Netflix, a name once synonymous with evenings willingly surrendered to the glow of the screen. Thirty-two-and-a-half million households, they say, subscribing across a world that seems, at times, to exist solely within the frame. A curious empire, built on borrowed stories and, increasingly, on the ambition to become the story. One observes, though, that empires are rarely built on contentment.

The share price, as of late, has been…restless. A decline of thirty-eight percent from its peak, a figure that carries a certain weight, doesn’t it? One imagines the analysts, those diligent observers of the market’s whims, murmuring amongst themselves, charting the descent with the solemnity usually reserved for matters of genuine consequence. But what is it, precisely, that troubles the waters? Is it merely the predictable ebb and flow, or something more…substantial?

The Competition of Empty Hours

The company, it appears, finds itself in a crowded room. YouTube, a relentless tide of user-generated content, claims the most attention. Netflix, a respectable third, observes this with what one can only assume is polite resignation. And Disney, a name that once evoked childhood wonder, now stands as a rival, offering its own carefully curated diversions. It’s a peculiar competition, really. A contest not for quality, perhaps, but for the sheer volume of empty hours consumed.

The recent quarterly earnings offered little solace. A miss of $1.10 per share, a small sum in the grand scheme of things, yet enough to elicit a collective sigh from those who track such matters. Revenue did rise, of course, by 17.2 percent. But the operating margin, that delicate measure of efficiency, had shrunk. A dispute with Brazilian tax authorities, a mere $619 million, was blamed. A convenient explanation, perhaps. Or simply the cost of doing business in a world determined to extract its due.

The fourth quarter brought slightly better news – a marginal improvement in revenue and margin. But the market, that fickle judge, remained unimpressed. The share price, predictably, dipped in after-hours trading. One begins to suspect that the market is not interested in facts, but in narratives. And the narrative surrounding Netflix, at present, is one of…uncertainty.

The Price of Dreams

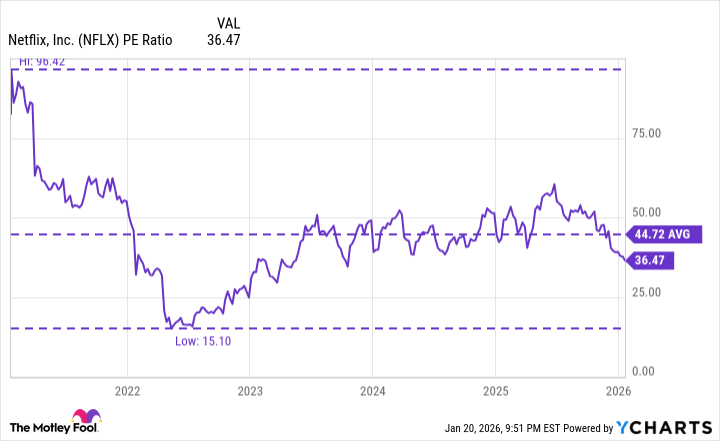

The price-to-earnings ratio, currently at 36.5, is below its five-year average. A promising sign, one might think. But compared to the S&P 500, it remains elevated. And the tech-heavy Nasdaq-100 trades at a slightly lower multiple. It suggests that Netflix, despite its recent struggles, is still valued as a growth stock. A precarious position, given the current climate.

The impending acquisition of Warner Bros. Discovery casts a long shadow. An $82.7 billion wager, a sum that feels…excessive. Investors are understandably skeptical. Mergers, one recalls, are rarely the panaceas they are promised. The history of corporate combinations is littered with failures. The AOL-Time Warner debacle, a cautionary tale of hubris and miscalculation, springs to mind. A grand vision, undone by cultural clashes and a bursting bubble.

The Weight of Expectation

Netflix anticipates closing the Warner Bros. deal within twelve to eighteen months. They’ve adjusted the terms, offering an all-cash transaction. A desperate maneuver, perhaps. Or a pragmatic adjustment. One cannot help but wonder, though, what will be lost in the process. The unique character of each company, the creative energies that once flourished, may well be stifled by the demands of integration.

The market, as always, remains watchful. Cautious. Waiting to see if Netflix can succeed where others have failed. But one suspects that the true challenge lies not in the financial calculations, but in the intangible realm of human endeavor. Can Netflix maintain its creative spark, its ability to captivate and delight, while simultaneously navigating the complexities of a vast and unwieldy empire? It is a question that, for the moment, remains unanswered. And as the credits roll on another quarter, one is left with a quiet sense of… resignation. The signal flickers, but the stream, inevitably, goes on.

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Top 15 Insanely Popular Android Games

- EUR UAH PREDICTION

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-22 12:44