It is a curious paradox, is it not, to speak of ‘cheapness’ in the same breath as ‘artificial intelligence’? The very phrase seems to mock the feverish speculation that has gripped the market of late. Yet, amidst the froth and the boundless optimism, a discerning eye can still detect value – a quiet corner where prudence and potential reside. One finds, increasingly, that the truly exceptional opportunities are not those that shout the loudest, but those that whisper a promise of sustained growth.

I speak, of course, of those established titans, those companies that have weathered many storms and emerged, if not unscathed, then certainly… adapted. They are not the nimble startups, chasing fleeting trends, but rather the enduring estates, capable of cultivating new harvests. And among these, two command our attention: Meta Platforms and Microsoft. Both, members of that illustrious, if somewhat over-praised, ‘Magnificent Seven,’ offer an intriguing proposition: a reasonable price, and a path to expansion in this burgeoning age of intelligent machines. But which, if one were forced to choose, warrants a more considered investment?

The Case for Meta Platforms

Meta, as it is known, is a name familiar to billions. It is the purveyor of those digital salons – Facebook, Messenger, Instagram, WhatsApp – where the world, in all its complexity and vanity, gathers to exchange news, opinions, and, increasingly, advertisements. These platforms, these modern town squares, generate a prodigious income, a steady stream of revenue that has allowed the company to not only sustain itself, but also to venture into new territories, to explore the possibilities of artificial intelligence.

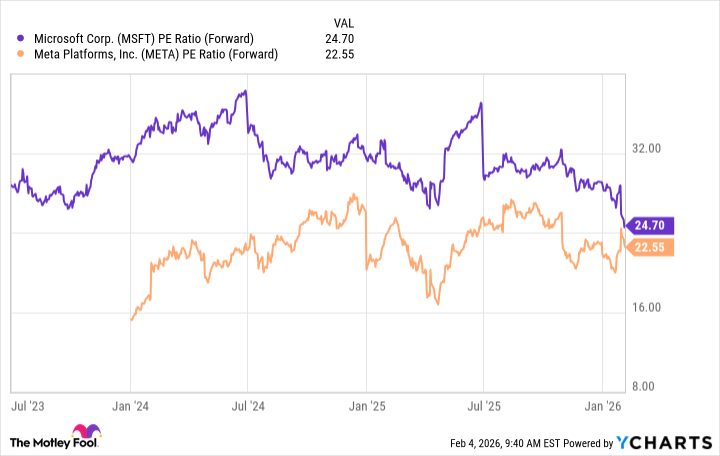

Indeed, Meta has begun to distribute a dividend, a gesture of financial strength, a recognition of the shareholder’s stake. It is a sign, perhaps, that the company has entered a more mature phase, a period of consolidation and responsible growth. The investments in AI – the construction of data centers, the development of large language models – are, one hopes, laying the foundation for future innovations, for new streams of revenue that will extend beyond the realm of advertising. The current valuation, at 22 times forward earnings, suggests a degree of affordability, a hint that the market has not yet fully appreciated the company’s potential.

The Case for Microsoft

Microsoft, a name synonymous with the digital revolution, is a company that needs little introduction. It is the creator of those ubiquitous software programs that have become indispensable tools for modern life. But Microsoft is more than just a software company; it is a cloud computing behemoth, a provider of infrastructure and services that underpin the digital economy. And it is within this cloud business that Microsoft’s AI strategy takes shape.

Through its cloud platform, Microsoft offers a comprehensive suite of AI products and services, from in-house developed chips to high-end processors from Nvidia, and a wide range of tools for building and deploying AI applications. The demand for these services is high, prompting Microsoft to invest heavily in infrastructure and expand its capacity. The recent dip in the stock price, a consequence of short-term investor impatience, may present a rare opportunity to acquire shares at a more attractive valuation. The long-term picture, however, remains bright. As a leader in the cloud, Microsoft is well-positioned to benefit from the unfolding AI story.

A Measured Choice: Meta or Microsoft?

Both Meta and Microsoft, it must be said, are worthy additions to a growth portfolio. They are established businesses with a proven track record of earnings, and both are likely to benefit from the AI boom. Both, too, are currently trading at valuations that appear, at least, reasonable. But if one were compelled to choose, I would lean towards Microsoft.

Meta has, in recent years, traded at valuations similar to, and even lower than, its current level. Even after a strong earnings report, the stock price has remained stubbornly resistant to significant upward momentum. This suggests a degree of stability, a sense that the market has already factored in the company’s potential. Microsoft, on the other hand, has historically traded at higher valuations. The current level, therefore, represents a relative anomaly, a fleeting opportunity to acquire shares at a discount.

Furthermore, Microsoft is already generating tangible revenue from its AI investments. This is not merely a promise of future growth, but a demonstration of current success. It is a company that is not simply adapting to the new reality, but actively shaping it. And in the ever-shifting landscape of technological innovation, that is a distinction worth paying attention to. It is a company that, like a well-tended estate, is poised to yield a bountiful harvest for years to come.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- EUR UAH PREDICTION

2026-02-06 15:12