As I delve deeper into analyzing the financial landscape of companies and their approach to cryptocurrencies, I find myself increasingly captivated by the strategic prowess demonstrated by MicroStrategy ($MSTR). This is not just an analysis; it’s a journey through the intricate world of corporate finance, where the old guard meets the new frontier.

By December 2, 2024, the company’s financial statement shows a cautious yet advantageous strategy in utilizing its assets, which makes it an engaging subject of analysis for financial experts on Wall Street as well as Bitcoin enthusiasts.

As an analyst, I’ve delved into the intricacies of Microstrategy’s (MSTR) financial strategy, and it’s fascinating to see how it has outsmarted skeptics, transforming into a blueprint for calculated risk-taking and strategic positioning. Here’s a summary of my findings as analyzed by Jeff Walton.

1. A Robust Balance Sheet: 5x More Assets Than Liabilities

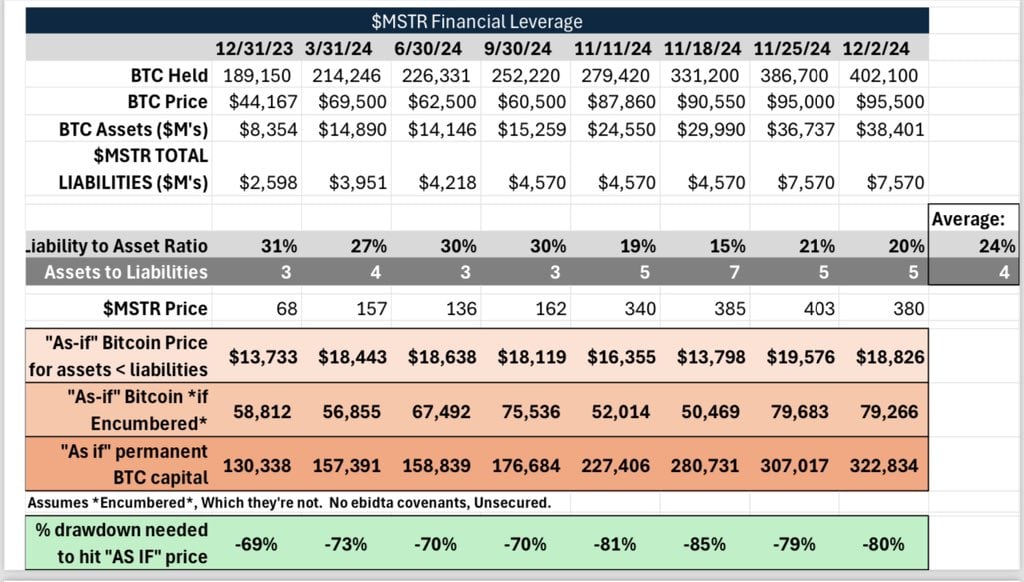

In my recent analysis, I’ve found that Mastercard (MSTR) has assets that are five times greater than its liabilities. This ratio is similar to only borrowing 20% of a home’s value in a mortgage, which is quite conservative in the financial world of corporations. This strong financial position suggests a robust ability to withstand economic downturns and seize future investment opportunities.

2. Leverage Ratios Improving Amid Bitcoin’s Surge

In November 2024, Bitcoin experienced a significant price increase, boosting its value. This rise, along with MicroStrategy’s (MSTR) At-The-Market (ATM) activity, positively affected its leverage ratios. The company’s leverage, calculated as liabilities over assets, decreased from 31% at the end of 2023 to a mere 20% currently. This substantial reduction demonstrates MicroStrategy’s capacity to expand its asset base quicker than its liabilities, providing more space for potential debt issuance in the future if required.

3. Bitcoin’s Safety Margin: The $18,826 Threshold

MSTR’s financial structure maintains robustness amidst possible declines in Bitcoin prices. For MSTR’s assets to dip below its obligations, Bitcoin would have to drastically fall to approximately $18,826 – a steep 80% decrease from the current price. This substantial buffer ensures that the company is not unduly vulnerable to Bitcoin’s fluctuations and alleviates fears of excessive exposure to Bitcoin’s volatility.

4. Debt vs. Bitcoin: A Hypothetical Illustration

If Mastercard’s debt were tied to its Bitcoin holdings (which it isn’t), the debt would equate to only 79,000 out of a total 402,000 Bitcoins. This means that an impressive 322,800 Bitcoins remain unpledged on their balance sheet. Notably, Mastercard’s debt is not secured, can be converted into equity, and does not have limiting conditions, providing the company with exceptional flexibility.

In previous comments, Michael Saylor, the co-founder and current Executive Chairman of MicroStrategy, has underscored this point.

We take a long-term approach and our financial setup mirrors this perspective. Our focus lies on maintaining financial agility while we view Bitcoin as the ultimate rare resource.

5. ATM Issuance: A Source of Permanent Capital

The strategy of ATM equity issuance provides a continuous boost to the capital resources of $MSTR, enhancing its financial stability without incurring repayment obligations, unlike debt. This method ensures that the company’s financial structure remains robust, with minimal liabilities. By adopting this approach, the company can maintain favorable leverage ratios and be ready for potential future borrowing, if required.

6. Leverage Falls as Bitcoin Rises

One captivating feature of Mastercard’s (MSTR) approach lies in its inverse relationship with Bitcoin’s price. As Bitcoin increases in value, Mastercard’s financial leverage ratios decrease at an accelerated pace. This results in a self-reinforcing cycle where the growth of assets enhances the company’s capacity to borrow more or weather market volatility.

7. Dispelling Ponzi Scheme Myths

Critics frequently accuse MasterStream’s approach of being similar to a “Ponzi scheme” or “pyramid scheme,” but the data reveals a contrasting narrative. In comparison to industry titans like Apple, Tesla, and JPMorgan Chase, MasterStream’s leverage ratio stands at a modest 20%, which is significantly lower than those of Apple (85%), Tesla (41%), and JPMorgan Chase (92%).

Compared to the highly-leveraged turmoil at FTX (110%), MSTR’s financial structure seems remarkably underused regarding its potential for leveraging.

Final Thoughts: A Strategic Masterclass in Leverage

MicroStrategy has transformed its Bitcoin assets into a powerful financial tool. With its cautious debt-to-equity ratio, inventive approach towards ATM stock issuance, and aptitude to profit from Bitcoin’s growth, the company stands as a trailblazer in Bitcoin-focused corporate tactics.

The $MSTR balance sheet isn’t just a symbol of the company’s resilience; it’s a response to critics who overlook the intricate strategies. As Bitcoin keeps climbing, MicroStrategy’s financial structure could serve as a guide for other companies aiming to add Bitcoin to their assets while preserving their financial stability.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- Elder Scrolls Oblivion: Best Battlemage Build

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

- Who Is Emily Armstrong? Learn as Linkin Park Announces New Co-Vocalist Along With One Ok Rock’s Colin Brittain as New Drummer

2024-12-04 13:30