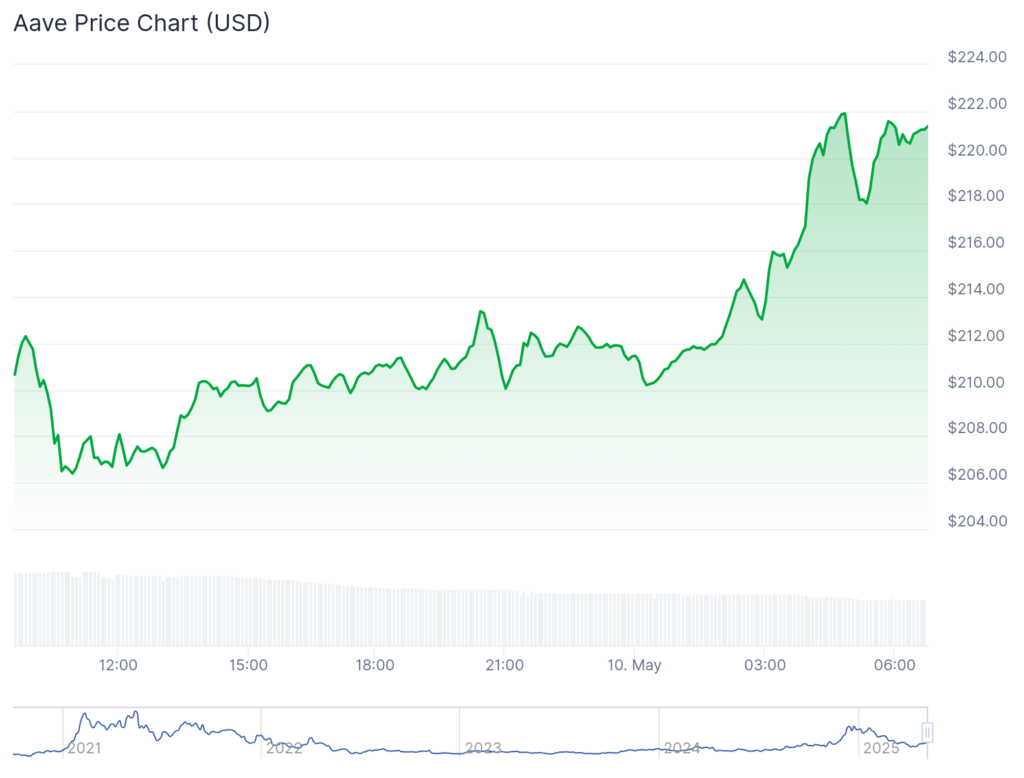

There are few pleasures in life as sweet as watching one’s bank balance elevate without the attendant inconvenience of effort. On this fine Saturday, AAVE—the darling of degenerate financiers everywhere—has ascended like an overindulged socialite, reaching heights not seen since the more innocent days of March 6. This heady climb coincided with a positively withering supply on exchanges and a total value locked that’s tumbling faster than the hats at Ascot.

AAVE (yes, the coin so delightful they named it after itself, twice) now boasts a price of $221.91, up an utterly immodest 95% since the debased lows of April 7. This sprightly leap has fluffed its market cap to a voluptuous $3.3 billion—proof one needn’t wear a cravat to enjoy a windfall.

According to the unremittingly serious folks at CoinGlass, investors have been accumulating AAVE with the fervor of vain poets chasing after forbidden muses. Thanks to Ethereum’s own theatrical breakout at $2,400—something not seen since February—confidence has returned! Or at least perfumed the air with enough optimism to induce a rally.

AAVE balances on exchanges have slouched to 4.76 million, down from 4.87 million only last week. In other words, a dwindling minority now resists the urge to hodl eternally. The supply on exchanges languishes at 29.74%, indicating that holders have become mysterious creatures, much like Victorian nannies—seen rarely, and selling never. 📉💅

Further excitement! AAVE has pirouetted into the role of DeFi’s matriarch, dazzling us all with a total value locked of $24.2 billion, according to DeFi Llama. Poor Lido trails behind at a mere $21.6 billion—one suspects it must be simply mortified at such social humiliation.

This ostentatious growth has paid handsomely: with year-to-date fees soaring to $224 million, AAVE is making more money than a Mayfair pawnbroker during Ascot week.

AAVE is, if you must know, a decentralized ‘banking’ contraption. It lets users earn interest on their idling coins, lending out assets and occasionally giving arch bankers of old a shudder of existential dread. In short: it is the peer-to-peer version of stuffing wads of cash under your mattress—except your mattress is now a blockchain, and you didn’t bother to tell the bank.

AAVE price technical analysis

On the daily chart, AAVE took a dramatic dip to $113.50 on April 7—presumably for dramatic tension—before bouncing back to heights not seen since March 6. It has skipped nimbly above the 50-day Exponential Moving Average and burst through the $1,000 phantasmagoria with all the subtlety of a Wildean witticism at a prudish dinner party.

The Relative Strength Index is draped in overbought excess at 75, while the MACD indicator, like a clever debutante, has crossed the zero line and refuses to return. This resurgence followed a falling wedge pattern between December and April—much like a melodrama staged for maximum suspense.

Speculators expect the bulls to keep running, targeting a most fashionable resistance at $400 (December’s own high-water mark). Should this unfold, we’ll be treated to an 83% dash skyward. However, let it be known: if AAVE falters and slips below support at $170, the bulls will scatter and—one assumes—the champagne will stop flowing. 🍾🕺

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- 9 Kings Early Access review: Blood for the Blood King

- Every Minecraft update ranked from worst to best

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 10 Shows Like ‘MobLand’ You Have to Binge

2025-05-10 17:26