![]()

Shares of Aehr Test Systems (AEHR +27.69%) experienced a rather energetic upward trajectory on Wednesday, rising with the sort of enthusiasm usually reserved for escaped laboratory experiments. It peaked at a 39.7% increase shortly after the opening bell, before settling down to a still-respectable 25% gain by mid-afternoon. This, as far as we can ascertain, is a direct result of a new contract in the increasingly vital, and slightly terrifying, field of artificial intelligence (AI) chip testing. It’s a good time to be testing things, apparently. Especially if those things are trying to take over the world. (Though they haven’t explicitly said that’s the plan. Yet.)

Someone Important Called. It Wasn’t the Police.

One of Aehr’s top customers – a being of considerable technological power, no doubt – has ordered several Aehr Sonoma test and burn-in systems, with delivery scheduled for the summer of 2026. Aehr, in a display of commendable discretion, hasn’t named this customer. They’ve merely described them as a “world-leading hyperscaler” and a “premier large-scale data center provider” who also designs high-performance AI accelerator chips. (Which sounds suspiciously like someone building a very large brain. But we digress.) This narrows the field of suspects down to a handful of companies capable of both housing enough servers to power a small country and designing the chips that make it all possible.

Aehr has been hinting at this deal for months, which is a bit like watching a particularly slow-motion avalanche. It’s impressive, certainly, but you knew it was coming. The important bit is that it’s now a firm contract, with actual revenue attached. (Revenue, that curious substance that allows companies to continue existing. A truly baffling concept, when you think about it.)

Financial details remain elusive, shrouded in the usual corporate mystery. But early projections suggest a significant impact on Aehr’s top and bottom lines, starting in Q2 2026. (Which, if our calculations are correct, is still some time away. Time, that relentless river carrying us all towards… well, you know.)

“We believe this initial production order positions Aehr very well for high-volume system and consumable shipments later this year and into 2027,” said CEO Gayn Erickson. (A perfectly reasonable statement, considering the circumstances. Though it does raise the question of what happens if the chips don’t work. But let’s not dwell on that.)

Wall Street and the AI Connection: A Symbiotic Relationship

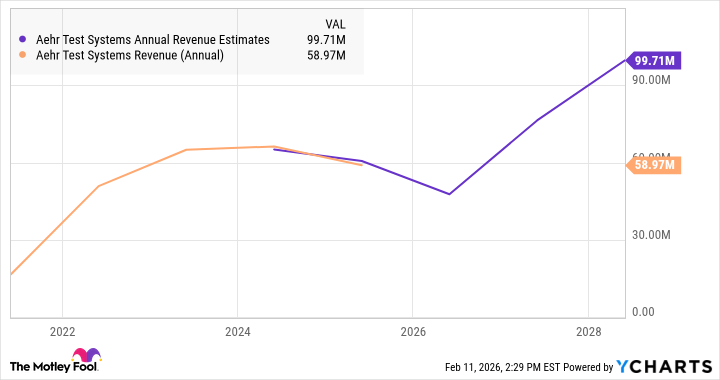

This new contract firmly places Aehr at the epicenter of the ongoing AI boom. And Wall Street, predictably, has taken notice. The stock is up by 238% over the last year, and currently trades at 459 times forward earnings estimates. (Which is, shall we say, optimistic. It’s like betting on a horse that hasn’t been born yet. A very, very expensive horse.) This is especially remarkable considering the company’s negative operating margins and revenue trends. Investors, it seems, are baking a truly colossal amount of growth expectation into the stock price.

One large contract, while encouraging, is hardly a guarantee of continued success. Aehr’s stock could certainly climb higher as the AI surge continues. However, a more compelling narrative would involve securing additional deals across the hyperscaler sector. (Diversification, after all, is the spice of life. And the safeguard against existential corporate risk.) For now, I’d prefer to stick with more profitable rivals, and stocks that don’t require quite so much faith in the future.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-11 23:02