One does tire of the perpetual hysteria surrounding the markets. The collective wisdom of investors, you see, is rarely wisdom at all. It’s more a sort of panicked flocking, occasionally punctuated by moments of startling, if temporary, lucidity. A share price, generally speaking, is a fiction agreed upon by people who haven’t the foggiest idea what they’re doing. But occasionally, just occasionally, the mob gets it spectacularly wrong. And that, my dears, is where the opportunities lie. Though finding them requires a degree of discernment sadly lacking in most financial analysts.

1. Chewy. Pets, Really.

Chewy. Yes, the purveyor of comestibles for furry companions. One assumes most pet owners are aware of its existence. It doesn’t quite rival Amazon in the sheer volume of kibble shifted, but it holds its own, which is more than can be said for many enterprises. They’re anticipating a turnover of $12.6 billion this year – a perfectly respectable sum, and a modest improvement on last year’s figures. Slow, but steady. Like a particularly well-bred tortoise.

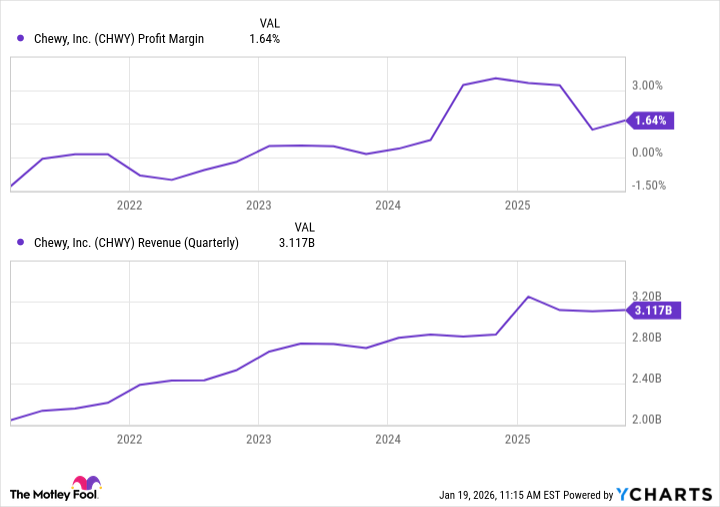

What they lack in explosive growth, they compensate for in predictability. A staggering 84% of their sales now come from automatic deliveries. Autoship, they call it. Ingenious, really. Locking people into a perpetual cycle of pet food dependency. It’s far cheaper to retain a customer than acquire a new one, you see. They’ve moved from 73.3% in 2022 to 84% currently. The numbers are tedious, but the trend is clear. And, naturally, their profit margins are widening. Not wildly profitable, mind you, but certainly heading in the right direction. A 30% drop from their peak? A temporary inconvenience, I assure you.

2. MercadoLibre. South America. Goodness.

MercadoLibre. One suspects most of our readership is blissfully unaware of its existence. And frankly, that’s perfectly understandable. It doesn’t operate in the United States, which, for some, is reason enough to dismiss it entirely. It’s the Amazon of Latin America, apparently. A rather unimaginative moniker, but accurate enough. They dabble in everything – e-commerce, logistics, digital payments. A perfectly competent operation, as far as these things go.

Their third-quarter revenue was up 39% year-over-year, and 49% after adjusting for currency fluctuations. Impressive, if one is inclined to be impressed by such things. They’re in the right place at the right time, with the right solutions. South America is where North America was twenty years ago. A surge in broadband connectivity, a growing smartphone adoption rate… the usual story. Latin America’s e-commerce market is expected to double between 2023 and 2027. All terribly predictable, really. The shares are down 20% from their highs, thanks to a free-shipping promotion that spooked the investors. But a short-term pain for a long-term gain, as any sensible person will tell you.

3. PayPal. The Original. How Quaint.

And finally, PayPal. A perfectly serviceable online payment platform. It’s lost a staggering 80% of its value since its pandemic-fueled peak. One suspects the investors got a little carried away at the time. The COVID-19 contagion forced everyone to shop online, and PayPal benefited accordingly. But the tide always turns, doesn’t it? Cryptocurrencies and digital wallets emerged, and PayPal was suddenly yesterday’s news.

But it still controls nearly half of the online payment space outside of China. A remarkable achievement, really. And it’s still growing. Their revenue was up 7% in the third quarter. Analysts are predicting a growth of just under 5% for the current year. But one suspects they’re underestimating what’s in store. They’ve even started paying dividends – a modest 10% of their net profits, but a gesture of confidence nonetheless. And yet, the shares remain near multi-year lows. One imagines Wall Street will eventually realize that PayPal is doing just fine, despite all the pessimism. Though one shouldn’t hold one’s breath.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-21 00:52