The architects of these financial contrivances demonstrate a peculiar fondness for lineage, as though the worth of an exchange-traded fund were measured not by its merits but by the illustriousness of its progenitors. The Invesco NASDAQ Next Gen 100 ETF (QQQJ +1.00%) bears the air of a well-connected younger sister to the Nasdaq-100, its fortune tied to the fortunes of its elder kin-the Invesco QQQ Trust (QQQ +0.40%) and Invesco NASDAQ 100 ETF (QQQM +0.40%). Yet, as with many a family of means, the true art lies in discerning which heir shall inherit the crown.

The Delicate Art of Financial Courtship

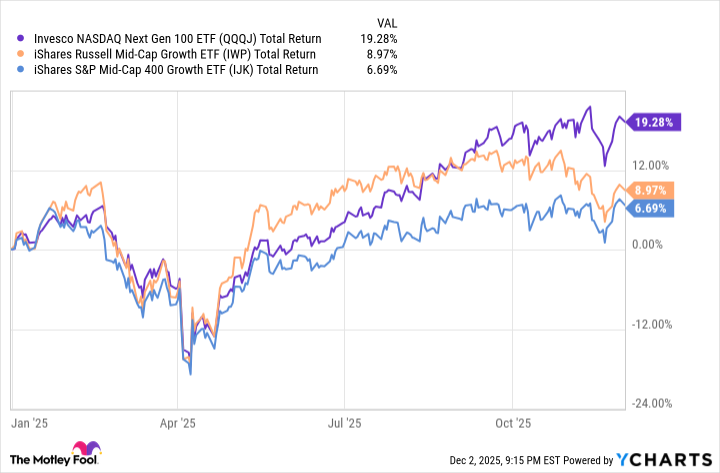

Though the next-gen fund’s lineage is undeniably distinguished, one must not mistake pedigree for prowess. This $723 million offering, classified as a mid-cap growth vehicle, occupies a peculiar position in the market’s great ballroom-neither fully a contender for the dance floor of mega-cap dominance nor entirely resigned to the periphery. Its holdings, though smaller in stature, possess a nimbleness that might yet outmaneuver their stately cousins, provided the tides of fortune favor such agility.

Observe closely: the fund’s composition, with a third of its weight in technology stocks, strikes a delicate balance between deference and ambition. It is a companion to the grander growth funds, yet one might argue it is the more astute partner in a partnership of prudence and potential. Should mid-cap stocks, like the dowagers of the stock market, reclaim their former vigor by 2026, this ETF may yet prove itself the most advantageous match for an investor’s portfolio.

The coming weeks shall test the mettle of this financial alliance. The Nasdaq-100’s quarterly rebalancing, a ritual as predictable as Lady Catherine de Bourgh’s tea parties, will see stocks shuffled between the two funds. Herein lies a subtle stratagem: those ejected from the Nasdaq-100 often find themselves in more propitious circumstances. History, that most reliable of historians, suggests these displaced stocks may yet outperform their newly ennobled counterparts. One might call it the market’s version of a trade-a barter of status for opportunity.

For the discerning investor, the lesson is clear: alliances in finance, like those in society, require both tact and timing. The next-gen ETF, with its blend of modesty and ambition, presents a case for patience. By 2026, it may well emerge as the most agreeable suitor for those seeking a harmonious balance of growth and governance. 📜

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Games That Faced Bans in Countries Over Political Themes

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Best Actors Who Have Played Hamlet, Ranked

- 9 Video Games That Reshaped Our Moral Lens

2025-12-05 23:17