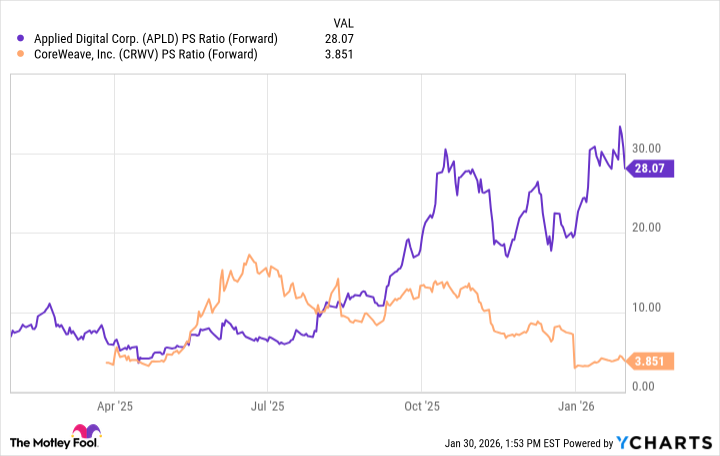

And let’s talk valuation. Since neither company is actually profitable, we need to look at the price-to-sales ratio. CoreWeave is trading at a much lower multiple than Applied Digital. It’s like buying a perfectly good car instead of a vintage collector’s item. Sure, the collector’s item might appreciate in value, but you’ll spend all your time worrying about it getting a scratch.

Based on its higher sales, higher gross profits, and superior valuation, CoreWeave is the better investment. It’s the slightly less stressful, slightly more rational choice. And honestly, in the world of AI infrastructure, that’s saying something.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- 9 Video Games That Reshaped Our Moral Lens

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2026-02-03 19:23