Adobe. The name itself echoes with the weight of creative endeavor, of digital landscapes sculpted by human will. For three decades, it has been a titan, a provider of tools that have transformed mere images into vessels of meaning, documents into pronouncements, designs into realities. A $10,000 investment, once made, has blossomed into nearly $400,000. A comfortable sum, certainly, but comfort breeds complacency, and complacency, as any seasoned observer of markets knows, is a prelude to suffering.

Lately, a disquieting tremor has run through the stock. A decline, not of gradual erosion, but of a precipitous fall, a halving of value in a mere four years. Is this merely a correction, a temporary lapse in the market’s fickle affections? Or is it a symptom of something deeper, a fundamental questioning of Adobe’s very existence? The whispers speak of Artificial Intelligence, of algorithms that threaten to supplant the artist, the designer, the very notion of human creation. It is a specter that haunts not just Adobe, but the entire landscape of innovation.

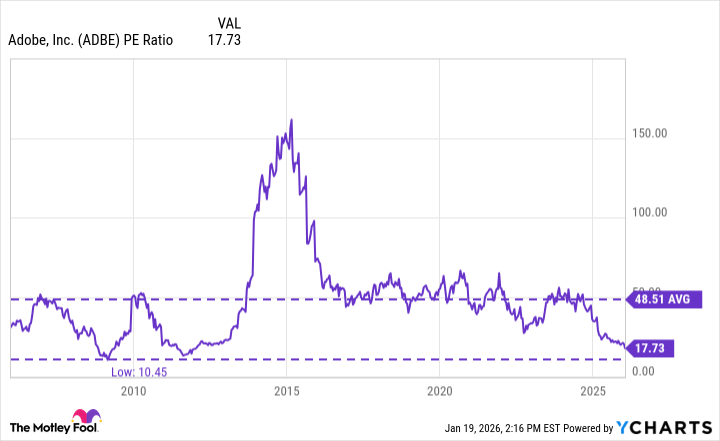

The valuation, as of this writing, has sunk to a level not seen in twenty years. A price-to-earnings ratio of 18. A paltry sum for a company of Adobe’s stature, yet a chilling reminder of the market’s unforgiving nature. It is as if the collective consciousness has deemed Adobe unworthy, cast it into a wilderness of doubt. One wonders, is this a moment of genuine opportunity, or a siren song luring unsuspecting investors to their doom?

The stock appears…cheap. A tempting morsel for the value-seeking investor. But to rush in blindly would be an act of folly. The AI risk is not merely a technical challenge; it is an existential threat. The question is not whether AI can replicate human creativity, but whether the market believes it can. And in the realm of belief, logic often takes a backseat to fear.

A Valuation’s Predicament

Adobe, at its core, is a purveyor of high-margin software. Consider Photoshop, that ubiquitous tool of image manipulation. Photographers, artists, and designers rely on it, willingly surrendering a monthly subscription fee for access to its power. It is a comfortable arrangement, a symbiosis of need and fulfillment. Yet, even the most entrenched dominance is vulnerable to disruption. Adobe enjoys a gross profit margin of 89%, an all-time high, a testament to its brand strength. But what is a brand, ultimately, but a fragile construct of perception?

The very height of that margin now feels precarious. The emergence of generative AI tools, capable of producing astonishing results with minimal human input, casts a long shadow. Alphabet’s Nano Banana, offered freely, is a particularly unsettling development. It is a challenge to the established order, a provocation that Adobe cannot afford to ignore. The moat, so carefully constructed over decades, is suddenly looking…erodible.

However, let us not succumb to despair. The concern, while valid, may be overstated. A full 72% of Adobe’s fiscal 2025 revenue stems from its Creative & Marketing Professionals segment. These are not casual users, but seasoned professionals who demand quality, precision, and control. They are less likely to be swayed by the allure of free, potentially flawed, AI tools. They require reliability, a guarantee of consistent results. And that, perhaps, is Adobe’s salvation.

Of course, superior AI tools, offered on a subscription basis, pose a genuine threat. But Adobe is not standing still. It is developing its own AI capabilities, integrating them into its existing product suite. These innovations are already driving top-line growth, with annual recurring revenue (ARR) increasing by nearly 12% year over year. It is a race, a constant struggle for survival. And in such contests, the victor is not always the strongest, but the most adaptable.

I am inclined to believe that Adobe possesses the resilience to weather this storm. Its large professional customer base, combined with its own AI offerings, provides a degree of protection. If I am correct, this stock represents a compelling opportunity, a chance to acquire a valuable asset at a deeply discounted price. The market, in its infinite wisdom (or folly), has presented us with a gift. It remains to be seen whether we have the courage to accept it.

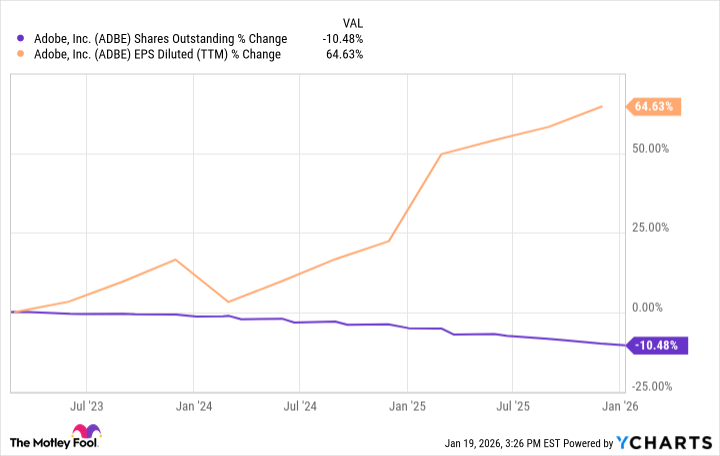

Adobe’s management, recognizing the undervaluation, is actively repurchasing shares. Over the past three years, they have reduced the share count by over 10%. This, combined with ongoing sales growth and high profitability, is accelerating the growth of per-share profits. The forward P/E ratio now stands at a mere 13. A number that whispers of opportunity, of potential reward.

In conclusion, the valuation of Adobe stock may be too enticing for opportunistic investors to ignore. It is a gamble, certainly. But in the realm of investing, as in life, there are no guarantees. Only probabilities, and the courage to act on them. It is a time for careful consideration, for sober judgment, and for a willingness to embrace the inherent uncertainty of the market. The despair of the valuation may, in fact, be the seed of future prosperity.

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-22 21:32