- Those Bollinger Bands are getting all cozy on ADA‘s 12-hour chart, signaling a potential upside rally! 🤔

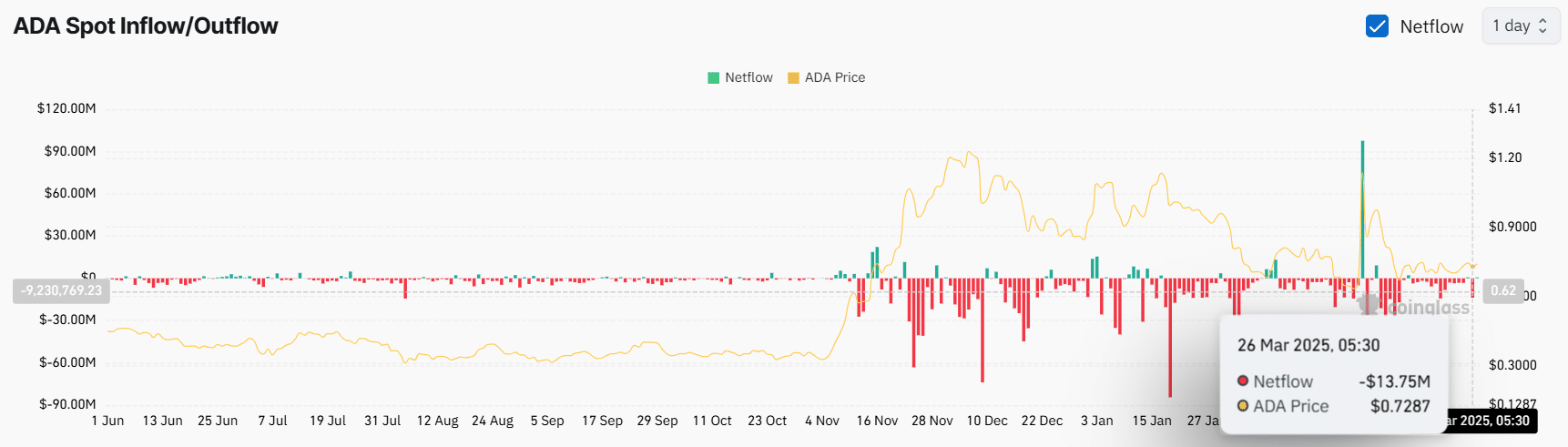

- It looks like exchanges have seen an outflow of $13.80 million worth of ADA tokens. What do you think is behind this? 🤑

Cardano (ADA) has been stuck in a tight spot for over a week, unable to get the momentum going. But fear not, friends! The market sentiment is looking up, and ADA might just break through and resume its upward rally! 🌟

Technical Analysis Time! 📊

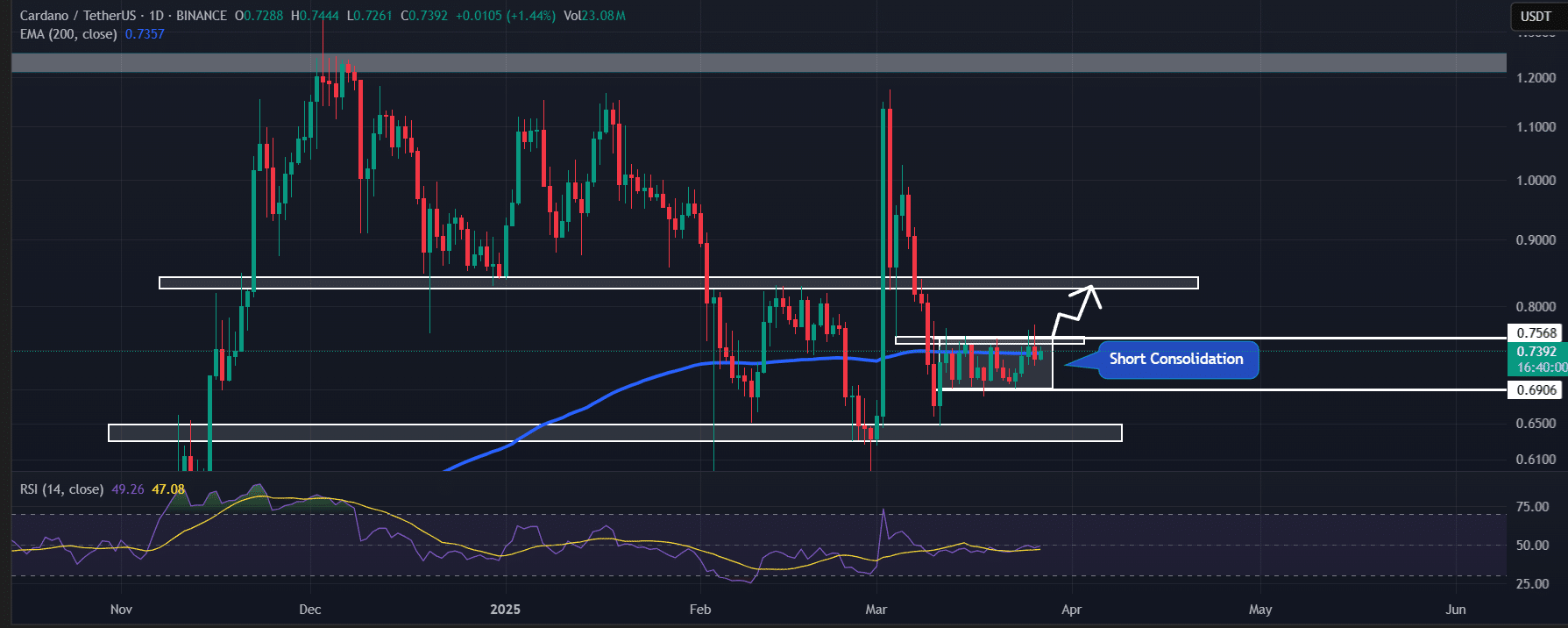

According to our trusty AMBCrypto analysis, ADA has been stuck in a range between $0.69 and $0.75. But now that the market is recovering, it’s hit the upper boundary, where reversals have happened before. Will it happen again? 🤔

And if that’s not enough, the 200-day Exponential Moving Average (EMA) is acting as a resistance level, limiting ADA’s upward movement. But don’t worry, our bulls are ready to take on the challenge! 🐂

A prominent crypto analyst shared a post on X (formerly Twitter) and used the Bollinger Bands to predict a potential spike in ADA’s price. The Bands are narrowing on ADA’s 12-hour chart, signaling a possible breakout in the coming days. 📈

Price Momentum, Baby! 🚀

At press time, ADA is trading near $0.74, down 1.5% in the last 24 hours. But don’t let that fool you – its trading volume has fallen by 10%, showing reduced trader and investor participation. And with the RSI at 47, the market sentiment could influence the price direction. 🤔

But if ADA breaks past the 200-day EMA and its consolidation range, closing a daily candle above $0.76, it could rise by 13% to reach $0.85. And that’s not all – a breakout could create opportunities for further upward momentum! 🚀

Bullish On-Chain Metrics! 📈

Despite the price drop, whales and long-term holders have been accumulating the token. According to Coinglass, exchanges have seen an outflow of $13.75 million worth of ADA tokens over the past 24 hours, indicating potential accumulation by holders. 🤑

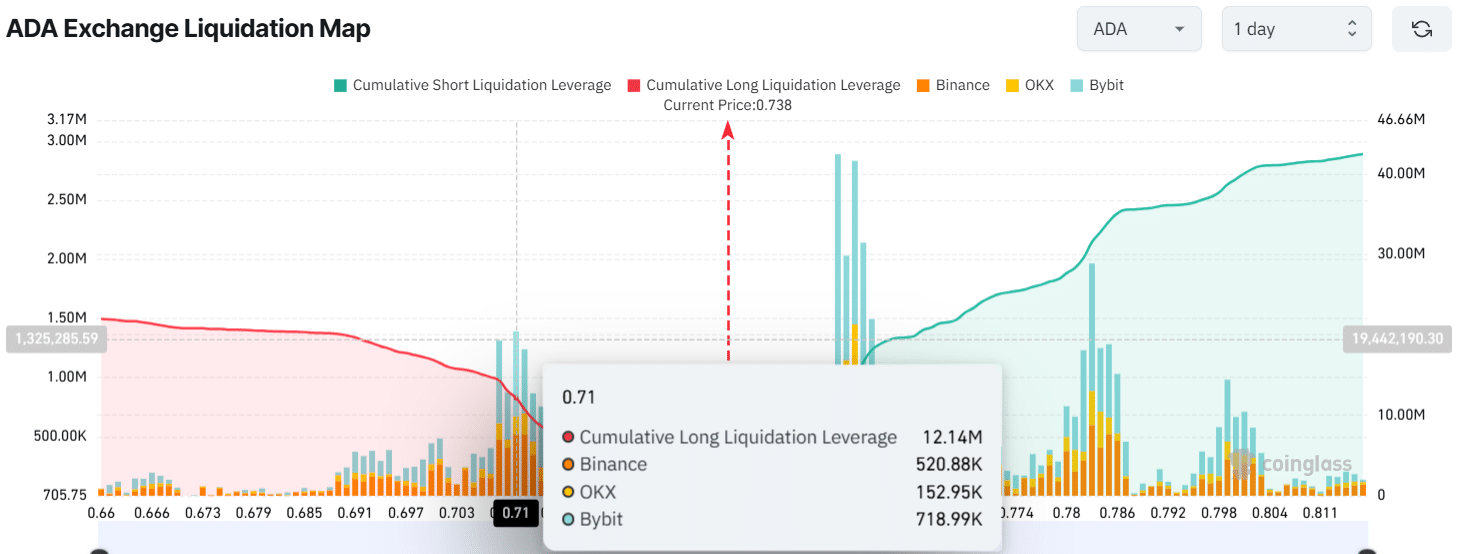

And it looks like intraday traders are following a similar trend. Coinglass data reveals that traders are currently over-leveraged at $0.71 on the lower side, with $12.15 million worth of long positions. On the other hand, the $0.753 level is another over-leveraged zone, where traders have held $9 million worth of short positions. 🤑

The over-leveraged levels suggest bulls are dominating the asset and are likely driving it toward ending its prolonged consolidation. Will ADA finally break through? 🤔

Read More

2025-03-27 16:11