It is a truth universally acknowledged, that a market in possession of ample fortune, must be in want of a correction. Indeed, the present elevation of certain valuations, coupled with an enthusiasm for novel, though perhaps untested, enterprises – these ‘artificial intelligences’, as they are termed – do give cause for a circumspect investor to seek a harbour of safety. Geopolitical disturbances and the ever-shifting sands of tariff policies add to the general air of uncertainty. Yet, to pronounce the prospect entirely bleak would be an excess of melancholy; for strong balance sheets and a continued, if modest, profitability remain within the grasp of many a well-established concern.

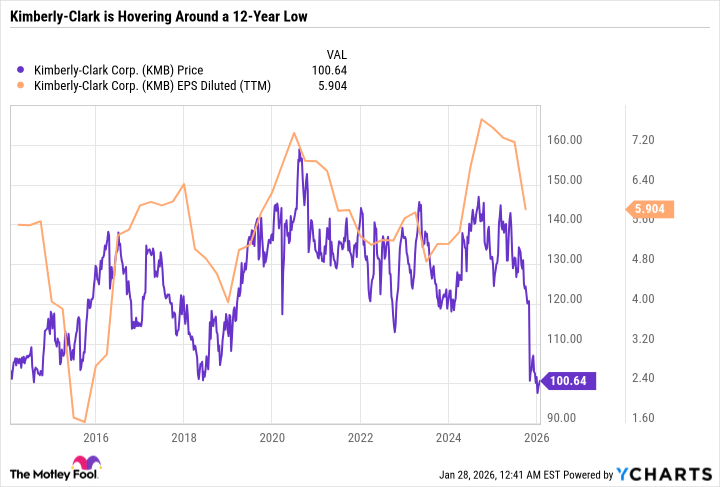

It is in this spirit that one might turn a discerning eye towards Kimberly-Clark, a company which, while not possessing the dazzling allure of its more fashionable contemporaries, has demonstrated a remarkable consistency in fulfilling its obligations to its shareholders. That they have now raised their dividend for the fifty-fourth consecutive year is a testament not to extraordinary growth, but to a steadfast adherence to prudent management – a quality, alas, too often overlooked in the present pursuit of speculative gain.

The current yield of five percent, whilst not extravagant, is a considerable improvement upon the more commonplace three percent of recent years, and warrants a closer examination. One must, of course, ascertain whether this increased payout is sustainable, or merely a desperate attempt to maintain appearances. Happily, a review of their earnings and cash flow reveals no reliance upon debt to meet these obligations – a circumstance which provides a measure of reassurance.

A Venture into New Territories

Kimberly-Clark’s principal business lies in the provision of everyday necessities – papers for wiping, coverings for infants, and comforts for those afflicted by the inconveniences of age. These are not goods which excite the imagination, nor do they command exorbitant prices. Yet, their consistent demand offers a degree of protection against the vagaries of fortune. Of late, however, the company has embarked upon a more ambitious undertaking – the acquisition of Kenvue, a concern formerly attached to the venerable house of Johnson & Johnson.

This venture, whilst potentially advantageous, is not without its risks. Kenvue’s offerings – bandages, remedies for fever, and lotions for the skin – lie somewhat outside Kimberly-Clark’s established sphere. One cannot help but observe a certain boldness in this departure, and a degree of speculation as to whether the two concerns will prove a harmonious match. That Kenvue’s stock suffered a decline following its separation from Johnson & Johnson is a circumstance which ought to give pause to even the most optimistic investor.

Nevertheless, Kimberly-Clark appears confident in its ability to integrate this new acquisition and to extract value from its brands. They speak of synergies and cost reductions, and anticipate a positive impact upon their earnings. Whether these expectations will be realized remains to be seen, but the company’s commitment to a strategy of ‘Powering Care’ suggests a determined effort to adapt to changing circumstances.

The market, it must be observed, has reacted with a degree of indifference to these developments. The stock currently trades at a modest multiple of its future earnings, and the increased yield offers a tempting reward for those willing to accept a degree of uncertainty. It is a circumstance which, to a discerning eye, suggests a potential opportunity.

A Prudent Speculation

To invest in Kimberly-Clark is not to pursue a dazzling fortune, but to seek a degree of security in a world of increasing instability. It is a venture founded not upon speculative enthusiasm, but upon a careful assessment of value. The company’s commitment to a steady dividend payout, coupled with its potential for modest growth, offers a degree of reassurance in a time of widespread anxiety.

One might observe, with a touch of irony, that Kimberly-Clark has already acknowledged the likelihood of less than spectacular results in the coming years, and has tempered expectations accordingly. This honesty, whilst perhaps discouraging to those seeking immediate gratification, is a quality to be commended. It suggests a company grounded in reality, and committed to a long-term strategy of sustainable growth.

In conclusion, Kimberly-Clark presents itself as a suitable, if unexciting, addition to a prudent portfolio. It is a company which, whilst lacking the glamour of its more fashionable contemporaries, offers a degree of security and a reliable source of income. For those seeking a haven from the storms of the market, it may prove a most agreeable harbour.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Exit Strategy: A Biotech Farce

- QuantumScape: A Speculative Venture

2026-01-31 20:54