It is a truth universally acknowledged, that a company in possession of a good fortune, must be in want of continued success. And in the intricate world of semiconductor fabrication, where fortunes are made and lost with each technological advance, a prudent investor might well consider the present standing of two prominent contenders: Intel and Taiwan Semiconductor Manufacturing.

For a considerable period, Intel enjoyed a position of unchallenged leadership, a circumstance which, while enviable, often breeds a certain complacency. However, the tides of innovation, as they are wont to do, have shifted, and Taiwan Semiconductor, or TSMC as it is more familiarly known, now occupies a most advantageous position. To declare, therefore, that a consideration of TSMC is the more sensible course for an investment in 2026, is not to disparage Intel, but merely to acknowledge the present disposition of the field.

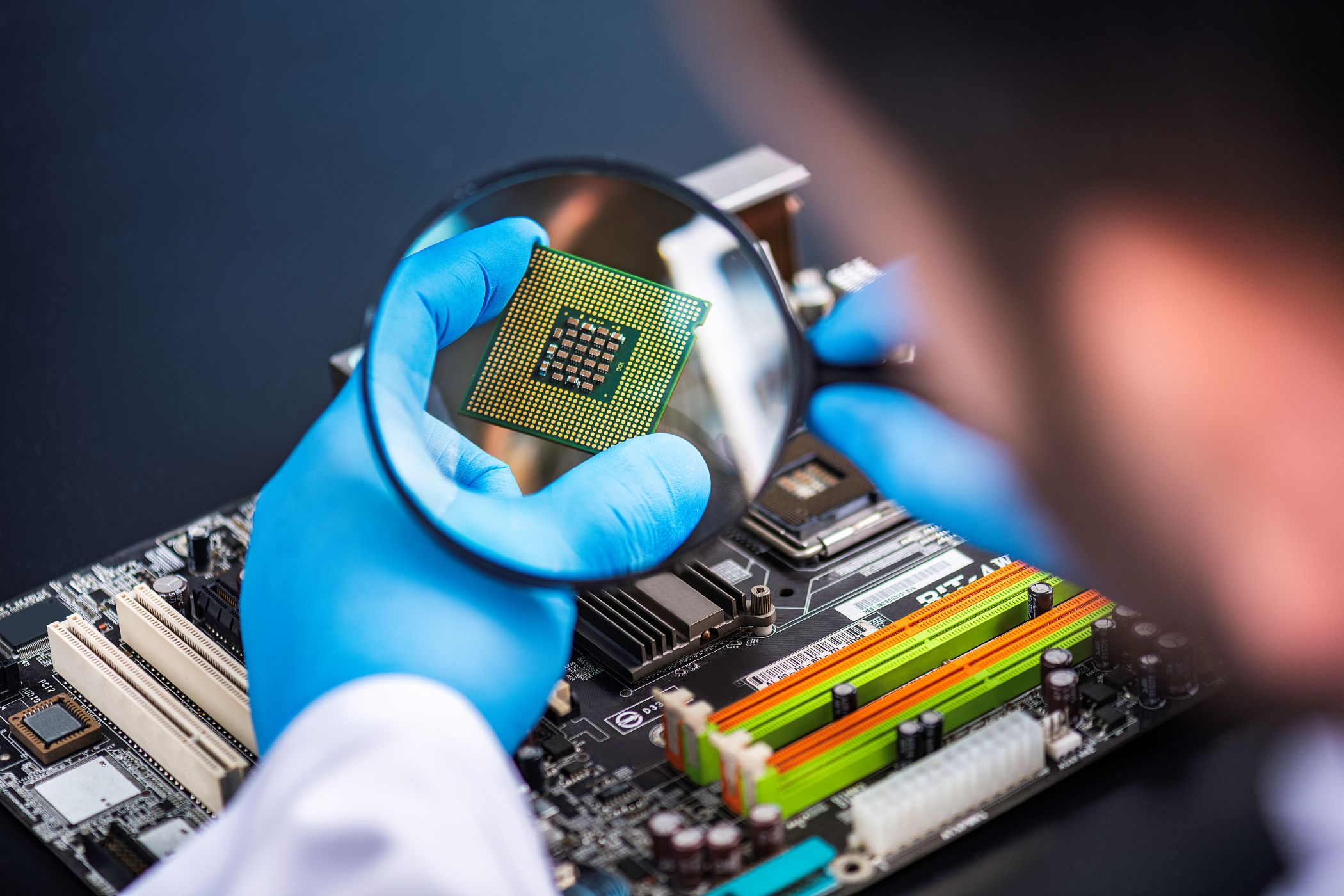

The Island’s Singular Influence

The nation of Taiwan, a place of considerable consequence, holds a sway over the global supply of semiconductors quite disproportionate to its size. It is there, upon that small island, that a full sixty percent of the world’s chips are fabricated, and a remarkable ninety percent of the most advanced varieties. A dependence so absolute, while perhaps convenient in the short term, does present a certain… vulnerability, a matter which any discerning investor would naturally consider.

It is TSMC, of course, which benefits most from this advantageous locale. Their financial reports, recently come to hand, reveal a prosperity most gratifying. For the past year, revenue reached $121.3 billion, an increase of thirty-seven percent over the previous period. Indeed, over the last three years, their growth has been consistent, achieving a compound annual rate of over twenty percent. Their margins, both gross and net, are most respectable – nearly sixty percent and forty-three percent respectively – suggesting a business conducted with both skill and prudence.

Nor should one overlook the dividend, a modest, yet reliable, return of nearly one percent. A gesture of stability, and a clear indication that TSMC is not merely focused on expansion, but also on rewarding those who have placed their confidence in the company. A far cry, one might observe, from the circumstances at Intel.

Intel, despite receiving a considerable influx of support, has experienced a decline in revenue over the past three years. Their margins, at thirty-three percent gross and a mere fraction of one percent net, are a cause for some concern. The suspension of their dividend, while perhaps a temporary measure, does little to inspire confidence. One cannot help but wonder if they have overextended themselves, attempting to compete on too many fronts.

A comparison of the figures is, frankly, most revealing. Intel’s revenue is less than half that of TSMC, their earnings per share a paltry five cents compared to TSMC’s two dollars. And while Intel carries a considerable debt, TSMC boasts a positive net cash position, a circumstance which allows them to pursue opportunities with a degree of freedom rarely enjoyed by their competitor.

Furthermore, TSMC is establishing a presence on American soil, even within Intel’s own territory. The construction of a vast facility in Arizona, and the acquisition of additional land, suggests a long-term commitment to the market. It is a bold move, and one which cannot be ignored.

One is often advised to place one’s bets upon the strongest contender, and in this instance, TSMC appears to possess a considerable advantage. While no investment is without its risks, and the future remains, as always, uncertain, TSMC presents a most compelling case. To choose wisely, after all, is not merely a matter of fortune, but of sound judgment and a clear understanding of the field.

Read More

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-20 01:14