The chronicles of commerce reveal a familiar pattern: a swelling of fortunes, a reaching for the heavens, and then—inevitably—the descent. AeroVironment (AVAV 1.10%), purveyor of unmanned aerial vehicles and, increasingly, ambitions in the orbital sphere, has experienced such a lift, followed this week by a precipitous fall of over twenty percent. The proximate cause, as reported by market intelligence, is a work stoppage on a U.S. military project. But to view this merely as a setback is to miss the deeper malaise—the structural vulnerabilities inherent in a system predicated on unsustainable growth and the transfer of risk.

Despite this recent disquiet, the stock, it is noted, remains elevated—seventy percent higher than it was twelve months prior. A testament, not to enduring value, but to the fleeting nature of speculative enthusiasm. The question, then, is not merely whether to ‘buy’ this stock, but whether to acknowledge the precariousness of a prosperity built on shifting sands.

The Burden of Orbital Ambition

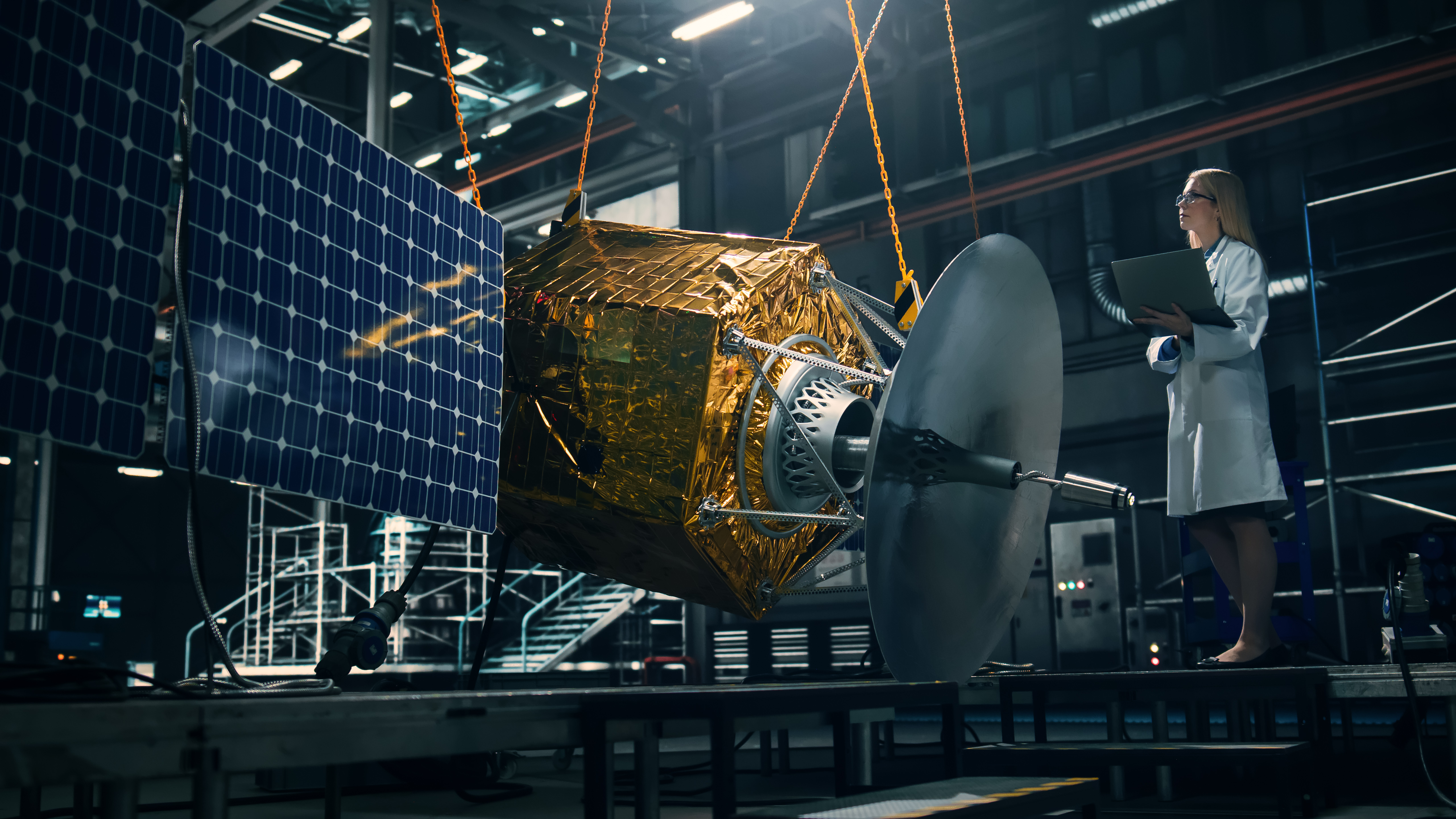

AeroVironment, initially known for its ‘Kamikaze’ drones—a grim nomenclature reflective of the times—now seeks to expand its dominion into the realm of satellite technology and cyber warfare. The ‘Golden Dome’ project, and the associated BADGER system—a ground support communication network for satellites—represent a calculated gamble on escalating military expenditure in space. The promise is to manage multiple orbiting platforms, boasting resistance to damage and interference. A laudable ambition, perhaps, if not for the manner in which it is financed and the burdens it places upon the contracting entity.

This week’s work stoppage concerning the BADGER system reveals a critical flaw. The U.S. government, in its wisdom, has imposed a halt, demanding renegotiation due to ‘new capabilities’ deemed necessary. But the more telling detail is the ‘fixed price’ nature of these contracts. A curious arrangement, whereby the burden of cost overruns—the inevitable consequence of complex technological endeavors—falls not upon the state, but upon the contractor. A convenient absolution of responsibility, and a potent disincentive for honest accounting.

The potential rewards—’hundreds of millions, even billions’—are dangled before the company. But such sums, earned under conditions of such inherent risk, carry a moral weight. To profit from the anxieties of nations, while simultaneously shifting the financial burden onto the shoulders of those who innovate, is a practice worthy of scrutiny.

A Reckoning in the Making?

The current market capitalization of $15 billion—a figure that, even after this week’s correction, remains stubbornly high—belies the underlying fragility. The price-to-sales ratio of 8.6, coupled with a persistent lack of operating earnings, speaks volumes. Revenue has indeed grown—a staggering 250% in the last five years—but this growth has not translated into genuine profitability. A phantom prosperity, sustained by the hope of future earnings, rather than the reality of present value.

The year 2026, it is anticipated, may well continue this trend of financial loss. And should cost overruns materialize on the BADGER system—a near certainty, given the circumstances—the stock price may fall further. To purchase shares at this juncture is not to embrace opportunity, but to participate in a gamble—a wager on the continuation of unsustainable practices. It is a transaction best viewed not with anticipation, but with a sober assessment of the risks—and a recognition of the human cost of unchecked ambition.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- DOT PREDICTION. DOT cryptocurrency

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- NEAR PREDICTION. NEAR cryptocurrency

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Top 15 Insanely Popular Android Games

- USD COP PREDICTION

2026-01-23 21:42