One returns, year after year, to the name of Advance Auto Parts. The proposition remains stubbornly the same: a belief, perhaps naive, that with a little… adjustment, a little mirroring of competitors like AutoZone and O’Reilly Automotive, the stock might finally reveal a value commensurate with its existence. Previous attempts at improvement, one notes, have dissolved like morning mist. This latest restructuring, however, possesses a certain… gravity. Early indications, though fragile, suggest a genuine effort, a willingness to confront the quiet desperation that seems to cling to this particular corner of the automotive market.

The Illusion of Cheapness

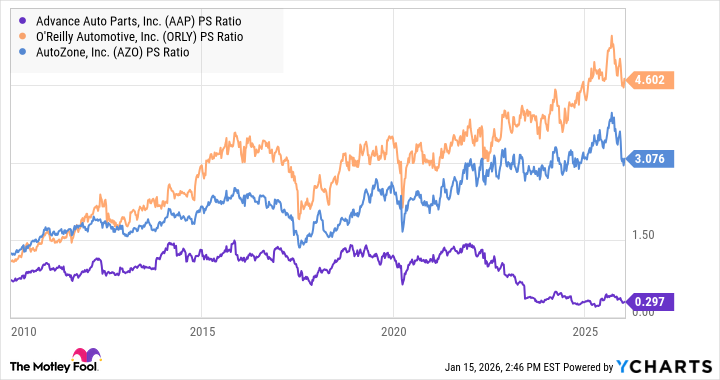

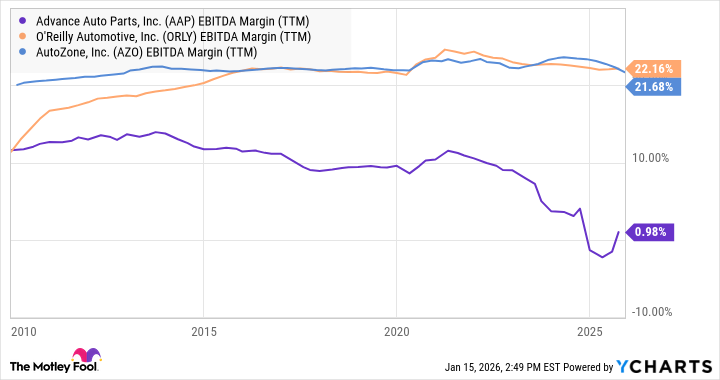

The stock, on a purely mathematical basis—price to sales, you understand—appears remarkably inexpensive. A bargain, one might say. Yet, it remains consistently so, a persistent anomaly. The reason, predictably, lies in its inability to generate earnings that align with its peers. EBITDA margins, that cold, clinical measure of performance, continue to lag. It is a familiar story: a potential unrealized, a promise unfulfilled.

A Shift in Gears?

Under the new leadership of Mr. Shane O’Kelly—appointed, as these things are, in September of 2023—Advance Auto Parts has begun a process of consolidation. Over seven hundred locations have been closed, a rather drastic pruning. The intention, one gathers, is to refocus on areas where the company holds a dominant—or at least a respectable—position based on store density. A hundred new stores are planned by 2027, alongside the thirty already opened this year. It’s a bold move, of course, though one wonders if it’s not simply rearranging the deck chairs on a slowly sinking vessel.

The strategy hinges on the creation of “market hub” stores—larger establishments, carrying a significantly broader range of parts. They aim to enhance same-day delivery, a particularly crucial service for professional mechanics. A commendable ambition, certainly, though one suspects the logistical challenges are considerable. The details, as always, are lost in a haze of corporate jargon.

The charts suggest a slight, almost imperceptible, uptick in profit margin. Perhaps, this time, the restructuring will take hold. Perhaps not. The stock, one suspects, will appeal to those investors willing to accept a degree of risk in pursuit of a potentially significant return. It is a gamble, of course. All investments are. But some, one feels, are more poignant than others.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-19 10:53