The motorcar, as anyone with a modicum of sense will tell you, is undergoing a bit of a transformation. Electric contraptions are all the rage, and while some firms are charging ahead like a startled stag, others are taking a more measured approach. This, naturally, presents opportunities for the discerning investor – the sort who appreciates a sound proposition rather than chasing every passing fad. We find ourselves, therefore, contemplating a couple of enterprises that, whilst perhaps not the most obvious choices, possess a certain…je ne sais quoi.

There’s QuantumScape, a company dabbling in the rather futuristic realm of solid-state batteries, and then there’s Ferrari, a name synonymous with speed, style, and a price tag that could make a banker blush. Both, in their own way, are attempting to navigate this electrified landscape. Let us, with a touch of analytical fortitude, examine their prospects.

A Battery of Most Promising Sort

Choosing the ultimate victor in this automotive race is, frankly, a bit like attempting to predict the winner of a particularly unruly steeplechase. However, regardless of which marque ultimately reigns supreme, QuantumScape, with its rather ingenious solid-state battery technology, stands to benefit. You see, these batteries promise a significant improvement over the current lot – faster recharging, a longer range before requiring a spot of juice, and, crucially, a reduction in costs. A dashedly clever bit of code, what!

QuantumScape is, in effect, attempting to achieve the Holy Grail of battery technology – commercial production of solid-state batteries. It’s a bold undertaking, and fraught with peril, naturally, but the potential rewards are immense. The good news is that they appear to have turned a corner, moving from the realm of pure research and development to actually generating revenue. Their new “Cobra” process, a rather snappy name, if I may say so, is a significant improvement over its predecessor, accelerating ceramic processing by a factor of twenty-five. This, my dear reader, is a step toward making large-scale production a reality.

Now, it’s a high-risk, high-reward proposition, and a small position is, perhaps, the wisest course of action. But for those with a taste for adventure, it could prove rather lucrative.

A Prancing Horse with an Electric Heart

When one thinks of Ferrari, images of Formula 1 racing and exquisitely crafted supercars spring to mind. An electric vehicle manufacturer? Not so much. Yet, increasingly, Ferrari is embracing the electric future, with hybrids accounting for a substantial portion of their recent shipments. A rather surprising development, wouldn’t you agree?

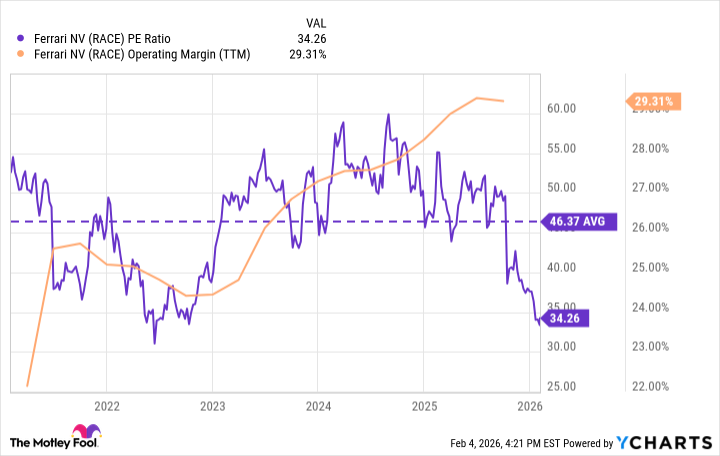

What’s even more remarkable is that, unlike many of its competitors, Ferrari’s profitability has actually increased in recent years. And, as you can see from the chart below, the company is currently trading at a rather attractive discount, considering its earnings. A most agreeable state of affairs.

Ferrari plans to unveil its first fully electric vehicle later this year, and if it applies the same level of craftsmanship and engineering to electric cars as it does to its hybrids, it could quickly establish itself as a leading manufacturer of ultra-premium electric vehicles. A most promising prospect, indeed.

A Spot of Investment Counsel

Both Ferrari and QuantumScape possess the potential to thrive in this evolving automotive landscape. However, Ferrari represents a far more stable investment. It boasts established competitive advantages, pricing power, a robust brand, and, crucially, profitability – a rare commodity in the automotive industry. The stock price is currently in rather good form.

QuantumScape, on the other hand, is a more speculative venture. While its solid-state battery technology holds immense promise, the risks are equally high, with numerous competitors vying for the same technological breakthrough. Ferrari, therefore, is a top pick for investors seeking a reliable automotive stock. QuantumScape, however, will likely remain highly volatile and should be limited to a small position. Research accordingly, and may your investments prove most fruitful.

Read More

- Gold Rate Forecast

- Silver Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- DOT PREDICTION. DOT cryptocurrency

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- NEAR PREDICTION. NEAR cryptocurrency

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Top 15 Insanely Popular Android Games

- USD COP PREDICTION

2026-02-13 02:13