In a move that can only be described as audacious, Abu Dhabi’s Mubadala Sovereign Wealth Fund has decided to dip its toes into the murky waters of Bitcoin, splashing a staggering $436 million into US-listed spot Bitcoin exchange-traded funds (ETFs). 💸

This rather extravagant acquisition, unveiled in a filing with the SEC on the 14th of February—how romantic!—highlights the fund’s burgeoning fascination with digital assets, as if they were the latest fashion trend. 🕶️

Abu Dhabi’s Mubadala: The Seventh-Largest Holder of BlackRock’s Bitcoin ETF

According to Mubadala’s filing, their investment was directed at BlackRock’s iShares Bitcoin ETF (IBIT), securing over 8.2 million shares in the fourth quarter of 2024. Quite the haul, I must say! This marks a fresh position for the fund, as no previous holdings of IBIT were reported—perhaps they were waiting for the right moment to pounce? 🦁

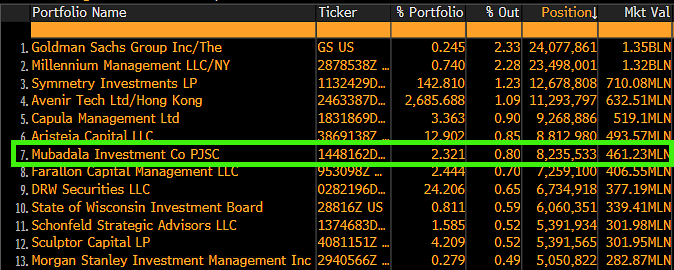

Following this acquisition, Bloomberg ETF analyst James Seyffart noted that Mubadala now ranks as the seventh-largest known holder of IBIT. A rather exclusive club, indeed! 🥂

The fund now joins an elite list of institutional investors, trailing behind the likes of Goldman Sachs, Millennium Management, and Symmetry Investments. One can only imagine the dinner parties! 🍽️

Meanwhile, Binance founder Changpeng Zhao has pointed out that Mubadala is merely one of Abu Dhabi’s sovereign wealth funds. He hinted that other state-backed investment entities might also be dabbling in Bitcoin ETFs. How delightfully scandalous! 😏

Market observers have noted that Mubadala’s investment aligns with the UAE’s grand ambition to establish itself as a leading hub for blockchain and digital asset innovation. Over the years, Abu Dhabi has positioned itself as a prime destination for firms seeking a warm embrace from supportive investment conditions. 🌞

This has led to the introduction of progressive regulations that have attracted major industry players, all eager to find a crypto-friendly jurisdiction. It’s like a digital gold rush! 🏆

The Global Bitcoin Adoption Race

Mubadala’s investment is but a reflection of a growing trend among global institutions seeking Bitcoin exposure. It seems everyone wants a piece of the pie! 🥧

This shift comes as policymakers ponder the potential for a strategic crypto reserve. Some in the US government have even suggested that Bitcoin could be part of this initiative. How very forward-thinking! 🤔

US Senator Cynthia Lummis has underscored the significance of Mubadala’s development, suggesting that a global race for Bitcoin exposure is indeed unfolding. 🏁

“I told you the race was on. It’s time for America to win,” Lummis proclaimed on X (formerly Twitter). A true rallying cry! 📣

The lawmaker has introduced the Bitcoin Act of 2024, proposing the creation of a US Bitcoin reserve. The plan involves selling a portion of the government’s gold holdings to fund the purchase. If enacted, it would secure 1 million Bitcoin, roughly 5% of the total supply. Quite the gamble! 🎲

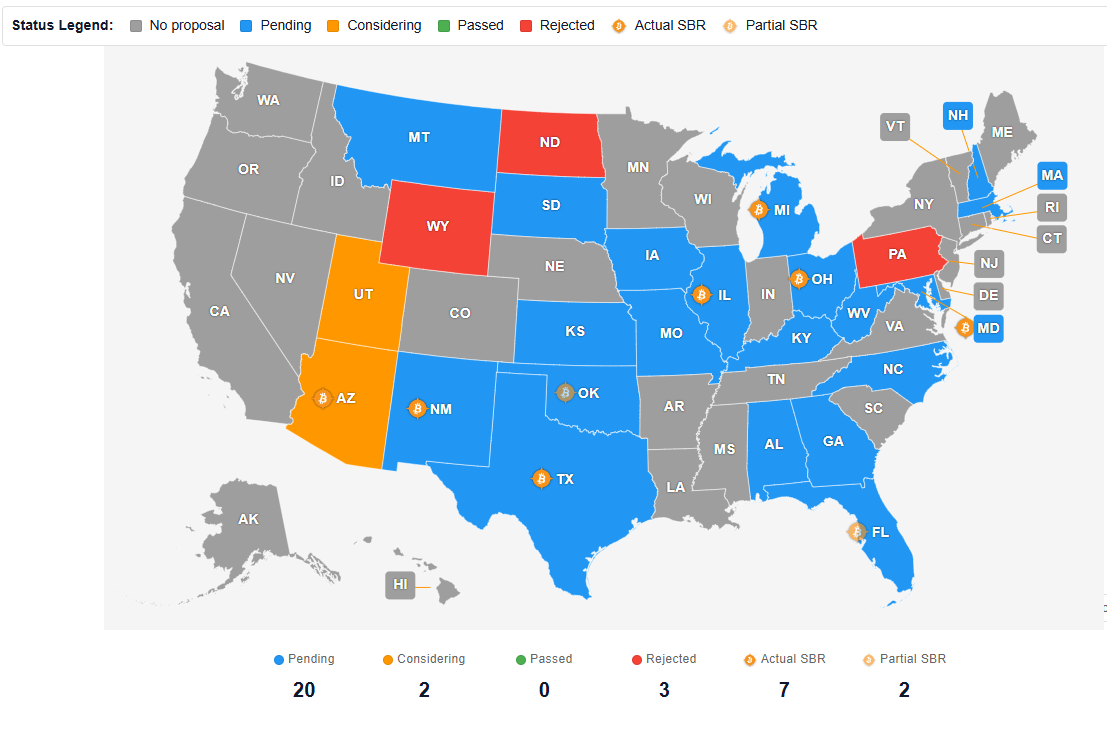

While the federal government’s stance remains as clear as mud, several US states have taken independent steps to integrate Bitcoin into their financial policies. Over 20 states have either proposed or enacted legislation to facilitate cryptocurrency investments. A veritable free-for-all! 🎉

Industry leaders view these developments as a sign of a global race for Bitcoin adoption. Satoshi Act Fund CEO Dennis Porter emphasized that US states are driving this shift. With this in mind, analysts expect the country to emerge as a leading pro-Bitcoin nation. The plot thickens! 📈

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-02-15 18:18