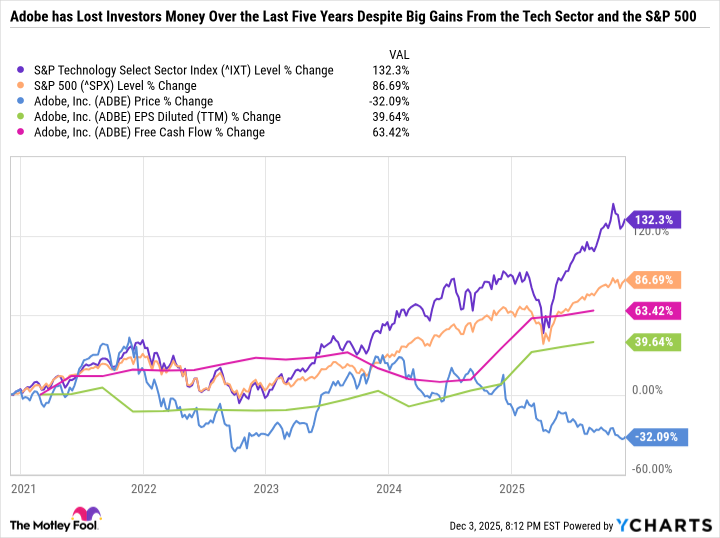

The tech sector’s been throwing punches like a heavyweight champ, outclassing the S&P 500 with muscle from chips-Nvidia, Broadcom, the usual suspects. But the software boys? They’re nursing bruises in a back alley. Adobe (ADBE +5.28%)-down 27% year-to-date-looks like a fighter who forgot to duck.

A ghost in the machine

Adobe once danced like Fred Astaire, pirouetting from boxed software to cloud subscriptions. Photoshop, Illustrator, the whole troupe bundled into Creative Cloud-suddenly every art director and college kid with a Mac had a front-row seat. Recurring revenue? That’s the jazz age of finance, honey.

By the late 2010s, Adobe traded its tap shoes for a cash register. Profit margins wider than a Hollywood boulevard. Stock peaked in 2021-then the music stopped. Market crash, recovery, then a slow bleed. Two years down, and the ticker’s trading like a used car with a bad transmission.

Here’s the kicker: earnings? Up. Free cash flow? Breaking records. But the stock? Drowning like a shot of bourbon in a dry county. Market’s got a taste for futures, not pastries. And Adobe’s serving yesterday’s éclairs while the kids at the bar demand AI cocktails.

The future’s a loaded gun

Artificial intelligence-every CEO’s new best friend. Adobe’s suits keep talking about “leadership” in AI, but the street’s heard that line before. Generative tools are nipping at their heels, promising to turn amateurs into Spielberg with a click. The question isn’t whether creatives will switch-it’s whether they’ll care enough to unpack their toolkits.

Apple and Alphabet took bullets earlier this year. Same song: growth slowing, competition sharpening. Then they ducked the next round. Adobe’s a coiled spring too, if they can lace their software with AI that actually pays rent. Losing subscribers? Maybe. But margins tighter than a new suit? Not if pricing’s done right.

Numbers don’t lie, but they ain’t honest either

20.4 times earnings. 14 times forward. Cheapest in a decade. Adobe’s trading like a relic in a pawn shop, while the S&P 500’s sipping champagne at 23.6. Buybacks? They’re carving shares like a Thanksgiving turkey-12.4% fewer tickets in five years. Balance sheet cleaner than a preacher’s conscience.

But the market’s got a hangover. Earnings growth means squat if the story’s written in disappearing ink. Adobe needs to prove they’re not just another has-been, that AI’s a door, not a coffin. Like Alphabet showing Gemini could sing in Chrome’s choir.

Final reel

Dec. 10’s the day the judge hands down the sentence. Management’ll talk tough, all “AI roadmap” and “value creation.” But investors need to hear the clink of coins, not brass bands. Adobe’s a deep-value play with a hangnail of risk. Buy now? Depends if you like your investments with a side of noir.

Stock’s a smoke-wreathed bargain, but even Bogart needed a lucky charm. 🃏

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Silver Rate Forecast

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-12-07 19:38