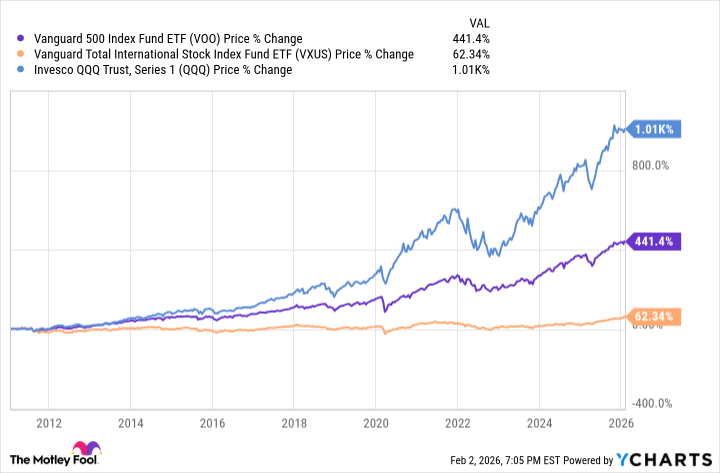

For a decade and a half, the American market has held sway, a glittering spectacle for the world to observe. The S&P 500, a measure of its ambition, has ascended to heights previously unimagined, multiplying itself by a factor of nearly five. The Nasdaq-100, driven by the feverish dreams of the technological age, has surpassed even that, a thousandfold increase that borders on the fantastical. One observes these figures with a certain…detachment. They speak, perhaps, more to the prevailing mood than to any fundamental shift in the earth’s economy.

Elsewhere, the story is less dramatic. The rest of the world’s markets have grown, certainly, but at a more measured pace, a gentle incline compared to America’s precipitous climb. The Vanguard Total International Stock ETF, a vessel carrying the hopes of many nations, has yielded a modest 62% over the same period. Even factoring in the trickle of dividends, a mere 156% – a respectable, if unremarkable, return. It is a landscape of quiet competence, overshadowed by a more boisterous neighbor.

Yet, a subtle shift is occurring. The past year has witnessed a stirring of the international markets, a tentative resurgence. The aforementioned ETF has gained 32.8%, doubling the performance of the S&P 500. The Nasdaq-100, once the undisputed leader, has been left trailing, a proud vessel overtaken by a fleet of smaller, more nimble ships. It is a fleeting moment, perhaps, a temporary correction. But it is a moment worth noting, like a single wildflower blooming in a barren field.

The Whispers of Disenchantment

A curious theme has begun to circulate amongst international investors: the notion of a “sell America” trade. It suggests a growing disenchantment, a quiet withdrawal of capital. If this trend were to solidify, it could lead to a selling of American assets – the dollar, government bonds, and, of course, the shares that have fueled this long bull market. One suspects that the reasons are manifold, a complex interplay of economic anxieties and shifting geopolitical currents.

There is talk of excessive valuations, particularly in the realm of technology. Concerns about American trade policy and the ever-present shadow of national debt. Doubts about the independence of the Federal Reserve, a once-respected institution now viewed with increasing skepticism. These are the murmurs of a world growing weary of American dominance, a world seeking a more balanced distribution of power and prosperity.

The signals are mixed, of course. The yield on the ten-year Treasury has dipped slightly, but remains stubbornly elevated. The price of gold has surged, then retreated, a fickle indicator of investor sentiment. The dollar, while weakened against the euro, remains a dominant force in global finance. But the undercurrents are undeniable. A sense of unease is spreading, like a mist rolling in from the sea.

For the American investor, a degree of portfolio protection against a weakening dollar might prove prudent. Diversification into international stocks, therefore, is not merely a matter of seeking higher returns, but of preserving capital, of weathering the inevitable storms that lie ahead. It is a recognition that no empire lasts forever, that even the most powerful nations are subject to the laws of entropy and decline.

A Broad Canvas: The Vanguard ETF

The Vanguard Total International Stock ETF offers a broad canvas upon which to paint this diversification strategy. It holds over 8,600 stocks, a veritable tapestry of global enterprise, and charges a remarkably low expense ratio. It spares one the tedious task of stock picking, of attempting to predict the future, a pastime best left to fortune tellers and charlatans.

Among its holdings, one finds familiar names: Taiwan Semiconductor Manufacturing, a titan of the chip industry; Samsung Electronics, a purveyor of consumer goods; Roche and AstraZeneca, pharmaceutical giants; Nestle and Toyota, household brands that have become ubiquitous in modern life. But it is the sheer breadth of the portfolio that is most striking, a testament to the interconnectedness of the global economy. TSMC, Tencent, and ASML account for a disproportionate share, yet even these giants are but threads in a larger, more complex weave.

The future of international stocks is, of course, uncertain. But the Vanguard Economic and Market Outlook projects annualized returns in the 4.9% to 6.9% range for the next decade, slightly higher than the forecast for U.S. stocks. It is a modest advantage, perhaps, but it is enough to suggest that the rest of the world is not yet ready to cede its place on the global stage.

Whether the “sell America” trade becomes a long-term trend remains to be seen. But for the American investor, diversification into international stocks is a prudent strategy, a way to protect capital and participate in the growth of the global economy. And the Vanguard Total International Stock ETF offers a simple, low-cost way to achieve that goal. It is a quiet diversion, a subtle acknowledgement that the world is larger, more complex, and more unpredictable than we often imagine.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Best Actors Who Have Played Hamlet, Ranked

- Games That Faced Bans in Countries Over Political Themes

2026-02-05 13:12