In a year that began amidst chaos and uncertainty, the semiconductor giant Intel (INTC) found itself entangled in an intricate web of corporate mismanagement and existential dread-until, somewhat abruptly, a figure of reclamation emerged in the form of Lip-Bu Tan, appointed in March to oversee the beleaguered operations previously helmed by the ousted former CEO Pat Gelsinger. This shift, however, merely transported the crisis from one dark corridor to another; the company’s foray into the foundry business-a capital-intensive venture intended to unfurl the curtain of its manufacturing technology to external clients-had yet to bear any fruitful relationships with meaningful customers. As Tan ominously articulated, the specter of an exit from the chip manufacturing sector loomed large if external revenue did not materialize swiftly.

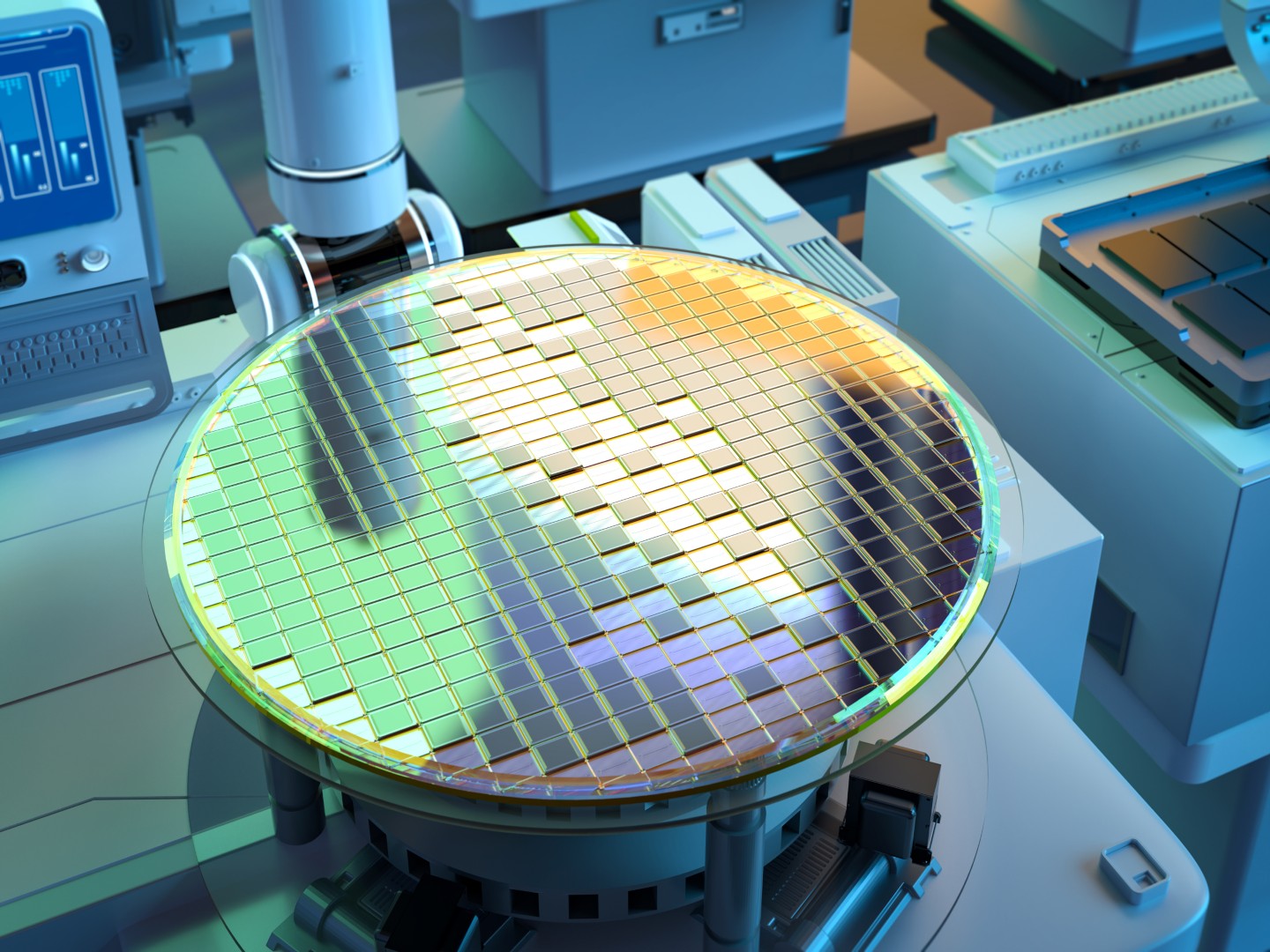

In this bewildering landscape of semiconductor fabrication, where cash is akin to a lifeline, Intel found itself suffocated by the impenetrable demands of scaling its Intel 18A process while simultaneously grappling with the burdensome mechanics of developing the upcoming Intel 14A process-each endeavor linked inexorably to the necessity of external clientele, which would justify the exorbitant investments required. In a strange twist, the release from this existential pressure came, as if by fate, through the machinations of Nvidia (NVDA).

A game-changing deal

The announcement of a partnership between these two titans of technology marks a bewilderingly transformative moment; Nvidia, the undisputed leader in AI chips, has entered into an agreement with Intel whereby both entities shall embark upon the joint creation of multiple generations of products suitable for the data center and PC realms alike. In this absurd theater of commerce, custom x86 chips designed by Nvidia are poised to circulate among various customers, while simultaneously, the convergence of Intel’s CPU technology with Nvidia’s GPU chiplets shall yield composite system-on-chips intended for the distant marketplace.

This unexpected development came hot on the heels of Intel’s perennial push into custom silicon-a desperate strategy to remain relevant in an unyielding milieu. Earlier in the month, the company unveiled plans for a new sector designed specifically to create bespoke semiconductor chips for external parties, with Nvidia seemingly emerging as the inaugural recipient.

Yet, the oddity of this partnership does not cease there; Intel is now tasked not merely with the design but also with the manufacturing of these custom chips for Nvidia. Though explicit timelines and process nodes remain shrouded in an air of vague uncertainty, the confirmation that Intel would “design and manufacture” custom data center and client CPUs incorporating Nvidia technology serves as a beacon-a flickering signal within the fog of its capitalistic endeavors. Indeed, Intel’s acquiescence to these demands reflects an acute need for an external foundry client, a title it has awkwardly acquired.

Moreover, Intel’s hunger for capital to underwrite its foundry aspirations has led to the additional dimension of this arrangement; Nvidia’s commitment to invest $5 billion in Intel, purchasing shares at a price of $23.28 each, offers a simultaneous relief and source of foreboding. The precise allocation of this newfound financial influx remains tantalizingly elusive, yet one can surmise that it will inevitably find its way into the labyrinth of funding now crucial for scaling its latest process nodes.

Cash infusions are adding up

This $5 billion infusion from Nvidia adds to what can only be described as an exasperating but necessary cash accumulation over the preceding month. In the inexplicable nature of bureaucratic funding, Intel secured a deal with the U.S. government, which is to invest $8.9 billion into the enterprise-a sum augmented by previous grants under the CHIPS and Science Act, the obligations of which had been amended and voided under the vicissitudes of bureaucratic negotiation. Intel subsequently confirmed that a payment of $5.7 billion had been received from the U.S. government towards this end in the twilight of August.

In an analogous twist of fate, Softbank also proffered a $2 billion investment in August, mere days prior to the governmental pact. Thus, when one combines the disjointed yet converging streams of financial support from Softbank, Nvidia, and the governmental agency, the sum emerges, astonishingly, as a total cash infusion amounting to $12.7 billion. Further complicating the narrative, recent transactions completed in the sale of a majority stake in Altera netted an additional $3.3 billion, bringing the aggregate monetary support to a surreal and perhaps unsettling $16 billion-albeit presupposing a few bureaucratic tributes tied to the Altera sale remain pending.

These substantiative cash infusions provide Intel with a modicum of breathing space, even while the partnership with Nvidia represents an exhilarating yet disconcerting vote of confidence in Intel’s custom silicon and foundry ambitions. However, as the phoenix emerges from the ashes, one must remember that the arduous journey towards a renaissance may well be tortuous, and the shadows of the past loom persistently over the company’s path forward.

😰

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- DOT PREDICTION. DOT cryptocurrency

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-09-18 22:28