The stock market, as anyone with a passing acquaintance with the financial pages will tell you, is currently putting on a rather dazzling display. Prices are soaring, and one might be tempted to believe the good times will roll indefinitely. However, a few rather insistent little warning flags are beginning to flutter, suggesting that a spot of bother might be brewing. Not a catastrophe, mind you, merely a temporary wobble, but a prudent investor, much like a well-prepared picnicker, is always best to be ready for a shower.

Now, nobody, absolutely nobody, can predict the future with any certainty. Attempting to do so is a bit like trying to herd cats, frankly. But downturns are as much a part of the market’s rhythm as sunshine follows rain. It’s inevitable, you see. Rather than attempting to dodge it altogether – a most undignified spectacle, that – it’s far more sensible to prepare. And how does one do that? Allow me to elucidate.

Will the Market Take a Tumble in 2026?

The short answer, as is so often the case, is a resounding “perhaps.” It’s a bit like asking if Aunt Agatha will bring her prize-winning gooseberry jam to the village fête. One can speculate, but certainty is a luxury we rarely enjoy. However, a couple of market indicators are hinting that a bit of a correction might be on the cards. Not a full-blown crisis, of course, just a temporary adjustment. A gentle nudge, as it were.

There’s the Shiller CAPE ratio, a rather complicated calculation that measures the S&P 500’s performance against average inflation-adjusted earnings over the past decade. It’s a bit like trying to determine the proper amount of cream for one’s tea – a delicate balance, you see. Currently, it’s hovering around the forty mark, which is rather higher than its historical average of twenty to twenty-five. Historically, such elevated levels have often been followed by a bit of a market dip. The last time it was this high was during the dot-com bubble, a period best remembered for its rather extravagant valuations and subsequent deflation.

But the CAPE ratio isn’t the only canary in the coal mine, as it were. Old Mr. Buffett, a chap with a remarkably astute understanding of financial matters, has his own indicator. It measures the ratio between total U.S. market capitalization and GDP. A rather clever bit of calculation, really. He famously warned that if it reached 200%, investors were “playing with fire.” And, as of this writing, it’s hovering just under 223%. A dash alarming, wouldn’t you say?

What Does This Mean for the Prudent Investor?

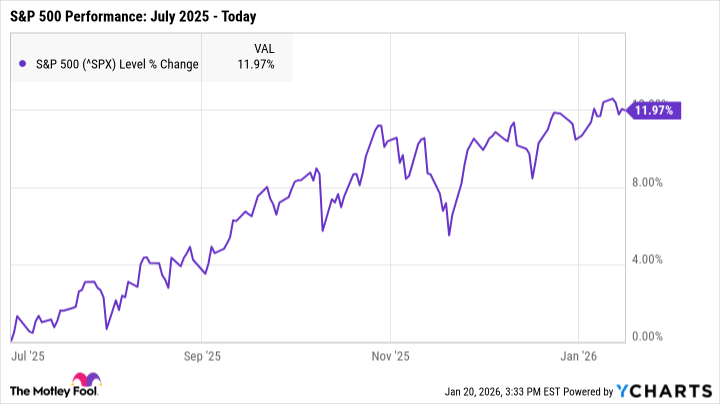

Now, let’s be perfectly clear: no market indicator is foolproof, especially in the short term. These indicators have been at elevated levels for some time, and if one had panicked and sold everything at the first sign of trouble, one would have missed out on some rather handsome gains. The indicator, for example, exceeded 200% in July 2025, and since then, the S&P 500 has surged by nearly twelve percent. A rather pleasant surprise, wouldn’t you agree?

In other words, while these indicators can be a bit unsettling, they don’t necessarily mean one should abandon ship. It’s simply a matter of being cautious about where one invests one’s funds. A bit of prudence never goes amiss, you see.

The Silver Lining for the Astute Investor

Market downturns, while a bit daunting, are also excellent opportunities for the discerning investor. Falling stock prices make it far more affordable to acquire quality stocks, relieving one’s wallet from the burden of record-high prices. A rather agreeable state of affairs, wouldn’t you say?

Rather than waiting for a downturn to decide where to invest, it’s wise to plan ahead and compile a list of stocks that pique one’s interest. That way, one will be ready to pounce as soon as prices fall. Proper research is key, of course, to ensure one is investing in companies that are likely to withstand volatility and deliver positive returns over the long term. Weak companies, as one might expect, are more likely to crash and burn during a downturn. A rather unfortunate outcome, wouldn’t you agree?

Perhaps the best course of action, then, is to ensure one is only investing in strong companies with healthy fundamentals. No matter when the next downturn begins, quality stocks are far more likely to thrive over time. A bit of common sense, really. And a dash of luck, of course. One can never have too much luck, you see.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-22 15:02