Alright, settle in, folks! We’re diving into the thrilling world of design software… yes, design software. It’s more exciting than watching paint dry, I assure you. Especially now that Artificial Intelligence is barging in like a Roman emperor demanding tribute. Goldman Sachs, those financial soothsayers, say computing is evolving. They’re right! It’s gone from “if this, then that” to “Hey, computer, do something useful!” A revolutionary concept, I tell ya.

We’ve got two contenders in this arena: Adobe, the old guard, a veritable Methuselah of software, and Figma, the upstart, fresh out of the IPO oven. Adobe tried to gobble up Figma, but those European regulators said, “Hold your horses!” Apparently, even in the digital age, monopolies are a no-no. Who knew?

Now, AI is the wild card. Will it be the secret sauce that makes these companies richer than Croesus, or will it render them obsolete faster than you can say “clip art?” Let’s take a look, shall we? And remember, I’m not a financial advisor. I just play one on the internet… and occasionally bet on horse races.

Adobe’s AI Adoption: The Empire Strikes Back

Can AI make Adobe irrelevant? Oy vey, that’s a loaded question! It’s like asking if the invention of the chariot would put shoemakers out of business. Probably not, but it certainly shook things up. The worry is that anyone with a keyboard and a clever prompt can now conjure up images and videos, bypassing the need for professional software. Wall Street got a little jumpy, and the stock took a tumble. A 30% drop! That’s enough to make a broker sweat, believe me.

Adobe’s strategy? Embrace the beast! They’re stuffing AI into everything, like a Thanksgiving turkey. They’re hooking up with over 25 different AI models, which sounds complicated even to me, and they’ve built their own platform, Firefly. They’re being careful with copyright, using their own images, public domain stuff, and openly licensed content. Smart move. You don’t want a lawsuit from a disgruntled artist. That’s just bad for business… and your karma.

And it seems to be working! Monthly active users are up 15%, and they’re raking in the big bucks – over $1 million in bookings and a 25% jump in customers spending serious dough. Revenue is up to $6.2 billion, and profits are climbing. Not bad for a company that’s been around since the dinosaurs… or at least since the first Macintosh.

How Figma Employs AI: The Rebel Alliance

Figma, the young buck, is going all-in on AI. They acquired a startup called Weavy, which sounds like a medieval weapon, but it’s actually a platform that brings together a bunch of AI models. It’s like having a Swiss Army knife for artificial intelligence. They also built their own tools, notably Figma Make. Apparently, 30% of their big-spending customers are using it weekly. That’s a lot of designing… or at least a lot of clicking.

The Bottom Line

Figma’s growth is impressive. They’re clearly integrating AI successfully. It’s tempting to jump on the bandwagon. But Adobe is also doing just fine. Those Wall Street worries about AI eroding their business haven’t materialized. They’re still the 800-pound gorilla in the room.

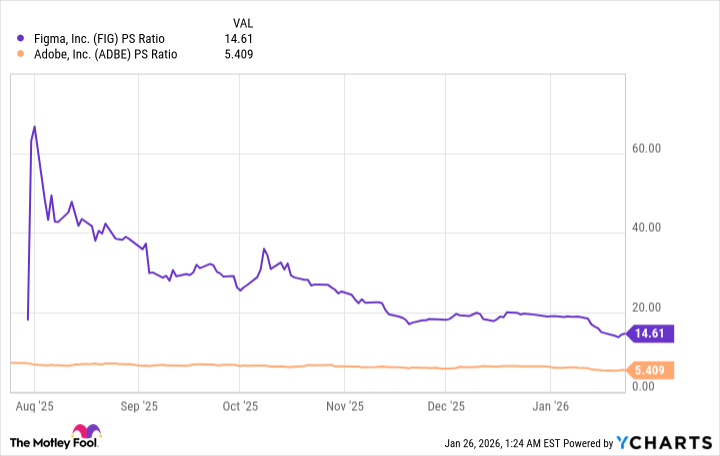

Now, let’s talk valuation. Figma’s price-to-sales ratio is almost triple Adobe’s! That’s a hefty premium. Adobe’s P/S has sunk, and given their continued performance, the stock looks attractively valued. It’s like finding a perfectly good suit at a clearance sale. A bargain!

So, here’s my take: Adobe’s solid financials, combined with its appealing valuation, make it the superior stock to buy. It’s not flashy, it’s not the hot new thing, but it’s reliable. And in the stock market, folks, reliability is golden. Now if you’ll excuse me, I have a horse race to bet on.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- ‘Bad Guys 2’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Again

- The Best Single-Player Games Released in 2025

- Brent Oil Forecast

2026-01-29 12:32