It has come to pass, in these times of technological frenzy, that two companies—Nvidia and Palantir—have captured the imaginations, and more importantly, the purses, of investors. Nvidia, a purveyor of silicon and speed, has ascended to a valuation that would make a king blush. Palantir, a weaver of data and dreams, has seen its market capitalization swell with a rapidity that borders on the miraculous. One might be forgiven for mistaking this for a sensible allocation of capital, were one not acquainted with the follies of humankind.

Though both claim a stake in this ‘Artificial Intelligence’ – a phrase uttered with such solemnity as if it were a divine revelation – their roles are, shall we say, distinctly different. To compare them directly is akin to juxtaposing a blacksmith with a poet; both create, but with vastly different materials and intent. However, if pressed to choose a single beneficiary of one’s modest savings, the decision, like a well-aimed thrust, becomes quite clear.

The Artisan of Silicon: Nvidia’s Craft

Nvidia, in its wisdom, provides the very tools that make this ‘Intelligence’ possible. Without its ingenious ‘GPUs’ and networking apparatus, the entire enterprise would remain a fanciful notion, a mere whisper in the digital ether. It is, in essence, the foundation upon which this technological castle is built. And as foundations are wont to do, it has grown exceedingly expensive. Indeed, its valuation has soared with a velocity that suggests a disregard for the laws of gravity, or perhaps, for prudent investment. Last quarter, its data center revenue rose by a most impressive 66% to $51.2 billion, a sum that once represented the wealth of small kingdoms. Three years prior, it was a mere $3.83 billion—a reminder that fortune, like a fickle mistress, can change her affections with alarming speed.

The Weaver of Shadows: Palantir’s Enigma

Palantir, on the other hand, is a more elusive creature. It fashions software, specializing in the analysis of data – a pursuit not unlike attempting to capture smoke with a sieve. Established in 2003, it has recently enjoyed a surge in popularity, largely due to its expanding clientele. For many years, its focus lay primarily with governmental entities—the Defense Department, the CIA, the FBI, and even ICE, all eager to decipher the secrets hidden within their mountains of information.

While the U.S. government remains its most generous patron, Palantir now seeks to broaden its reach into the commercial sphere, attempting to convince the world that it is more than merely a purveyor of surveillance tools. This ambition, while admirable, has also fueled a valuation that borders on the preposterous.

A Question of Prudence: Which to Favor?

Were I compelled to choose between these two contenders for my investment, I would, with a sigh of resignation, select Nvidia. Its offerings are fundamental, essential to the very infrastructure of this ‘Intelligence’. Palantir, however, relies upon the adoption of its software, a far more precarious proposition.

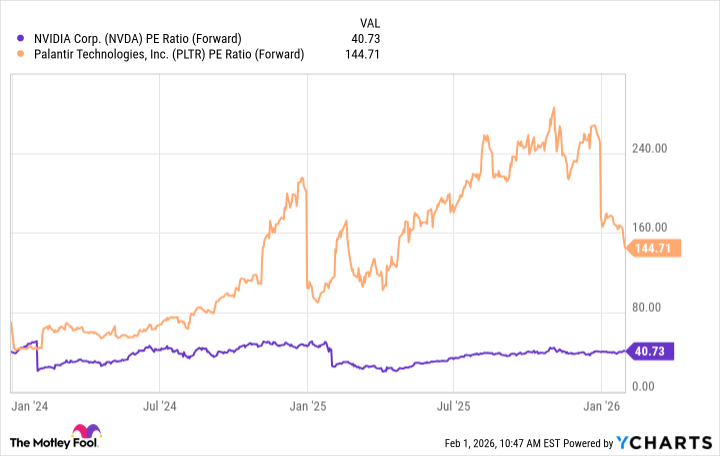

Let us not ignore the chasm that separates their valuations. As of late, Nvidia trades at a somewhat steep 40.7 times its projected earnings, a price that even a seasoned speculator might deem ambitious. Palantir, however, is trading at an utterly extravagant 144.7 times its projected earnings—a figure that suggests a collective delusion, a fever dream of boundless profits. Nvidia is expensive, yes, but Palantir is, quite simply, unreasonable.

The future of this ‘AI boom’ remains shrouded in uncertainty. We know not what forms it will take, or what challenges it will present. Therefore, I would rather invest in a company that focuses on the foundational infrastructure, capable of serving multiple markets, rather than one solely reliant on the fickle winds of this technological fashion. For, as any discerning observer of human folly knows, foundations endure, while fashions fade.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- The Weight of Choice: Chipotle and Dutch Bros

- The Best Actors Who Have Played Hamlet, Ranked

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2026-02-04 12:32