Shares in the venerable Advance Auto Parts (AAP 0.06%) experienced a modest elevation of 10.1% in November, a figure that, while not meriting a ball at Netherfield, might suffice for a quiet supper with a sprig of rosemary. This slight upward turn followed a flurry of analyst commendations, occasioned by the company’s third-quarter earnings announcement in late October. Let us consider, with due diligence, whether this portends a genuine transformation or merely a polite nod to the season’s cheer.

A Perennial Contender in the Race for Value

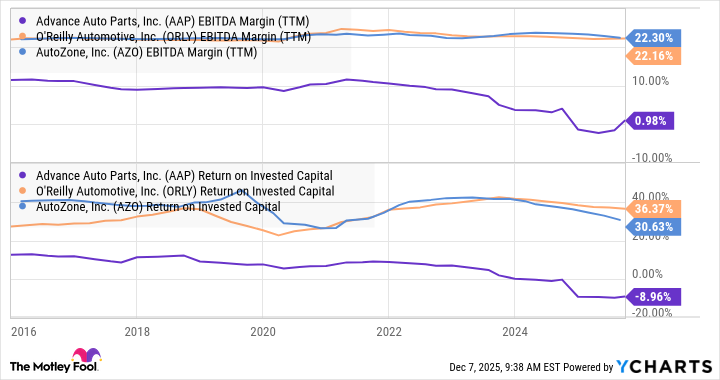

The company, long engaged in a delicate waltz of restructuring, presents an investment case as old as the proverbial O’Reilly Automotive or AutoZone, yet with the poise of a debutante uncertain of her footing. One might inquire, with the curiosity of a well-meaning aunt, why Advance Auto has not yet matched the operational elegance of its peers. Should it achieve such parity, the potential for improvement would be as tantalizing as a first proposal in a drawing room. Yet the charts below, with their melancholic curves, suggest that the dance has been less than graceful.

Indeed, a decade of restructuring has yielded but a flicker of progress, akin to a heroine’s perseverance in a society where fashion and fortune hold sway. One suspects that even the most ardent shareholder might sigh at the tempo.

The Gentleman’s Gambit: A New Sheriff in Town

Enter Shane O’Kelly, the newly appointed President and CEO, whose ascension in September 2023 might be likened to a gentleman of refined taste entering a house long in disarray. His pedigree in supply chain matters, honed during his tenure at HD Supply, suggests a certain competence, though the task before him is as formidable as a quadrille with ten partners and no music.

Yet Mr. O’Kelly’s arrival coincided with a tempest in the form of 2025 tariffs, which have inflated the cost of imported goods. As he observed on the recent earnings call, retailers have responded “rationally” to these tribulations-though one might argue that rationality is a virtue best exercised in the company of a good claret and a warm fire.

Nonetheless, the new regime’s three-year plan-marked by the closure of 700 stores and four distribution centers-suggests a boldness worthy of a country estate’s renovation. The consolidation of facilities and the establishment of “market hub” stores aim to satisfy professional customers with reliable inventory, a strategy that, if executed with the precision of a well-timed curtsy, might yet win favor.

The Road Ahead: A Promising Prospect?

Management’s recent assurances of 1% comparable same-store sales growth and a 2.5% operating income margin in 2025 offer a glimmer of hope, though such figures must be weighed against the shadow of a 0.7% decline in 2024 and a $713 million loss. One might compare this to a heroine’s inheritance-a modest sum, but sufficient to avoid ruin.

And yet, investors, those ever-watchful matrons of the market, are beginning to murmur of a genuine turnaround. Whether this proves to be a fleeting fancy or a lasting alliance remains to be seen. For now, the stage is set, and the audience holds its breath. 🧘♀️

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Silver Rate Forecast

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Why Nio Stock Skyrocketed Today

2025-12-08 11:48