Does Warren Buffett require assistance in selecting stocks? The premise is absurd. For decades, he has navigated the markets with a blend of intuition and institutional inertia, seldom in need of an outsider’s input. Yet here we are, indulging the fantasy of offering counsel to the man who built an empire on defying consensus.

Buffett, ever the pragmatist, would likely dismiss the idea of “stock picking” altogether, insisting he is a “business picker.” This semantic distinction-like calling a sledgehammer a “precision tool”-masks the same activity. Even so, he has delegated parts of this “business picking” to Todd Combs and Ted Weschler, two men entrusted with steering Berkshire’s capital. But let us entertain this hypothetical: If the Oracle himself asked for a recommendation, which stock would I suggest? The Home Depot (HD), a company that once graced his portfolio and might yet return.

Why Home Depot would make a great Buffett stock

Home Depot warrants consideration as a Buffett stock, not merely because it once occupied that niche in his portfolio, but for reasons that speak to both its resilience and the enduring logic of its business model. In 2009, Buffett sold his stake, a decision that now reads like a historical curiosity. Over the past 14 years, HD’s shareholders have enjoyed a 1,570% return-nearly double Berkshire’s own performance. With dividends reinvested, the figure balloons to 2,370%. Such numbers are not merely impressive; they are a quiet rebuke to the notion that any investor, even one as revered as Buffett, holds a monopoly on wisdom.

The company’s 13.1% operating margin and 31.2% return on invested capital are not mere statistics. They are testaments to a business that operates with the efficiency of a well-oiled machine. Buffett, who once described his ideal holding as a business with “a durable competitive advantage,” would likely appreciate the simplicity of Home Depot’s moat: people will always need to fix their homes. Even as the median age of U.S. homes climbed to 41 years in 2023, the demand for its services remains as predictable as the seasons.

The fly in the ointment

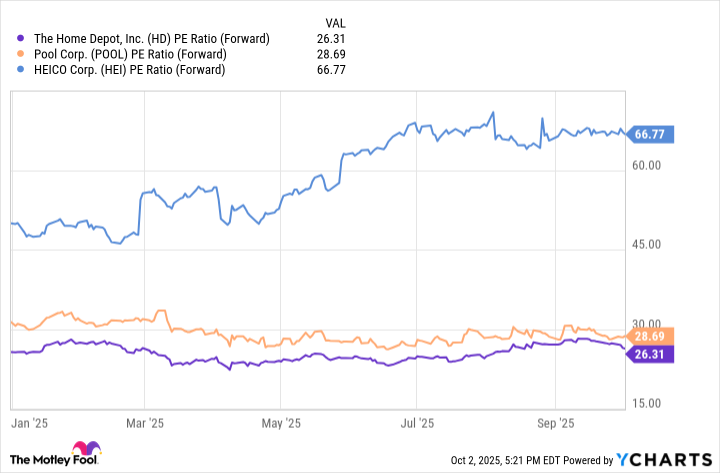

Is Home Depot the perfect Buffett stock? Of course not. No business is immune to the laws of arithmetic or the caprices of the market. Its valuation-trading at a P/E of 26-raises eyebrows. For a man who once professed to “be fearful when others are greedy and greedy when others are fearful,” this might seem like a betrayal of principle. Yet Buffett’s recent acquisitions tell a different story. In Q2, Berkshire added Heico (HEI), trading at 66.8 times forward earnings, and Pool Corp. (POOL), at 28.7. The message is clear: even the Oracle is not above paying a premium for what he perceives as enduring value.

This inconsistency is not a flaw but a feature of the market. Investors are not machines; they are creatures of psychology and circumstance. Buffett’s willingness to bend his own rules-when the reward seems sufficient-reflects the same pragmatism that built Berkshire into a colossus.

Is Home Depot a good pick for every investor?

Home Depot is not a universal solution. Its 2.3% dividend yield may leave income seekers cold, and its modest growth trajectory will disappoint those chasing the next Amazon or Tesla. The stock’s valuation, while reasonable by historical standards, still demands a leap of faith. For the purist value investor, it may feel like a betrayal of orthodoxy. Yet this is the paradox of modern investing: the lines between value, growth, and speculation have blurred into irrelevance.

I do not own Home Depot myself. I find it compelling, but not compelling enough to override my own biases and constraints. Unlike Buffett, I lack the luxury of a $344 billion cash hoard to smooth over misjudgments. Still, I recommend it not as a panacea, but as a reminder that even the most seasoned investors are perpetually students of the game. The market does not reward certainty-it rewards the courage to adapt. 🤷♂️

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

2025-10-06 03:49