Now, Abbott Laboratories (ABT +1.22%) – a name that may not immediately set the Thames on fire, but a company producing goods one encounters with surprising frequency. From those little tests for, shall we say, unwelcome viral visitors, to the rather restorative Ensure shakes favoured by aunts and convalescents, Abbott is rather more present in one’s life than one might initially suppose. And a jolly good thing too.

Over the years, these and other products have allowed Abbott to build a record of earnings growth that’s positively dazzling, and the financial muscle to maintain a dividend program that’s, well, remarkably persistent. A Dividend King, they call it – meaning they’ve been increasing those payments for over half a century. A truly impressive feat, and one that rather tickles the fancy of a cautious investor, don’t you think?

Consequently, I find myself viewing Abbott as a healthcare dividend stock I’d be perfectly content to hold onto for the foreseeable future. Let’s delve a bit deeper, shall we, and examine just why this company seems so remarkably… reliable.

A Diversified Affair

The first thing that strikes one about Abbott is its admirable diversification. Four business units – diagnostics, medical devices, nutrition, and established pharmaceuticals – offer a comforting degree of stability. Should one area find itself in a bit of a pickle, another is likely to step up and keep things afloat. Recently, for instance, while the diagnostics division experienced a slight dip due to a lessening demand for those coronavirus tests, the medical device business has been positively booming. In the latest quarter, they reported sales growth of a decidedly cheerful double-digit percentage.

Abbott also boasts a portfolio of market-leading products, including the aforementioned Ensure and the rather ingenious FreeStyle Libre continuous glucose monitor. Sales of these monitors have climbed a most respectable 15% recently. Their commitment to innovation, coupled with a shrewd habit of acquiring promising companies, suggests that earnings growth will continue apace. The acquisition of Exact Sciences, a leader in cancer screening, is particularly noteworthy – a dash of brilliance, if I may say so. It’s expected to be finalized in the second quarter.

A Passive Income Proposition

All of this means Abbott is well-positioned to deliver steady earnings growth, and, as I mentioned earlier, it also provides a most agreeable stream of passive income. Last year marked their 54th consecutive year of dividend increases – a truly astonishing record – and the dividend itself has increased by a handsome 70% in just five years. Rather like a well-trained butler, it consistently delivers exactly what is expected.

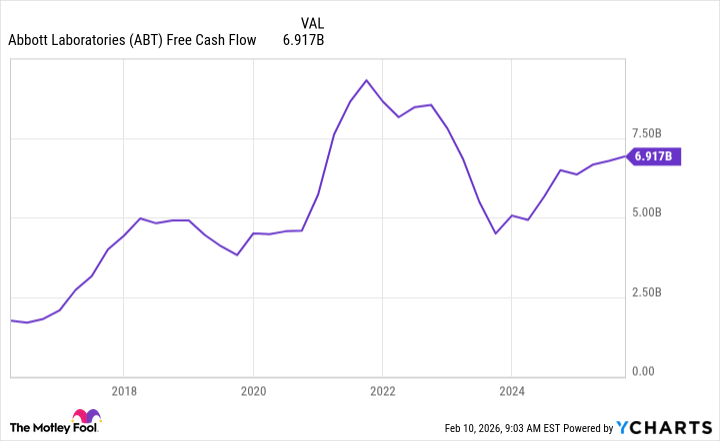

They’ve maintained high levels of free cash flow over the years, which gives one a comforting sense of security.

Currently, Abbott pays a dividend of $2.52, resulting in a yield of 2.2% – a shade more generous than the 1.1% offered by the S&P 500. Dividend stocks, particularly those with a history of consistent growth, are splendid things to hold onto. They provide an extra boost during prosperous times, but are particularly welcome during less fortunate periods, offering a degree of protection – or at least mitigating the damage.

All in all, Abbott appears to be a rather exceptional stock to acquire and hold indefinitely. A most agreeable investment, wouldn’t you say?

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-12 14:23