Now, the Vanguard S&P 500 ETF, a perfectly respectable sort of investment it is, has become something of a fixture in many a portfolio. And no wonder! The S&P 500 itself, that index of American enterprise, has been doing rather well for itself these past twenty years – nearly 700% return, if you please! – which is a state of affairs that tickles the fancy of any investor with a modicum of sense.

However, a spot of bother has arisen. The index, you see, is becoming frightfully enthusiastic about technology companies. A perfectly good thing, perhaps, if one is feeling particularly bullish about silicon and such, but it does leave one a trifle exposed. Some investors, with a penchant for a more balanced approach, might find themselves yearning for an alternative. And that, my dear reader, is where the Invesco Equal Weight S&P 500 ETF comes into the picture, looking rather like a deus ex machina, what?

A Delicate Imbalance

Most S&P 500 ETFs, including the Vanguard variety, operate on a principle of market capitalization. In plainer terms, the larger the company, the more influence it wields within the fund. A perfectly logical system, one might think, until one considers that a handful of colossal companies now dominate the landscape.

Nvidia, Apple, and Microsoft – a rather imposing trio, wouldn’t you agree? – collectively boast a market capitalization exceeding eleven trillion dollars. They account for over 20% of the Vanguard S&P 500 ETF’s holdings. A considerable weight, and one that introduces a certain… precariousness. Tech stocks, while undeniably lucrative – Nvidia has surged nearly 1,000% recently, a positively dizzying ascent! – are also prone to a bit of volatility.

Many investors turn to S&P 500 ETFs seeking a relatively stable haven for their funds. While it remains a sound long-term proposition, this increasing tilt towards the tech sector does introduce a dash more risk than some might prefer. A bit like trusting a particularly energetic dachshund to guard the family silver, if you follow.

A More Equitable Arrangement

The Invesco Equal Weight S&P 500 ETF, on the other hand, takes a different tack. It, too, tracks the S&P 500, but instead of weighting companies by size, it gives each constituent stock a roughly equal share of the portfolio.

This means no single company – not even the titans of technology – can unduly influence the fund’s performance. It’s a rather democratic approach, really, limiting risk by spreading the wealth, as it were. When tech behemoths are treated the same as the more established, steady-going companies, the fund’s fortunes aren’t quite so reliant on the whims of the market.

Of course, this isn’t without its drawbacks. Limiting risk also means limiting potential gains. When high-performing stocks are given the same weight as slower-growing ones, the superstars can’t lift the ETF’s overall earnings quite as dramatically. A bit like asking a champion racehorse to pull a plough, you see.

A Comparison of Fortunes

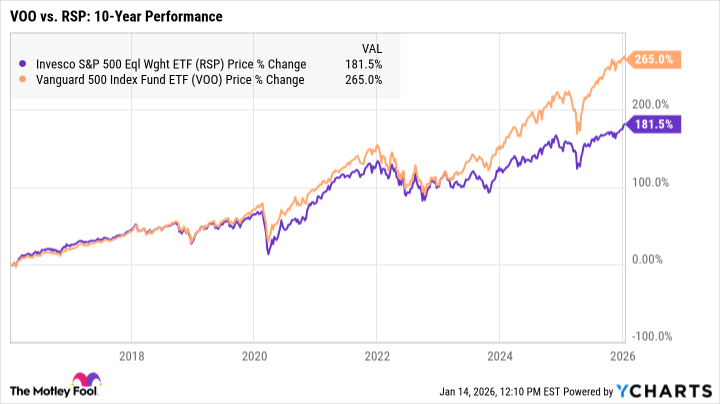

Over the past decade, the Vanguard S&P 500 ETF has, shall we say, rather outpaced the Invesco Equal Weight S&P 500 ETF. A good deal of this advantage, however, has accrued in recent years, fueled by the extraordinary growth of technology stocks. Prior to 2020, the two funds were, for the most part, neck and neck. Should technology continue to reign supreme – particularly with the rise of artificial intelligence, a positively baffling innovation! – we might well see an even wider divergence in their returns.

Note, too, that during the 2022 bear market, the Vanguard fund took a rather substantial hit, its returns nearly falling below those of the Invesco fund at times. Tech stocks, being the excitable creatures they are, tend to experience steeper declines during periods of volatility. And this effect is magnified in a market-cap-weighted fund like the Vanguard S&P 500 ETF.

The choice of which fund to invest in, therefore, depends on your personal risk tolerance and investment objectives. If you’re seeking tech-heavy growth and are comfortable with a bit of a rollercoaster ride, the Vanguard S&P 500 ETF might be the ticket. But for more cautious investors, seeking to minimize risk and maintain a steady course, the Invesco Equal Weight S&P 500 ETF could prove to be the more sensible option. A bit like choosing between a dashing sports car and a reliable family saloon, wouldn’t you agree?

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- EUR UAH PREDICTION

- Gold Rate Forecast

- EUR TRY PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-17 16:33