The markets, like vast orchards, are dominated by a few ancient, gnarled trees. Vanguard, State Street, BlackRock – their branches spread wide, casting long shadows. One assumes the sun shines only upon them. Yet, even in the most established groves, a slender sapling can, with a little light and a determined root system, reach for the heavens. This is the story of one such tree.

Perth Tolle, a former custodian of wealth at Fidelity, conceived of a simple, almost forgotten truth: freedom, in its various forms, is not merely a moral imperative, but a potent economic force. She founded Life & Liberty Indexes on this premise – that nations embracing personal, political, and economic liberty would, over time, prove more fertile ground for investment. It felt less like a financial strategy and more like a hopeful observation of the human spirit.

In 2017, the Freedom 100 EM Index was born. Tolle presented her vision to the established houses, seeking their patronage. The response, predictably, was a polite deferral. They saw no immediate advantage in nurturing a wildflower amidst their cultivated roses. Alpha Architect, however, possessed a different sensibility, a willingness to cultivate the unexpected. In 2019, the Freedom 100 Emerging Markets ETF (FRDM +0.18%) debuted, a small, quiet bloom in a vast and often indifferent landscape.

The Architecture of Freedom

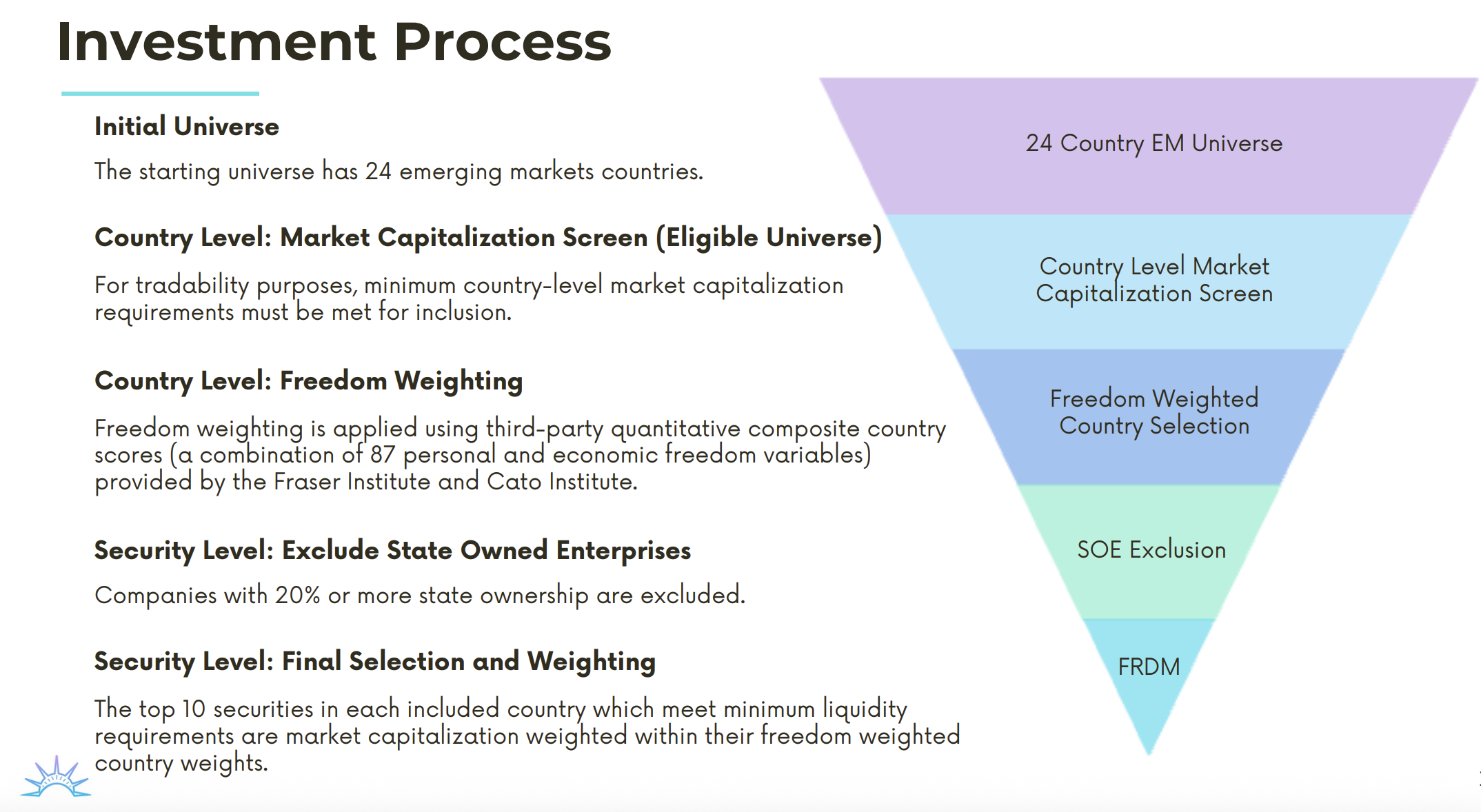

The construction of this index is elegantly simple. Eligible emerging economies, some twenty-four in number, are assessed across eighty-seven variables, a meticulous accounting of freedom’s many facets. The criteria are not abstract ideals, but concrete realities: the prevalence of violent crime, the integrity of the legal system, the quality of monetary policy, the very air that a business breathes. State-owned enterprises, those monuments to a different era, are wisely excluded; their motivations are rarely aligned with the pursuit of genuine value. The resulting portfolio is a reflection of opportunity, weighted by market capitalization, but tempered by a fundamental belief in the power of liberty.

It is a subtle but powerful distinction. To seek out those nations most likely to prosper, not simply because of their raw material wealth or burgeoning populations, but because they have created an environment where innovation can flourish and capital can flow freely. It is a wager on the long-term health of the human spirit, and, as it turns out, a remarkably prescient investment strategy.

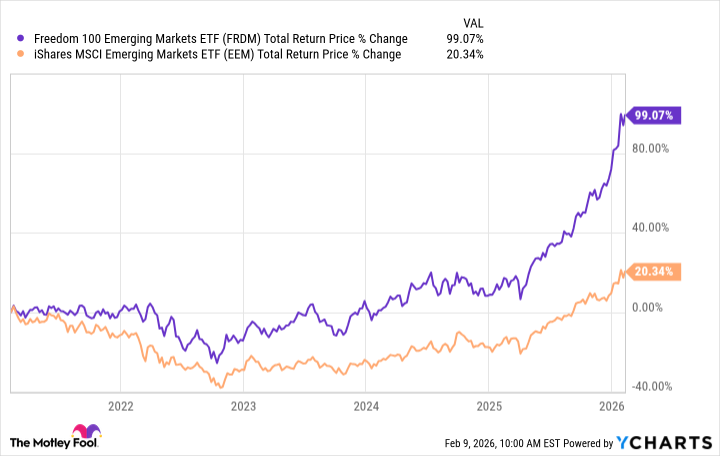

And the results speak for themselves. Over the past five years, the fund has yielded a total return of 99%, nearly five times that of the iShares MSCI Emerging Markets ETF (EEM +0.43%). A remarkable performance, especially considering the prevailing winds. For years, the conventional wisdom held that a tilt towards quality – towards companies with strong balance sheets and sustainable business models – would inevitably lead to superior returns. Yet, the major indexes have stubbornly refused to confirm this hypothesis.

The Freedom 100 Emerging Markets ETF has proven that it is possible to have both. To select winners and avoid losers, not through arcane algorithms or complex predictive models, but through a simple, unwavering commitment to the principles of freedom and opportunity. It is a testament to the power of a well-defined strategy, executed with discipline and conviction.

Investors have begun to notice. Assets under management have grown to approximately $2.5 billion. It may never rival the behemoths of the industry, but its performance record stands as a beacon of hope, a reminder that even in the most crowded of markets, there is always room for a little bit of light. A quiet bloom, perhaps, but one that is undeniably beautiful, and, as it turns out, remarkably resilient.

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Wuthering Waves – Galbrena build and materials guide

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The Best Directors of 2025

- Games That Faced Bans in Countries Over Political Themes

- Most Famous Richards in the World

- The Most Anticipated Anime of 2026

- Top 20 Educational Video Games

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

2026-02-15 17:02