AbbVie (ABBV) spun off from Abbott Laboratories in 2013 like a bad breakup where both parties insisted they’d be better off alone. Classic corporate midlife crisis. Now we get to see if this divorce actually worked out, or if it’s just another “I’ll show you” move that ends in tears and SEC filings.

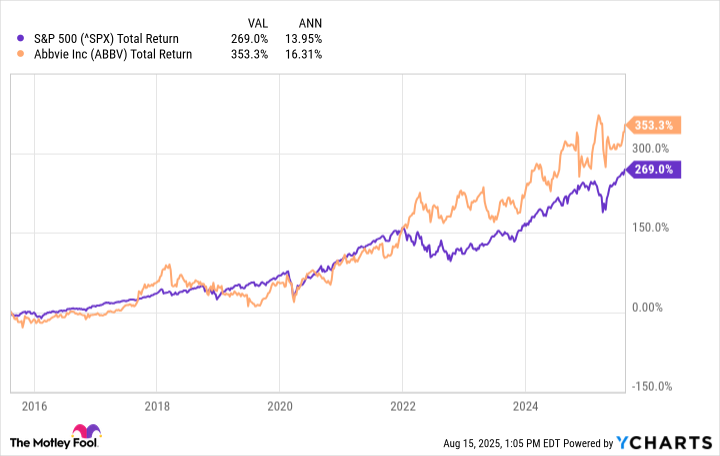

So here’s the deal: You invested $1,000 in AbbVie ten years ago? You’re sitting on $4,530.75 today. The S&P 500? Chump change at $3,690.99. But wait – was this genius investing or just getting lucky with a patent cliff that kept giving? Let’s dissect this like a medical malpractice lawsuit.

The Humira Effect: A Love Letter to Patent Protection

AbbVie’s golden goose was Humira, a drug so successful it makes you wonder why your dermatologist won’t prescribe it for your cat’s attitude problem. Approved for 12 conditions including “existential dread” (probably). Sales peaked at $22.1 billion before the patent expired like expired yogurt in 2023.

Now here’s where things get awkward. When Europe‘s patent expired in 2018, AbbVie acted like someone who forgot to RSVP to a wedding – slight panic, then doubling down on U.S. sales. It’s the pharmaceutical equivalent of wearing a winter coat in July because “well, it might snow”.

The Great Biosimilar Replacement Scheme

Meet Skyrizi and Rinvoq – AbbVie’s desperate attempt to replace Humira. Approved in 2019, these drugs are basically Humira’s younger, hungrier cousins who “totally understand TikTok metrics”. Management claims they’ll hit $31 billion by 2027. Bold talk! But let’s see them survive their first Midwest regional sales conference before we crown them kings.

Then there’s the $63 billion Allergan acquisition. Botox? Vraylar? Sounds like a spa menu and a Russian oligarch’s yacht. But hey, desperate times call for desperate measures when your blockbuster drug has all the longevity of a Blockbuster Video.

And the pipeline! Acquiring Denmark’s GUB014295 for weight management is like buying a Weight Watchers franchise right before Thanksgiving. Brilliant timing or corporate self-sabotage? We’ll see who’s laughing when semaglutide becomes the new table salt.

The Dividend Diaries

Now for the part that makes grumpy investors swoon: 53 consecutive years of dividend increases. That’s longer than your marriage lasted, and with better ROI. Current yield? A meaty 3.2% vs the S&P’s sad 1.3%. It’s the investing equivalent of finding a $20 bill in your old jeans – reliable, slightly thrilling, and totally taxable.

So is AbbVie still a buy? Depends if you enjoy playing Whack-a-Mole with patent cliffs. The new drugs might work, the pipeline could surprise, and the dividend will keep coming like your mother-in-law’s unsolicited advice. But remember – every time they say “long-term growth”, they’re really thinking “please don’t sue us”.

Reinvest that dividend if you want. Just don’t say I didn’t warn you when Skyrizi starts needing its own biosimilar in 2030. 🎭

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- EUR UAH PREDICTION

- Gold Rate Forecast

- EUR TRY PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-08-18 13:23