As a researcher who has witnessed the evolution of DeFi since its inception, I am consistently amazed at the pace of innovation and growth in this space. The year 2024 was no exception, with Aave leading the charge. Integrating with multiple blockchain networks, introducing groundbreaking updates like V4, and launching GHO—a decentralized overcollateralized stablecoin—Aave has solidified its position as a key player in the DeFi ecosystem.

Looking ahead to 2025, Aave’s plans to expand further into new blockchain networks are nothing short of inspiring. I can only imagine what the future holds for this trailblazing platform.

On a lighter note, it seems that as DeFi continues to grow, so does my need for more coffee to keep up! It’s a small price to pay for being part of such an exciting journey. After all, who needs caffeine when you have the thrill of witnessing financial innovation at its best? 😜

Reaching this significant point emphasizes the crucial part Aave plays in the current reemergence of the Decentralized Finance (DeFi) industry. This sector has experienced swift expansion not only in terms of user adoption but also in the total value secured (TVS).

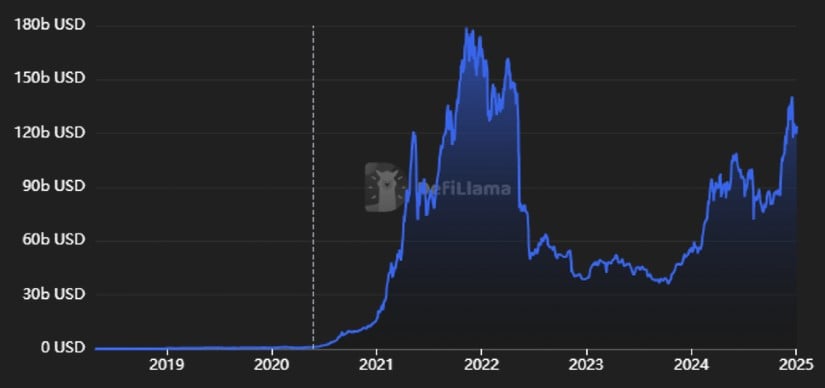

Based on DefiLlama’s data, the overall value locked within the DeFi sector experienced a staggering increase of around 150%, reaching nearly $130 billion in 2024. This substantial growth can be attributed to groundbreaking protocols and what appears to be a shift towards more crypto-friendly policies after Donald Trump’s reelection as U.S. President in November. His win sparked a surge in DeFi token prices, with many tokens experiencing gains of up to 30% right after the election.

Expanding Horizons in 2024

2024 saw Aave expanding its reach substantially by teaming up with prominent blockchain networks such as BNB Chain, ZKsync Era, Scroll, and Ether.fi. These collaborations opened up fresh market opportunities for the protocol, infusing an additional $2.55 billion into its ecosystem.

As a researcher, I am excited to share that we’ve recently unveiled the eagerly awaited Version 4 (V4) update for Aave. This update focuses on promoting flexibility through modularity, minimizing governance burdens, improving capital efficiency, and fostering liquidity advancements.

Furthermore, the introduction of GHO, Aave’s decentralized overcollateralized stablecoin, represents another significant step forward in their strategy. GHO initially launched on Arbitrum and is expected to expand to networks like Base and Avalanche within the upcoming months, enhancing Aave’s multi-chain influence.

Ambitious Goals for 2025

As we move forward to 2025, Aave aims to build upon its recent triumphs. The community has proposed several integration possibilities for the next year with Sonic, Mantle, Linea, Spider Chain, and Aptos. If successful, these integrations would expand Aave’s ecosystem by adding six new blockchain networks.

Drawing from my extensive experience in the cryptocurrency market, I firmly believe that Aave and other decentralized finance (DeFi) projects are poised for long-term growth based on recent developments. The adoption of revenue-sharing mechanisms and improvements in regulatory clarity have the potential to significantly reshape the DeFi landscape. As someone who has closely followed the evolution of DeFi, I’ve seen firsthand how these changes can drive innovation and foster a more stable and secure environment for investors. It’s an exciting time for those interested in this rapidly growing sector.

Security and Stability Drive Confidence

In the world of Decentralized Finance (DeFi) during 2024, one of the notable milestones was an impressive boost in security. According to blockchain security specialist Hacken, there was a decrease of 40% in hacking incidents compared to the previous year, 2023. This reduction can be attributed to progress made in cryptography, updates to protocols, and more robust designs for bridges.

In stark contrast, the decentralized exchange (DEX) sector has seen far fewer security issues compared to the centralized exchange sector. Last year’s losses due to breaches amounted to just over half a billion dollars, which is nearly doubled from the year before.

Market Performance and Industry Impact

The AAVE token, which is native to the Aave protocol, reflected its impressive year-long performance by hitting a peak of $385 in price, a figure last observed in September 2021. Although the token’s value has dipped slightly since then, it still sits approximately 180% above where it was in January 2024.

As a crypto investor, I firmly believe that Aave’s expanding ecosystem, continuous innovative advancements, and unwavering focus on security make it poised to lead the charge in the DeFi sector’s development through 2025 and beyond. As the decentralized finance industry broadens its horizons, trailblazers like Aave are not just keeping pace, but are actively spearheading growth and innovation.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Summer Game Fest 2025 schedule and streams: all event start times

2025-01-03 15:48