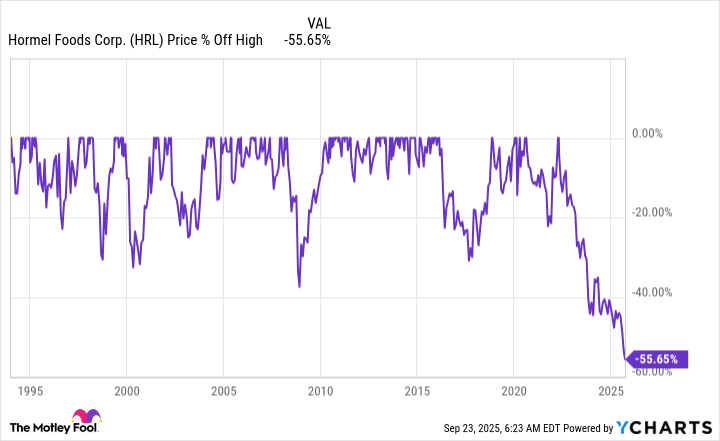

From the heights of prosperity to the depths of despair, the path of a stock is often a mirror to the soul of the system. A consumer staples giant, once crowned with a 4.7% yield and the revered title of Dividend King, now bears the weight of its own decline. Its stock, a shadow of its former self, has fallen 55% from its peak-a testament to the cruel arithmetic of market forces.

Yet here I stand, a lifelong shareholder, tethered to this enterprise as if bound by the chains of fate. I would purchase its shares anew, were I not already entangled. The company’s plight is not merely a financial matter; it is a story of human endurance, of a system that demands resilience from those who dare to invest in its uncertain future.

The Abyss of a Food Maker

The company in question is Hormel Foods (HRL), a name etched into my portfolio since 2017. I have added to my stake as its value withered, a foolish gambit born of hope. Now, it is my most painful loss-a wound that may yet be salved by selling to offset gains elsewhere. The wash sale rule looms like a specter, but I am not the first to dance with such ghosts.

I do not fear missing a sudden rebound, for the road to recovery will be long and arduous. The company’s branded products, once a beacon of consistency, now falter under the weight of shifting tides. Volume in the first nine months of fiscal 2025 slipped 2.5%, while sales rose modestly through price hikes. Yet costs surged faster than revenue, leaving profits in tatters-a 6.5% decline that echoes the struggles of the working class.

The board, in a bid to restore order, has dismissed the CEO and summoned his predecessor, a man of experience but also of uncertainty. Change is inevitable, yet it is a slow, grinding process, much like the labor of the people who fuel this system.

Hormel’s legacy as a Dividend King is not easily discarded. A 50-year streak of annual increases is no mere coincidence-it is a covenant with the shareholders, a promise that even in darkness, the light of dividends persists. The current crisis, though dire, is not the end of the tale.

The Guardian of Dividends

The true guardian of Hormel’s dividends lies not in the boardroom but in the shadows of the Hormel Foundation, which wields 47% of the stock. This entity, a silent partner in the game, channels dividends into philanthropy-a paradox of generosity and self-interest. Its stake ensures the dividend remains a priority, for it is both investor and patron.

The foundation’s influence is a double-edged sword. It shields the company from the whims of Wall Street, allowing long-term decisions to take root. Yet it is also a reminder that even in the realm of finance, the interests of the few shape the fates of the many.

The Glimmer of Hope

The financial reports for fiscal 2025’s first nine months paint a bleak picture, but the third quarter reveals a flicker of resilience. Volume rose 2.7%, a small victory against the tide. Costs still outpace pricing, but the numbers are not as grim as they seem-a lesson in perspective for those who dwell on the worst.

The leadership upheaval may bring short-term turbulence, but the company’s history of perseverance offers solace. Its dividend, a relic of better times, remains a beacon for those who trust in the long game. In a world where fortunes rise and fall like the waves, Hormel’s story is a reminder that even the most battered enterprises can endure.

🛠️

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- Banks & Shadows: A 2026 Outlook

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-09-25 16:04