One does rather tire of the predictable oscillations of the market, doesn’t one? Especially when a certain gentleman insists on making headlines. President Trump’s first term, you’ll recall, was a positively giddy affair for investors. The Dow, the S&P 500, and the Nasdaq – all positively soaring. A rather vulgar display of prosperity, perhaps, but undeniably effective. A 57%, 70%, and 142% increase respectively. One almost expected a ticker-tape parade. And now, a similar pattern is emerging. Since January 20th, 2025, we’ve seen gains of 13%, 16%, and 22%. It’s all terribly… repetitive.

Of course, it hasn’t been entirely champagne and canapés. The little unpleasantness of early 2020 – that pandemic, you know – caused a bit of a wobble. A 34% drop in the S&P 500. Ghastly. And then, the tariffs. Oh, the tariffs. A two-day plunge of 10.5%. One felt quite sorry for the traders. Though, naturally, one didn’t express it.

The question, naturally, is whether a third such ‘event’ is on the cards. History, as they say, doesn’t exactly repeat itself, but it does have a rather irritating habit of rhyming. And the current valuations? Frightfully high. The Shiller P/E ratio is hovering around 41 – the second highest on record. Mere months from matching the dot-com bubble’s extravagance. One almost expects a bursting sound.

S&P 500 Shiller PE Ratio hits 2nd highest level in history 🚨 The highest was the Dot Com Bubble 🤯

– Barchart (@Barchart) December 28, 2025

The economists at the New York Federal Reserve, bless their diligent hearts, have pointed out that Mr. Trump’s previous tariffs didn’t exactly encourage robust business practices. Declines in productivity, employment, sales, and profits. One wonders if anyone actually thought it would be otherwise. Still, it’s useful to have the data confirmed.

However, and this is rather crucial, a high valuation and questionable trade policies don’t necessarily equate to an immediate catastrophe. One shouldn’t confuse a precarious situation with an imminent one. The market is perfectly capable of remaining irrationally exuberant for rather longer than is strictly logical.

The truly discerning investor, you see, isn’t overly concerned with short-term fluctuations. One doesn’t panic over a few red arrows. One anticipates them. And one uses them as opportunities. Corrections, bear markets, even crashes – they are simply part of the cycle. And, historically, rather short-lived. The COVID crash? Recovered in six months. The tariff-driven dip? One month. The market has a remarkable knack for defying pessimism.

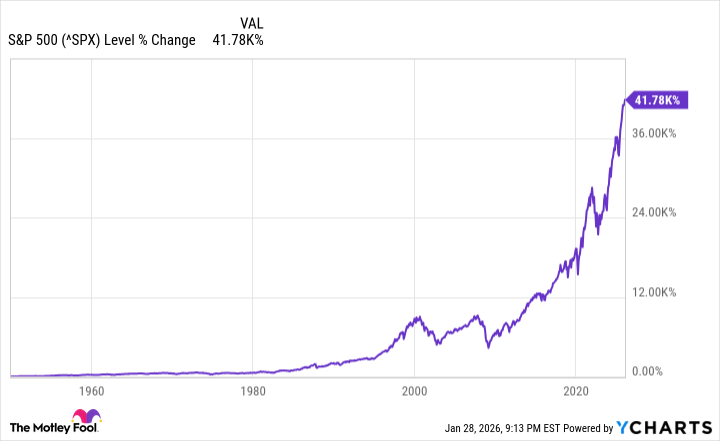

Crestmont Research, those meticulous people, have calculated the rolling 20-year total returns of the S&P 500 back to the start of the 20th century. And guess what? Every single one of those 107 periods generated a positive return. Every one. The market, it seems, has a rather stubborn habit of heading upwards, regardless of the obstacles thrown in its path.

So, if a correction does materialize under President Trump – and one wouldn’t be entirely surprised – the sensible course of action is to maintain perspective, remain optimistic, and position one’s portfolio for the future. After all, a little turbulence is a small price to pay for long-term prosperity. And frankly, it’s far more interesting than a perfectly smooth ride.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-01 14:43