The pronouncements from Washington, alas, are often less prophecy and more a desperate attempt to rearrange the deck chairs on a listing vessel. This past Wednesday, the Federal Reserve, with a solemnity usually reserved for pronouncements of plague, held rates firm. A disappointment, naturally, to those who fancy themselves seers of the market, and a minor inconvenience to the rest of us. But let us not dwell on what is, but rather what could be. For the market, like a particularly capricious babushka, is prone to sudden shifts in mood.

Let us entertain, for a moment, the unsettling possibility that the macroeconomic winds turn decidedly…brisk. That the central bank, cornered by circumstance and haunted by the specter of inflation, is forced to tighten the screws. A grim thought, to be sure, but a prudent one. And for those who wish to navigate such turbulent waters, there exists a most curious vessel indeed: the Fidelity Dividend ETF For Rising Rates (FDRR +0.35%). A fund, one might say, built not for calm seas, but for the gathering storm.

A Fund That Dances to a Different Tune

This $660 million creation of Fidelity, a sum that could, incidentally, purchase a rather respectable collection of samovars, follows an index of its own devising. An index, mind you, designed to identify those companies whose fortunes rise in tandem with the yield on the ten-year Treasury. A peculiar correlation, one might think, but then, the world is full of peculiarities. It seeks out those dividend-paying enterprises that not only continue to distribute their wealth, but actually increase it, even as the cost of borrowing rises. A most sensible approach, if one considers that true wealth, like a well-fed goose, tends to grow with time.

Some sectors, naturally, fare better in such an environment than others. The real estate and utility companies, those titans of capital intensity, tend to wilt under the pressure of rising rates. It is not surprising, therefore, to find them occupying a mere 4.1% of this fund’s holdings. A small slice of the pie, to be sure, but perhaps a wise omission. For a fund built for rising rates has no need for ballast that drags it down.

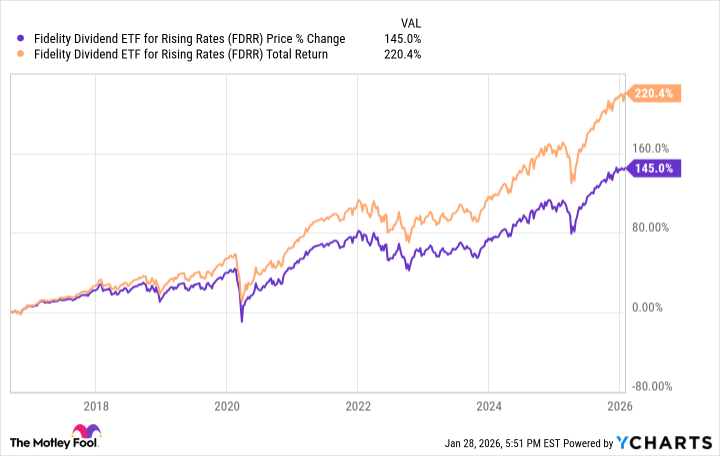

Launched in September of 2016 – a date that feels, in these accelerated times, like a forgotten epoch – this ETF has witnessed a parade of central bank machinations. Cuts, raises, twists, and turns. And yet, despite the prevailing winds of easy money, it has managed to deliver a respectable performance. A testament, perhaps, to its peculiar methodology, or simply to the enduring power of a well-chosen dividend stock. And, one suspects, a healthy dose of luck, for even the most astute trader is at the mercy of the market’s whims.

But how does it fare when the central bank actually tightens the screws? The news, thankfully, is encouraging. Over the past five years, a period marked by eleven rate hikes, this Fidelity fund has emerged as one of the better-performing dividend ETFs. A feat, one might say, akin to navigating a blizzard in a paper boat. Just four rivals, including another offering from Fidelity, managed to outperform it. A testament, perhaps, to the fund’s peculiar resilience, or simply to the enduring power of a well-chosen dividend stock.

A Sector Surprise, or the Case of the Unexpected Tech

One might expect, given its focus on rising rates, that this ETF would shy away from sectors inversely correlated to yields. And yet, a closer inspection reveals a most curious allocation: a full 32% devoted to technology stocks. A significant portion, to be sure, and one that might raise an eyebrow or two. Almost in line with the S&P 500‘s exposure, and far above the average for dividend ETFs. A fun fact, indeed: its weight to Nvidia exceeds that found in a basic S&P 500 index fund. The explanation, one suspects, lies in its focus on stocks that not only pay dividends, but also benefit from rising yields. These mega-cap tech names, flush with cash and boasting pristine balance sheets, are well-positioned to thrive in such an environment. A fortunate circumstance, to be sure, and one that sets this ETF apart from its rivals, who often prioritize dividend streaks or yield at the expense of growth potential.

Indeed, this Fidelity ETF employs a unique, though potentially rewarding, methodology. And it can be accessed at a modest annual fee of 0.15%, or just $15 on a $10,000 stake. A small price to pay, perhaps, for a vessel that might just navigate the coming storm.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- QuantumScape: A Speculative Venture

- 9 Video Games That Reshaped Our Moral Lens

2026-02-02 20:32