Aave, a prominent player in the world of decentralized finance (DeFi), plans to implement a new system for adjusting fees, with the goal of enhancing their underlying economic structure.

This action supports larger initiatives aimed at maintaining longevity and generating value within the Aave network.

Aave’s Fee Switch Initiative

January 4 saw Stani Kulechov, founder of Aave, suggest a plan for implementing a fee switching mechanism. This idea is designed to improve the management of Aave’s income streams by allowing the Aave Decentralized Autonomous Organization (DAO) to modify how fees are gathered and allocated.

These types of systems are often found in Decentralized Finance (DeFi) environments, where they generally distribute rewards to token owners and those who stake their tokens, by sharing out transaction fees.

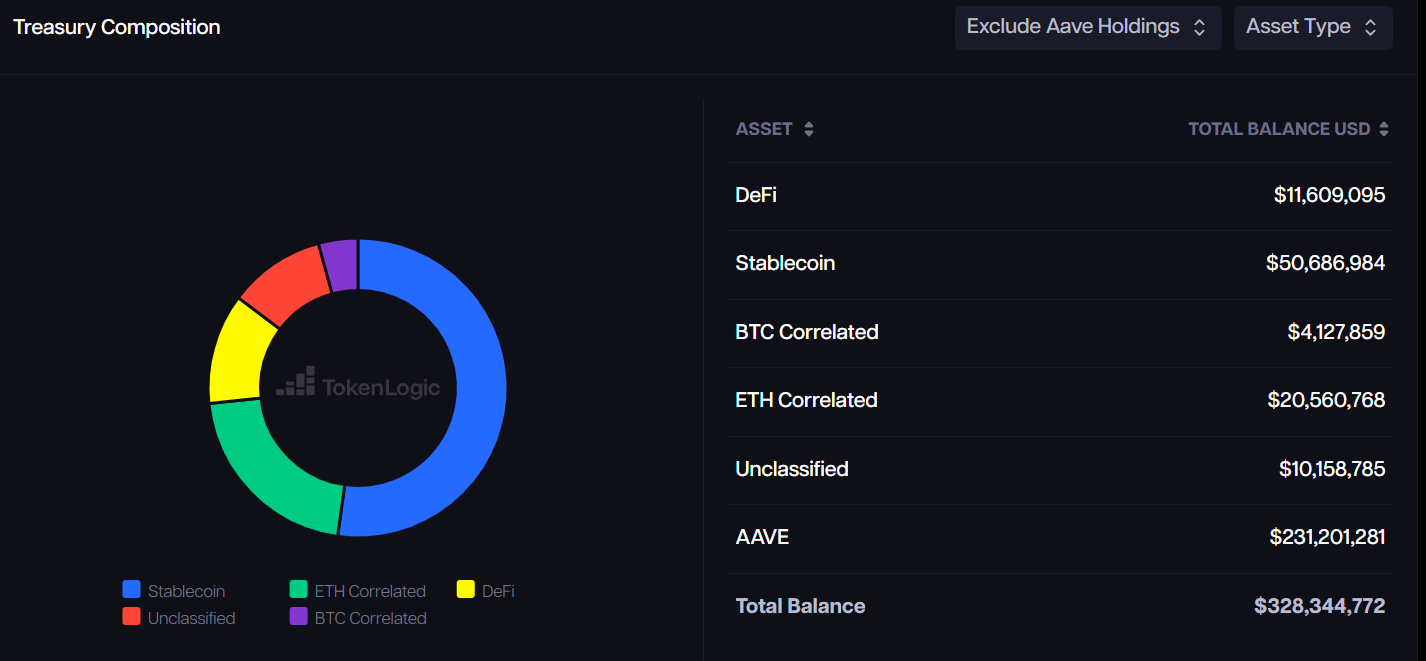

Aave’s strong financial position underpins this endeavor. The organization’s treasury contains approximately $100 million worth of assets that aren’t native to the platform, such as stablecoins, Ethereum, and various other cryptocurrencies. In addition, when AAVE tokens are included in the calculation, the total value surpasses $328 million, as per TokenLogic’s analysis.

Last year, Marc Zeller, founder of Aave Chan, initially proposed the concept of a fee switch, and more recently reiterated its imminence. As per Zeller’s statements, Aave’s earnings exceed its operational costs substantially, making this transition not just feasible but strategically advantageous.

If your protocol’s treasury resembles this setup and the DAO’s total income exceeds its operating expenses (including incentives) by more than double, according to Zeller, it’s not a matter of ‘if’ but rather ‘when’ the Fee Switch will be activated.

Aave stands out as the foremost Decentralized Finance (DeFi) lending system, offering users a variety of decentralized loaning and lending opportunities. As per DeFillama’s statistics, an impressive sum exceeding $37 billion in assets is secured within this platform.

Aave’s USDe-USDT Proposal Sparks Criticism

Currently, the Aave community is considering a controversial plan to connect Ethena’s USDe, a synthetic stablecoin, with Tether’s USDT. In simpler terms, they are looking at a proposal that might tie the USDe stablecoin from Ethena with Tether’s USDT.

By adopting Aave’s pricing feeds, we’ll make USDe’s value mirror that of USDT. This move will replace the current Chainlink oracle. The aim is to minimize risks related to price volatility and unnecessary liquidations due to unfavorable market movements.

USDe distinguishes itself from conventional stablecoins such as USDT by utilizing derivatives and digital currencies like Ethereum and Bitcoin instead of traditional fiat reserves. As per DeFillama data, USDe is currently the third-largest stablecoin, trailing behind USDT and USDC.

Although there’s strong backing for the plan, certain community members voice concerns about potential conflicts of interest due to advisors who worked on the proposal having connections with Aave and Ethena. Some critics, like ImperiumPaper, recommend that these advisors step aside from the process to maintain objectivity.

On Ethena’s Risk Committee, where LlamaRisk serves, there is a monthly remuneration provided. Ethena initially brought in Chaos to assist in creating and refining the risk structures that Ethena employs. It has been suggested by Imperium Paper that both parties, being part of the committee, should abstain from supervising USDe parameters due to their prior involvement.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 30 Best Couple/Wife Swap Movies You Need to See

- Persona 5: The Phantom X Navigator Tier List

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

2025-01-05 22:06