It has been the prevailing sentiment amongst those engaged in the affairs of Wall Street – a company, one might observe, not always distinguished by its prudence – that prosperity shall continue unabated. Indeed, the principal indexes, most notably the S&P 500, have exhibited a degree of elevation in recent years that might encourage a less discerning observer to anticipate perpetual good fortune. Three times since 1928 has this benchmark enjoyed such sustained advancement, and two of these occasions have transpired within the last seven years – a circumstance which, while pleasing to those presently benefiting, ought, perhaps, to inspire a degree of circumspection.

The Dow Jones Industrial Average and the Nasdaq Composite have followed this upward trajectory, achieving new heights with an almost disconcerting regularity. One cannot help but remark upon the eagerness with which these figures are proclaimed, as though repeated announcement might somehow secure their permanence. Yet, experience teaches us that even the most promising ascent is subject to interruption, and that the path to lasting gain is rarely, if ever, a smooth one.

It is, however, not merely the inherent volatility of commerce that gives one pause. A more singular influence now threatens to disturb the present calm – the Federal Reserve, an institution whose pronouncements are received with a deference bordering on the superstitious. Its role, ostensibly to maintain stability, is often complicated by the very methods employed to achieve it.

A Gathering Disquiet: The Prospects for Wall Street

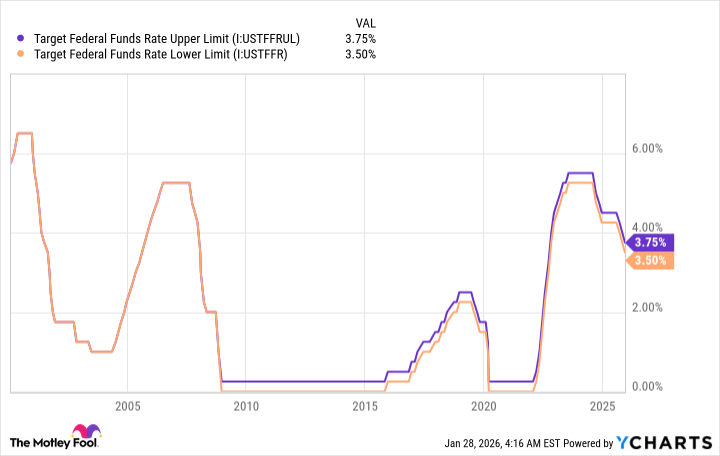

The Federal Reserve, as any informed gentleman or lady knows, is charged with overseeing the nation’s monetary policy, with the laudable aim of fostering employment and maintaining stable prices. A straightforward enough undertaking, one would think, were it not for the complexities of human behaviour and the unpredictable currents of the economic sea. The Federal Open Market Committee, a body of twelve individuals including the esteemed Mr. Powell, relies primarily upon adjustments to the federal funds rate – the overnight lending rate between financial institutions – to navigate these turbulent waters. This rate, in turn, influences the cost of borrowing for businesses and individuals, a mechanism whose effects are seldom immediate or entirely predictable.

The Committee also engages in open market operations, buying or selling U.S. Treasury bonds to further influence interest rates. A delicate balancing act, to be sure, and one requiring a degree of consensus that appears, alas, increasingly elusive. While a degree of disagreement is to be expected in any assembly of independent minds, a pronounced division within the ranks of those responsible for guiding the nation’s financial destiny is a circumstance that cannot be regarded with equanimity.

Investors, one observes, are generally tolerant of errors in judgment, provided those errors are consistent and stem from a unified approach. But a fractured central bank, divided against itself, inspires a degree of unease that no amount of reassuring rhetoric can entirely dispel.

It has come to my attention, through reliable sources, that a considerable divergence of opinion prevails within the Committee. One member anticipates further increases in rates, whilst another foresees a reduction. A most curious state of affairs, and one that suggests a lack of shared understanding regarding the prevailing economic climate.

Indeed, in recent meetings, at least one member has consistently dissented from the consensus decision regarding the federal funds rate. More concerning still, the dissents have, on occasion, been directed in opposite directions – a circumstance that suggests a fundamental disagreement regarding the proper course of action. Over the past thirty-six years, such opposing dissents have been rare, occurring only three times – and two of those instances have transpired within the last three months. A most unsettling development.

The situation is further complicated by the impending conclusion of Mr. Powell’s term as Fed Chair in May of 2026. Whilst this date has been known for some time, it casts a shadow over the proceedings, particularly given the uncertainty surrounding the identity of his successor. One cannot help but speculate upon the potential impact of a new appointment, and whether that individual will be capable of uniting a divided Committee.

Further Considerations

The division within the Federal Reserve and the forthcoming change in leadership represent but one aspect of a more complex picture. Historical precedent, too, ought to give one pause. One often hears it said that reducing interest rates is a positive development for the economy and the stock market, stimulating borrowing, investment, and innovation. A pleasing notion, to be sure, but one that is not always borne out by experience.

Rate-easing cycles, it appears, have often foreshadowed periods of weakness in the stock market. This is not to suggest that the Fed intentionally seeks to depress prices, but rather that rate cuts are often a response to underlying economic concerns. The Committee does not typically lower rates unless it anticipates a slowdown in growth or a rise in unemployment. Thus, a rate cut can be seen as a signal that the economy is not as robust as it appears.

Consider the three rate-cutting cycles that have occurred since the beginning of the 21st century. In each case, the stock market experienced a decline after the first rate cut. In 2001, the market did not bottom out for over 645 calendar days. In 2007, it took 538 days. And in 2019, the market hit its low point 236 days after the first rate cut. A pattern that cannot be ignored.

When compounded with the division within the Federal Reserve and the forthcoming change in leadership, the prospect for Wall Street appears, alas, rather less promising than some might suggest. Whilst the market has historically risen over time, 2026 appears to be shaping up as a particularly volatile and potentially vulnerable period for equities. A discerning investor, therefore, would be well-advised to proceed with caution and to temper any excessive expectations of continued prosperity.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

2026-02-01 12:15