As a seasoned researcher with a decade of experience in the ever-evolving crypto market, I must say that the current bull run for AAVE is nothing short of impressive. With my fingers permanently stained with the ink of charts and indicators, I’ve witnessed numerous trends come and go, but the strength of AAVE’s momentum is truly remarkable.

As a researcher exploring the dynamic world of cryptocurrencies, I’ve observed that the price of AAVE has been consistently rising, thereby reinforcing its dominant status as the largest lending protocol in the crypto space. With a staggering market capitalization of $5.5 billion, it outweighs the combined market caps of all other top 10 lending protocols.

This year, the value of the token has soared an astonishing 220%, while it’s also increased by a significant 110% over the past month. This remarkable growth is fueled by robust bullish sentiment and escalating market attention. The RSI (Relative Strength Index) and CMF ( Chaikin Money Flow ) suggest persistent upward trends, yet hints of slowing momentum could indicate a period of consolidation may be on the horizon.

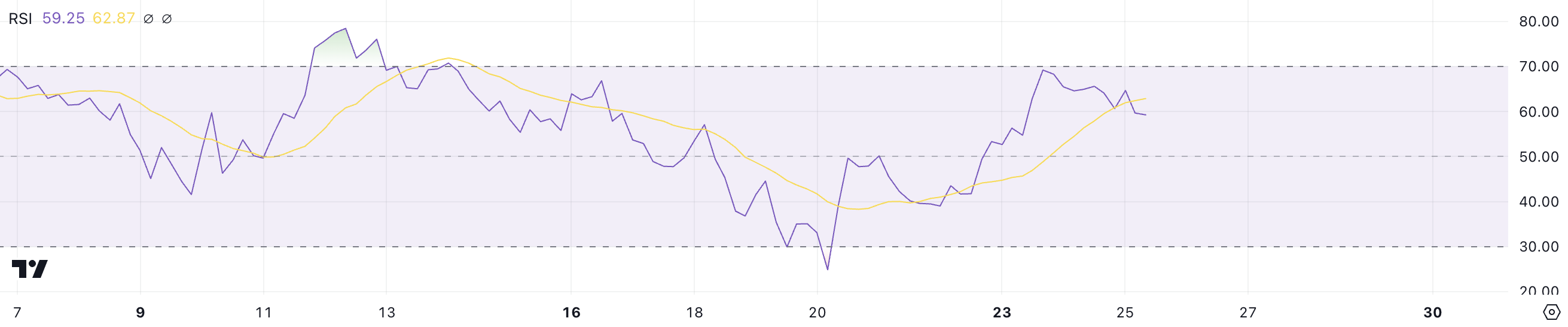

AAVE RSI Is Neutral After Almost Reaching the Overbought Zone

The AAVE’s Relative Strength Index (RSI) has dropped from 69.19 on December 23, when it reached its highest price of $382, to 59.2 now. This decrease in RSI indicates that the AAVE price has moved away from an overbought state, which is usually followed by a price adjustment after periods of increased buying activity.

As a researcher, I’ve noticed that despite the ongoing RSI suggesting robust momentum, the recent downturn suggests a potential market stabilization following an extended phase of aggressive buying activity.

The Relative Strength Index (RSI) is a tool that gauges how quickly and intensely prices are changing, ranging from 0 to 100. When the RSI exceeds 70, it signals overbought conditions, possibly predicting a price correction. Conversely, if the RSI falls below 30, it may indicate oversold conditions that might lead to an upturn or rebound in prices.

In simple terms, when the RSI (Relative Strength Index) of AAVE is at 59.2, it indicates a neutral-to-favorable outlook for the coin’s price trend. This suggests that if buying pressure picks up again, there might be a continuation of the uptrend in the near future. However, the drop from overbought levels hints that the AAVE price may experience consolidation. This means the market needs time to process recent gains before determining its next move.

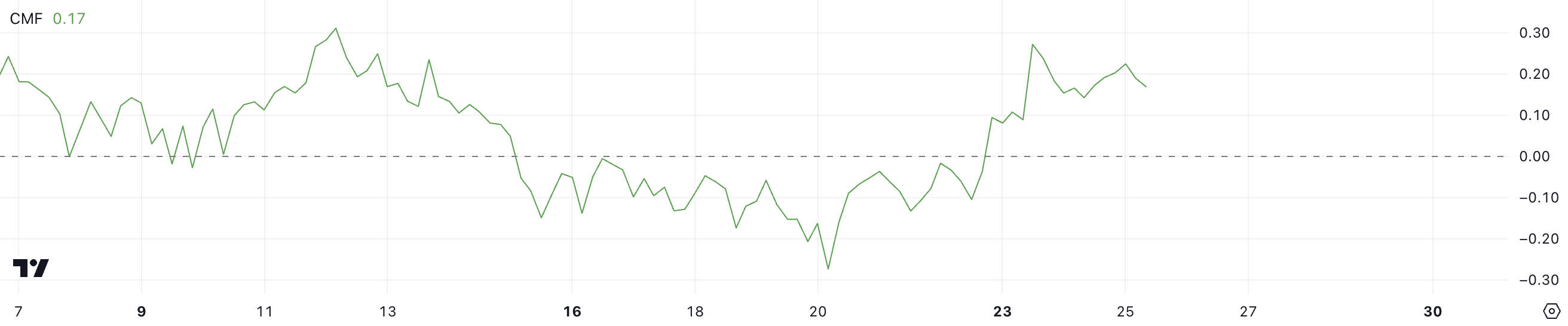

AAVE CMF Is Still Very Positive, But Down From The Recent Peak

The Chaikin Money Flow (CMF) for AAVE is currently at 0.17 and has remained positive since December 23, when it hit a high of 0.27. This suggests that there’s been continuous investment flowing into AAVE, which underscores robust demand and strong market interest in buying the asset.

Although the Crowd Momentum Factor (CMF) has dropped from its highest point, the fact that it remains positive indicates that buyers are still dominating, although their strength may be somewhat diminished.

The Capital Movement Function (CMF) is a statistical tool that quantifies the movement of a particular asset over a given timeframe, scoring between -1 to 1. A CMF score above zero suggests accumulation and increasing demand or buying pressure, whereas a score below zero indicates distribution and supply or selling pressure.

Given the Current Market Fundamental (CMF) at 0.17, the continuous influx of positive investment suggests that the token could maintain its current price range or possibly increase in the near future if buying interest continues. Nevertheless, the drop from the high on December 23 hints at a slowing momentum, which might result in a phase of stabilization before any significant shift occurs.

AAVE Price Prediction: Can AAVE Rise to 3-Year Highs?

Should the ongoing upward trend prevail, Aave’s price might challenge the notable level of $400. This would be a new peak for Aave since 2021, requiring only an increase of approximately 7.5% to achieve this milestone. The ascent is bolstered by the golden cross formation on December 23 and EMA indicators suggesting the bullish trend could endure further.

The arrangement of these technical signals indicates that positive market sentiment continues to be robust, suggesting that buyers could drive prices up further if the current trend persists.

Nonetheless, as pointed out by the CMF, the intensity of the upward trajectory seems to have weakened compared to a few days past, suggesting the possibility of a shift in trend direction. If the upward momentum of AAVE weakens, the price may decrease to touch the $355 support line.

If the current support doesn’t hold up, it’s possible that AAVE could experience additional drops, potentially reaching as low as $297 or even $271, indicating a substantial downtrend.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- PENGU PREDICTION. PENGU cryptocurrency

- ANDOR Recasts a Major STAR WARS Character for Season 2

- 30 Best Couple/Wife Swap Movies You Need to See

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

2024-12-26 01:40