Alright, so picture this: AAVE-the token that sounds like a bird noise but is actually the governance token of Aave-just surged 19% in 24 hours. Yes, you read that right. Nineteen. Bloody. Percent. 🐦💸 Investors are losing their minds faster than I lose my keys after one too many cocktails.

What You Need to Know (Because Cryptos Love Drama):

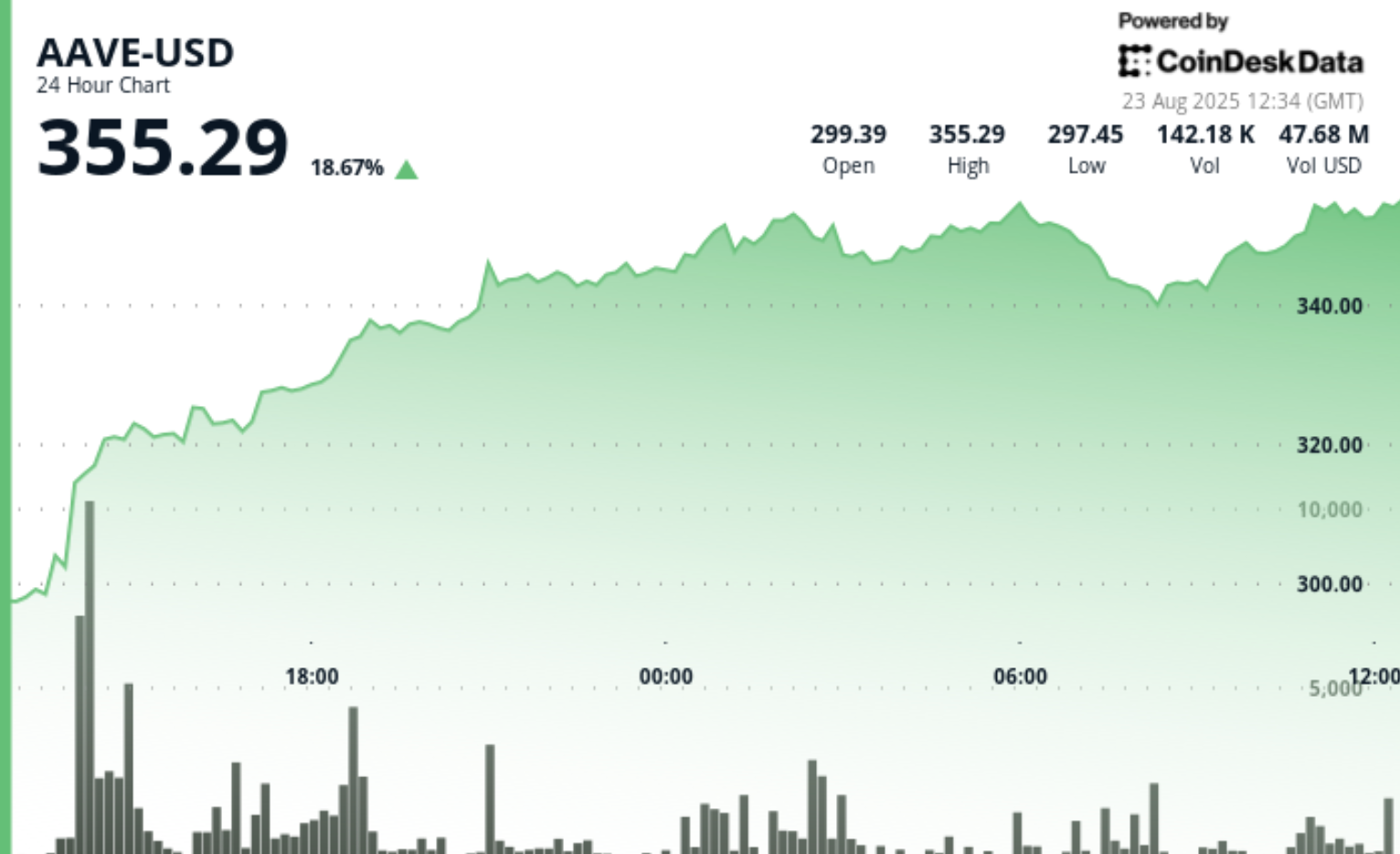

- AAVE hit $355.29, making it the belle of the crypto ball among the top 40 cryptocurrencies. Cue the confetti and awkward slow claps. 🎉👏

- Why? Two words: Aptos expansion. Oh, and Jerome Powell being all “dovish” about interest rates. Basically, he said something nice for once, and everyone freaked out. 🕊️📉

- Analyst Simon from Delphi Digital thinks Aave’s WLFI exposure might be worth more than we thought. Like, “sell your kidney now” levels of undervalued. 🚨💰

So yeah, AAVE just mooned harder than a werewolf at a full moon party 🌕, thanks to its recent expansion into Aptos and Chair Powell’s soothing words about rate cuts. Markets loved it so much they started throwing cryptos around like confetti at a wedding. 🎊

What Even Is Aave? (Besides a Weirdly Spelled Word)

Aave is basically the Robin Hood of crypto lending-minus the tights and questionable moral compass. It lets users lend and borrow cryptocurrencies without some middleman taking a cut. Smart contracts do all the heavy lifting, while borrowers have to put up collateral worth more than their loans. Classic overachiever energy. 🤓📚

Oh, and the AAVE token? It’s the Beyoncé of the protocol. You can stake it, use it as collateral, or flex your governance rights like you’re on the board of directors. Holders get voting power and fee perks, which makes it kind of a big deal. 🗳️💎

Aptos Expansion: Because One Blockchain Isn’t Enough

On August 21st, Aave V3 went live on Aptos-a non-EVM blockchain. Translation: they rewrote the codebase in Move (not the exercise kind), rebuilt the interface, and adapted everything for Aptos’ virtual machine. Fancy, right? 🧠💻

They even threw in audits, a mainnet capture-the-flag competition (yes, really), and a $500,000 bug bounty because apparently, they had money burning a hole in their pocket. The first market supports assets like APT, sUSDe, USDT, and USDC, with supply and borrow caps gradually increasing. Chainlink provided price feeds, because why not add another layer of complexity? 🤷♀️🔗

Stani Kulechov, Aave Labs’ founder and CEO, called it “an incredible milestone.” Which, fair enough-it’s like moving out of your parents’ basement and finally branching out. Except instead of suburbs, it’s blockchains. 🏡➡️🌐

Jerome Powell’s Speech: Dovish AF 🕊️

Fed Chair Jerome Powell gave a speech at the Jackson Hole Economic Policy Symposium that sent markets into a frenzy. He basically said, “Hey, maybe we’ll cut interest rates soon,” and boom-everyone started buying everything in sight. 🛒📈

CME FedWatch data showed expectations for a quarter-point cut in September jumping to 83%. U.S. equities and crypto rallied harder than a football team winning the Super Bowl. And guess who was leading the charge? Yep, AAVE. 🏈🔥

WLFI Exposure: The Plot Twist No One Saw Coming 🌀

Oh, and let’s not forget Aave’s stake in World Liberty Financial (WLFI). Back in October 2024, WLFI proposed launching its own Aave V3 instance on Ethereum mainnet. As part of the deal, AaveDAO got 20% of WLFI’s protocol fees and 7% of its governance tokens. Cha-ching! 💸✨

Analyst Simon pointed out that if WLFI’s token starts trading at a $27.3 billion valuation, Aave’s share could be worth around $1.9 billion. That’s more than a third of Aave’s current fully diluted valuation. So maybe investors are only now realizing how much free money they’re sitting on. 🤑💡

Technical Analysis Highlights (For the Nerds) 📊

- According to CoinDesk Research, AAVE climbed from $297.75 to $353.22-a whopping 18.65% increase-in 24 hours. Confidence in Aave’s expansion strategy? Check. 📈💪

- Price movements were wild, fluctuating between $294.50 and $356.60. The biggest spike happened when trading volume hit 340,907 units-way above the daily average of 102,554. Someone clearly forgot to tell these people it’s summer vacation. 🏖️📉

- Sustained buying pressure pushed AAVE from $349.61 to $353.79 in the final hour. Volumes consistently exceeded 3,000 units at key levels, suggesting institutional players are sneaking in like ninjas. 🥷📊

And there you have it, folks. AAVE’s 19% surge explained in all its chaotic glory. Now go forth and invest-or don’t. Either way, enjoy the ride. 🎢💸

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- The Best Actors Who Have Played Hamlet, Ranked

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2025-08-23 18:12