A Most Lucrative Comedy: Nvidia & Microsoft

Behold, gentle investors, a spectacle most diverting! The market, that fickle mistress, has, in a moment of uncharacteristic generosity, offered us a pair of jewels at a price that borders on the absurd. It is a scene ripe with opportunity, a comedy of errors where the foolish rush to sell, and the discerning may enrich themselves. We speak, of course, of Nvidia and Microsoft, two companies whose fortunes have, of late, been subject to a most peculiar oscillation.

It is a truth universally acknowledged, that a company in possession of a good fortune, must be in want of a temporary setback. And so it has proven with these two titans. The recent sell-off, a tempest in a teacup if ever there was one, has presented us with a chance to acquire shares at valuations that would have been deemed fantastical but a season ago. Let us not mistake this for prudence, however; it is merely the market indulging in a fit of the vapors.

The Stage is Set: A Valuation Most Favorable

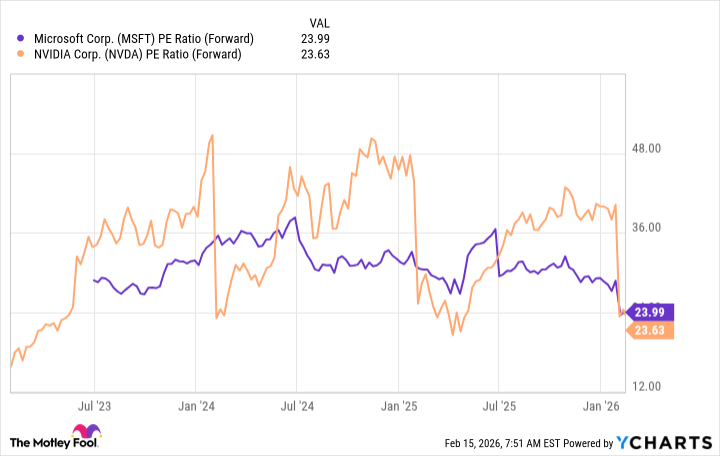

To speak of value is to descend into the tedious realm of numbers, a task I confess I find somewhat irksome. Yet, even I must concede that a measure is necessary. The price-to-forward earnings ratio, that most sensible of metrics, reveals a truth that the more excitable amongst us might overlook: these companies are, quite simply, undervalued. To cling to the past, to judge a company by what it was rather than what it shall be, is a folly worthy of a character from one of my plays.

Indeed, the present moment recalls a similar juncture. Both Nvidia and Microsoft, having endured a brief period of disdain, now stand poised for a resurgence. The depths of the tariff anxieties and the broader tech retreat of yesteryear appear, in retrospect, a most advantageous time to have invested. And so it is now, my friends, a second act offering a similar promise.

The Engine of Progress: AI and the Pursuit of Profit

Nvidia, that purveyor of graphical enchantments, finds itself at the very heart of the artificial intelligence revolution. Its processing units, the engines of this new age, are in constant demand. Each data center erected, each algorithm refined, adds to the coffers of this most fortunate company. And now, the lifting of export restrictions to China promises a further bounty, a stroke of good fortune that even the most cynical amongst us must acknowledge.

Microsoft, though perhaps lacking the flamboyant growth of its rival, is no less a beneficiary of this technological tide. Its Azure cloud platform, expanding at a most impressive rate, provides the very foundation upon which many of these AI endeavors are built. To rent computing power, rather than to own it outright, is a pragmatic solution, and Microsoft stands ready to provide it. Furthermore, the integration of AI into its core software suite promises a steady stream of revenue, a quiet but substantial gain.

Let us not be deceived by the murmurings of fatigue, by the suggestion that AI spending is waning. The pursuit of progress is rarely a smooth affair, and temporary setbacks are to be expected. This recent sell-off, therefore, is not a cause for alarm, but a golden opportunity. To acquire shares of Nvidia and Microsoft at these prices is to secure a one-two punch of growth and resilience, a most judicious investment indeed.

I confess, I find little to fault in this pairing. For those who have missed the impressive ascent of these stocks, now is the time to rectify that oversight. Let the foolish lament the downturn, while we, the discerning, prepare to reap the rewards. The comedy, my friends, is far from over.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- 9 Video Games That Reshaped Our Moral Lens

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

2026-02-22 01:25