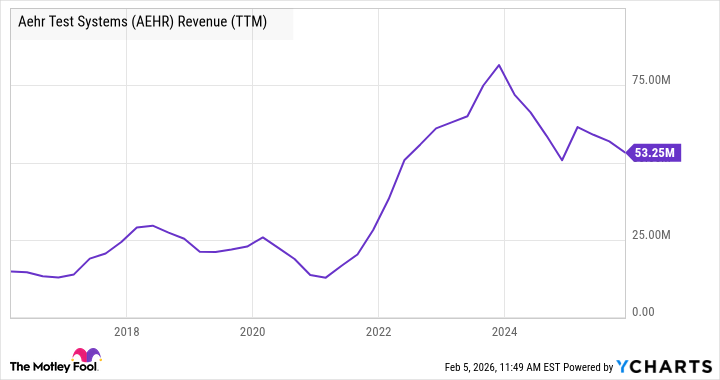

Aehr Test Systems (AEHR 3.10%) experienced a rather enthusiastic upward twitch in January – a 27% surge, according to those diligent number-counters at S&P Global Market Intelligence. It remains, as of this writing, a respectable 15% up for the year. This isn’t, of course, to suggest the stock is defying the fundamental laws of physics (though, frankly, given the current state of everything, one wouldn’t entirely rule it out). Rather, it appears Aehr’s strategic re-orientation toward the AI processor market is, shall we say, bearing fruit. Or, more accurately, silicon.

Aehr Test Systems’ Pivot

Aehr manufactures equipment for testing semiconductors – ensuring they don’t, you know, spontaneously cease functioning. A critical service, naturally, as a malfunctioning chip can cause issues ranging from mild inconvenience to catastrophic failure – particularly in electric vehicles (EVs), where a sudden loss of power tends to be frowned upon. The EV sector, specifically silicon carbide (SiC) chips, was once Aehr’s primary haunt. Sales boomed during the lockdowns (a period of heightened optimism, now largely regarded as a collective delusion), only to…adjust…when the anticipated automotive revolution failed to materialize quite as spectacularly as some had hoped. (It’s always the hopes, isn’t it?)

However, the universe, in its infinite wisdom (or perhaps indifference), rarely leaves a vacuum. EVs aren’t the only industry deeply suspicious of unexpected component failure. Aehr has therefore embarked on a course correction, focusing on burn-in test systems for those building AI processors. A sensible move, one might say, though whether it’s actually sensible in the grand cosmic scheme of things remains an open question. (The answer, of course, is 42. But don’t ask what the question is.)

Aehr Test Systems is About to Take Off

Last year, Aehr secured an undisclosed customer – described by management as a “world-leading hyperscaler.” A term which, translated from marketing-speak, means “a very large company that owns a lot of servers.” Orders have already begun to flow. The real acceleration, however, is anticipated in the current financial year. (Time, naturally, being a purely relative concept.)

For those keeping track (and frankly, who isn’t?), Aehr reported its second-quarter 2026 earnings (ended Nov. 28) in January. Thus, when management projects bookings of $60 million to $80 million for the second half of the year, they’re referring to the period spanning late November to late May. A rather arbitrary slice of time, when you consider the age of the universe, but useful for quarterly reports.

This booking expectation is, shall we say, significantly higher than the $6.2 million reported in the previous quarter. In fact, at the midpoint, it’s approximately 1.5 times Wall Street’s revenue expectations for Aehr in 2026 – a figure of $47 million. (Numbers. They’re everywhere. One wonders if they actually mean anything.)

Where Next for Aehr Test Systems

Now that CEO Gayn Erickson has publicly stated this figure, investors will naturally expect Aehr to achieve it. And then, presumably, to announce further order growth. Meanwhile, the EV market, while not quite the runaway success some predicted, will likely stabilize and eventually expand, as lower interest rates and a general acceptance that internal combustion engines are somewhat passé begin to take hold. Combined with the nascent but accelerating demand from AI processors, Aehr appears to be poised for a…well, a future. A bright one, perhaps. Or at least, one that isn’t immediately followed by a catastrophic implosion. (One can always hope.)

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- The Best Actors Who Have Played Hamlet, Ranked

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Games That Faced Bans in Countries Over Political Themes

2026-02-05 22:02