My aunt Mildred, bless her, decided last Tuesday that she was going to invest in “artificial intelligence.” She doesn’t understand how her microwave works, but she saw a commercial with a robot vacuum and figured she was on the verge of early retirement. It reminded me, frankly, of the tech bubble, only instead of Pets.com socks, it’s…well, more clouds. Digital clouds, to be precise. And everyone is scrambling for a piece.

The pitch is simple enough. These AI things need power, and lots of it. Training these models is like running a small city, and then actually using them—the “inference” stage, they call it—is like adding another city on top. So, the cloud providers are, predictably, thrilled. The big ones, like Alphabet, can probably handle it, but then you have the smaller players, the upstarts, the companies trying to carve out a niche. I’ve been looking at two of them: Nebius and CoreWeave. Mostly because my broker suggested them, and I’m a sucker for a good suggestion, even if it’s probably terrible.

Nebius, it turns out, is all about “essential resources.” They offer everything you need for your AI journey, which sounds suspiciously like a timeshare presentation. They’ve signed deals with Microsoft and Meta, which is impressive, if you ignore the fact that Microsoft and Meta sign deals with everyone. It’s like a corporate version of collecting stamps. Apparently, they sold out of all their capacity. Which is great for them. I’m just picturing a warehouse full of blinking servers, desperately trying to keep up. They’ve raised over four billion dollars, which, let’s be honest, is just a lot of money. They’re buying GPUs, land, and other assets, presumably to build even more blinking servers. It’s a self-perpetuating cycle.

Then there’s CoreWeave. They’re focused on Nvidia GPUs, which makes sense, since Nvidia seems to own the entire AI market at this point. They were the first to offer Nvidia’s Blackwell platforms, which is like being the first to sell fidget spinners. It’s a temporary advantage. Nvidia has a lot of money invested in CoreWeave, which is either a vote of confidence or a strategic takeover in the making. It’s hard to tell. Like Nebius, they’re also seeing triple-digit revenue growth. Which, again, is great for them. I’m just wondering if anyone is actually making a profit, or if we’re all just shuffling money around until the music stops.

Wall Street, predictably, is enthusiastic about both of these companies. Analysts are predicting a 43% increase for CoreWeave and a 67% increase for Nebius. Which means, of course, that the stocks are probably already overpriced. My aunt Mildred would be thrilled. She doesn’t understand price targets, only potential gains. I tried to explain the concept of risk to her, but she just started talking about her robot vacuum again.

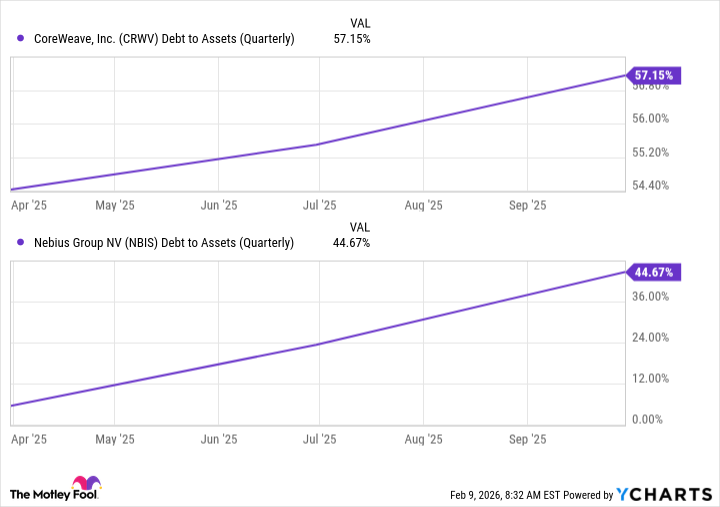

So, which is the better buy? Honestly, I have no idea. Both of these companies are riding the AI wave, and the wave could crash at any moment. Nebius might be slightly less risky, simply because they haven’t borrowed quite as much money. But that doesn’t mean they’re a good investment. It just means they might not go bankrupt quite as quickly. If you’re a cautious investor, you should probably stay away. If you’re a growth-focused investor, well, good luck. And maybe send me a share or two if it works out. I’m starting to think my aunt Mildred might be onto something. Or maybe we’re all just delusional.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-10 19:12