Right. So, everyone’s throwing money at AI, which, let’s be honest, feels a bit like that friend who suddenly becomes an expert in something after reading a Wikipedia article. FactSet Research says we’re looking at half a trillion dollars this year just on infrastructure. The usual suspects – Microsoft, Alphabet, Amazon, Meta, even OpenAI – are basically building digital kingdoms. Which, fine. It means data centers, chips… the whole shebang. And it means, if you’re paying attention, there’s money to be made. But let’s skip the obvious, shall we? Everyone’s chasing Nvidia like it’s the last chocolate biscuit. I’m looking for something… a little less crowded.

1. Broadcom

Broadcom. Now, they’re not exactly flashy, are they? They’re the unsung heroes, the plumbing of the internet, quietly ensuring everything else functions. Everyone gets excited about the GPUs, the shiny bits that actually do the AI magic. But who builds the stuff that connects it all? Broadcom. They make the networking gear, the switches, the interconnects… the stuff that keeps the whole data center from collapsing into a digital heap. It’s not glamorous, but it’s essential. And, frankly, it’s where the real, consistent money is.

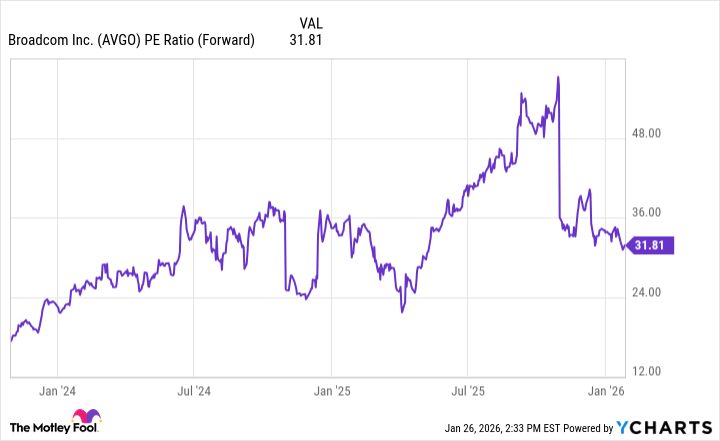

And here’s the really interesting bit. While everyone’s obsessing over what AI can do, the hyperscalers are starting to realize they need custom solutions. They want to build their own silicon, and guess who’s helping them? Broadcom. They’re working with Apple, Alphabet, ByteDance, Meta… the big players. It’s a quiet power move, and it’s incredibly smart. Almost 100% of analysts rate it a buy, which, admittedly, always makes me slightly suspicious. But the valuation? Actually, it’s… reasonable. Which, in this market, is practically a miracle. I’m buying.

2. Taiwan Semiconductor Manufacturing

this is my kind of play. It’s the pick-and-shovel stock, as they say. Except, it’s less about striking gold and more about quietly profiting from everyone else’s obsession with it. They don’t make the AI chips. They make the chips that make the chips. Nvidia, AMD, Micron… they all outsource to TSMC. They’re the largest chip manufacturer in the world, holding about 70% of the market. That’s… a lot of chips.

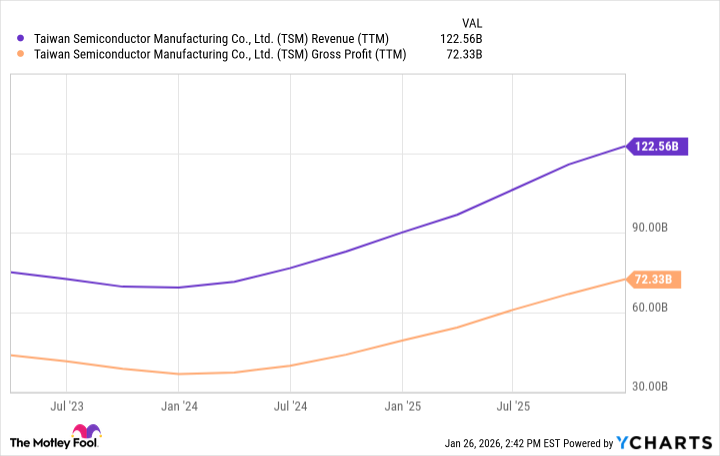

For years, the semiconductor industry was a rollercoaster. Cyclical, unpredictable… a headache. But AI has changed everything. Suddenly, demand is constant. Hyperscalers are throwing money at TSMC, and they’re not slowing down. The company’s revenue and profitability are accelerating faster than Wall Street anticipated, which, let’s be honest, is saying something. They’re guiding for further growth, and I actually believe them. It’s… unnerving.

New applications are entering the market, workloads are expanding… big tech needs capacity, and they need it now. They need general-purpose chips, they need custom chips… they need TSMC. Honestly? I think it’s the most underrated AI stock of the decade. And, frankly, I’m loading up before everyone else realizes it. Don’t judge me. It’s a gut feeling. And my gut is usually right… about these things, anyway.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- Nvidia vs AMD: The AI Dividend Duel of 2026

- Where to Change Hair Color in Where Winds Meet

2026-01-30 10:33