AGNC Investment (AGNC 0.48%) currently offers a dividend yield that resembles a small principality’s annual revenue – a hefty 12.5%. The S&P 500 (^GSPC 1.57%), by comparison, trickles along with a yield barely enough to buy a decent cup of coffee. And the average Real Estate Investment Trust? A respectable, but rather pedestrian, 3.8%. Now, before you rush off to mortgage your goblin collection, let’s unpack this. It’s rarely quite as simple as it looks.1

What Does AGNC Investment Actually Do?

A traditional REIT, you see, deals in bricks and mortar – actual buildings, leased to actual tenants. Understandable. Reliable. Like a dwarf crafting a particularly sturdy table. AGNC, however, operates in the somewhat more ethereal realm of mortgage-backed securities. It doesn’t own the houses; it owns the promises of houses. It buys and sells these bundles of mortgages, which is less like being a landlord and more like being a very sophisticated (and slightly unsettling) pawnbroker. It’s a business built on other people’s debts, and that, my friends, is always interesting.2

This means that while dividends are a necessary offering to shareholders – a sort of tribute to keep the investment gods appeased – management isn’t solely focused on the immediate payout. They’re looking at “total return” – the dividends plus any change in the price of the shares. Essentially, they’re assuming you’ll reinvest those dividends, turning them into more shares, and hoping the whole thing grows like a particularly stubborn fungus.

A Word to the Income Seekers

If you’re the sort of investor who relies on dividends to fund your retirement, or perhaps your collection of miniature dragons, you might find AGNC…disappointing. The dividend hasn’t been a consistent friend. It’s been rather volatile over the years, trending downwards like a disgruntled gnome. And, unsurprisingly, the share price has followed suit. A dwindling income and a shrinking pile of capital? Not a recipe for a happy retirement, unless your idea of happiness involves eating gruel.

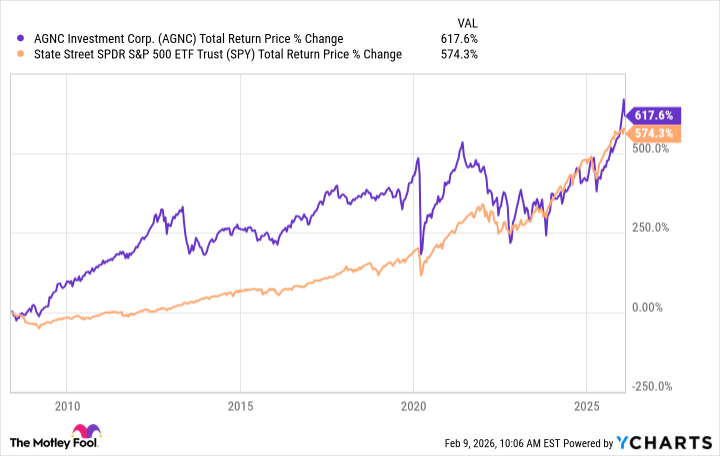

However, if you’ve been diligently reinvesting those dividends since AGNC first appeared on the scene (its Initial Public Offering, or IPO), the story takes a rather unexpected turn. As the chart above demonstrates, on a total return basis, AGNC has actually outperformed the S&P 500. It’s a bit like discovering that a seemingly useless swamp hag is actually a powerful sorceress. The returns aren’t identical, mind you, suggesting that adding AGNC to your portfolio might offer a bit of diversification – a sort of magical shield against the unpredictable whims of the market.

Not a Golden Goose, But Not a Bad Beast Either

The key, as with any investment, is to know what you’re looking at. If you’re a dividend hunter, AGNC is likely to leave you feeling peckish. But if you’re focused on long-term total return, this mortgage REIT might just be the peculiar sort of treasure you need to help you reach your financial plateau. It’s not a guaranteed path to riches, of course. No investment is. But in a world obsessed with instant gratification, a bit of patient, long-term thinking can go a surprisingly long way.

1The Guild of Alchemists and Venture Capitalists, you see, has a saying: “Anything that looks too good to be true probably involves a small dragon and a complicated contract.”

2It’s a bit like owning a share in everyone’s mortgage. Which is either brilliantly clever or deeply unsettling, depending on your perspective.

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Silver Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- NEAR PREDICTION. NEAR cryptocurrency

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Top 15 Insanely Popular Android Games

- USD COP PREDICTION

2026-02-13 17:12