Behold, the stock of AGNC Investment—a labyrinth of financial intricacy, where the investor’s soul is both tested and tormented. To comprehend its nature is to confront the abyss of complexity, where the mind wrestles with the paradox of yield and risk, of hope and despair. For some, it is a beacon; for others, a shadow that lingers too long in the corridors of the portfolio.

Why the Investor Might Be Tempted

AGNC Investment, a mortgage real estate investment trust, is a creature of shadow and light. It purchases securities born of pooled mortgages, a dance of numbers and uncertainty. The investor, like a pilgrim in a foreign land, must grapple with the forces that shape its fate: interest rates, housing markets, and the fickle rhythm of repayment. Management, with its feverish calculations, seeks to outpace the cost of capital, yet the path is fraught with the weight of human frailty.

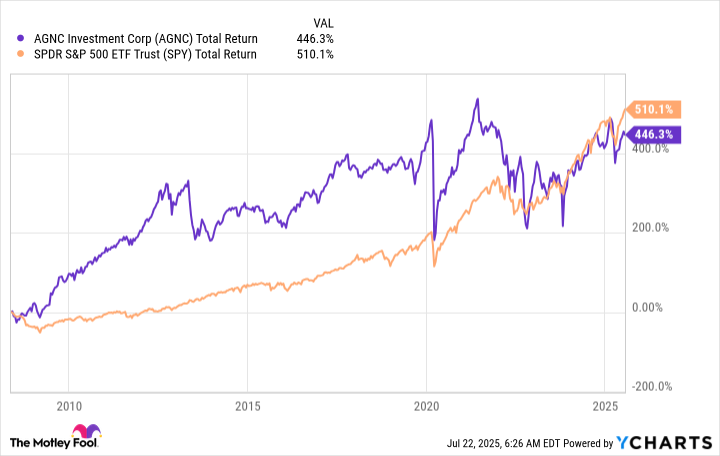

Yet, in the longue durée, AGNC has shown a resilience that rivals the S&P 500. Its total return, though divergent in character, offers a counterpoint to the index—a melody of diversification that may soothe the restless spirit of the investor. To embrace AGNC is to accept the gamble of a different rhythm, a cadence that may or may not align with the heart’s deepest desires.

But lo! The dividend, that elusive specter, flickers with a volatility that mirrors the investor’s own trembling soul. It is a force both alluring and treacherous, its decline a testament to the futility of clinging to fleeting gains. To live off its income is to court a fate as uncertain as the tides, for the stock’s price follows the dividend’s descent like a shadow cast by a dying sun.

And yet, AGNC is not a villain. It is a mirror held to the mREIT space, where the very nature of mortgages binds it to a cycle of decline. Each payment, a drop of interest and a sliver of principal, flows to shareholders like a balm, yet the portfolio, the very essence of the business, shrinks with each passing day. The dividend investor, seeking growth, finds only the echo of a fading promise.

To invest in AGNC is to stand at the crossroads of hope and despair. The potential for rate cuts may ignite a flicker of salvation, yet the investor’s soul remains shackled to the relentless march of time. Here, in this financial abyss, one must ask: is the pursuit of total return worth the price of a fractured psyche?

Thus, the question lingers, heavy as lead: a buy or a sell? A choice not merely of numbers, but of the heart’s deepest yearnings. The market, like a cruel god, offers no answers—only the silence of the void, and the echo of one’s own trembling.

🧠

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- HSR Fate/stay night — best team comps and bond synergies

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Top gainers and losers

2025-07-28 03:07