In the grand theatre of economic folly, where the actors strut and fret their hour upon the stage, one cannot help but marvel at the peculiar spectacle presented by President Donald Trump’s tariff and trade policies. As a historian of commerce, I am drawn to these moments when hubris meets economics, much like a moth to a flame-albeit a flame that threatens to consume the very fabric of prosperity.

Consider, if you will, the indices-the mighty S&P 500, the venerable Dow Jones Industrial Average, and the ever-innovative Nasdaq Composite. These are not mere numbers; they are the pulse of an empire, beating with the vigor of speculation and the frailty of overvaluation. The Shiller Price-to-Earnings Ratio, that grim arbiter of financial rectitude, has reached a multiple of nearly 39. Such heights have only been scaled twice before in the past century and a half. And what follows such peaks? A descent, often steep and calamitous, into the abyss of correction.

Yet, for all their vigilance, the custodians of monetary policy-the Federal Reserve, led by the stoic Jerome Powell-appear curiously unconcerned. Except, that is, for one specter haunting their deliberations: stagflation. That ghastly chimera of high inflation, sluggish growth, and elevated unemployment looms larger now than it did before the inauguration of Mr. Trump. It is as though his tariffs, those blunt instruments of economic warfare, have summoned it from the depths of history.

The Blueprint of Economic Misfortune

Let us turn our gaze to the mechanisms of this potential calamity. The Federal Reserve, that august institution, typically operates within well-defined parameters. When the economy booms, it seeks to rein in inflation; when it falters, it stimulates job creation. But stagflation defies such neat categorization. Lowering interest rates risks fanning the flames of inflation; raising them risks suffocating an already gasping economy. It is a conundrum worthy of a Greek tragedy.

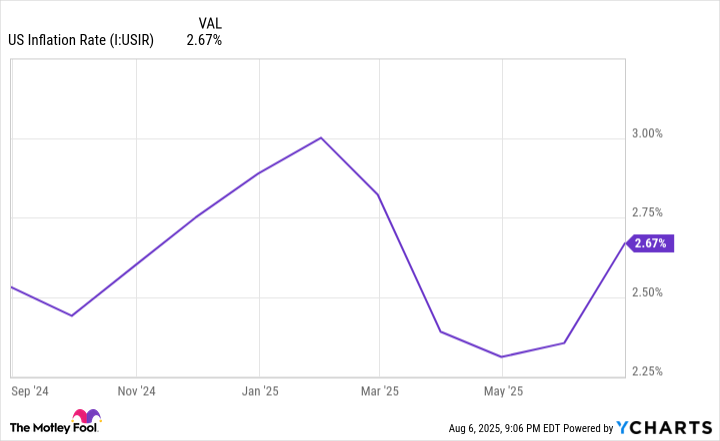

Enter President Trump’s tariffs-a curious concoction of global levies and reciprocal measures aimed at redressing trade imbalances. Yet, as the June inflation report revealed, these policies may be doing more harm than good. The Consumer Price Index rose from 2.35% to 2.67%, a modest increase perhaps, but one that hints at the insidious effects of protectionism. The New York Fed economists, in their Liberty Street Economics report, noted how poorly differentiated tariffs can strangle businesses and consumers alike. Input tariffs, those hidden daggers, raise costs and disrupt supply chains with devastating precision.

And so, we find ourselves confronted with the prospect of weaker job markets and faltering growth. The Bureau of Labor Statistics, with its revisions downward, whispers of fragility beneath the surface. Public companies, once buoyed by optimism, now languish under the weight of punitive duties. Sales decline, profits evaporate, and productivity wanes. It is a tableau of decay, painted with the broad strokes of misguided policy.

The Resilience of Markets: A Historian’s Perspective

Yet, amidst this gloom, there remains a peculiar resilience-a stubborn refusal of markets to capitulate entirely. Chairman Powell, ever the optimist, dismisses stagflation as a distant threat. “We have warned of it,” he says, “but it is not something that we are facing.” One wonders whether this is confidence or denial, but the markets seem inclined to agree.

For all their volatility, the indices possess a remarkable capacity for recovery. Recessions, those periodic convulsions of economic life, rarely endure beyond a year. Expansions, on the other hand, stretch on for half a decade or more. It is a lesson etched in the annals of history: adversity is fleeting, while progress endures.

Loading…

–

Bespoke Investment Group’s analysis confirms this asymmetry. Bear markets, those tempests of despair, last on average less than ten months. Bull markets, by contrast, persist for years. The S&P 500, that barometer of capitalist ambition, always finds a way to rise again, no matter the obstacles placed in its path.

Thus, while the shadow of stagflation looms, it is unlikely to extinguish the light of enterprise entirely. History teaches us that folly, however grand, is ultimately transient. And so, we watch and wait, with a historian’s eye and a satirist’s pen, for the next act in this drama of economics and ego 🎭.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- 9 Video Games That Reshaped Our Moral Lens

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- The Best Actors Who Have Played Hamlet, Ranked

2025-08-09 10:36