In the grand bazaar of modern enterprise, where data flows like champagne at a particularly lively soiree, two gentlemen of industry have donned their brightest waistcoats and taken to the dance floor. The first, a sprightly fellow named Palantir Technologies, has recently polished his gilded lorgnette with a dash of artificial intelligence. The second, Snowflake, has been arranging his data clouds into the most elegant of confections, all while humming a tune about generative algorithms. Both have, in their own peculiar ways, secured a rather enviable position at the head of the queue for AI-fueled growth-though one might wonder, dear reader, which of these two would make the better partner for your portfolio?

Palantir, you see, launched his Artificial Intelligence Platform (AIP) in April 2023 with the air of a man who’d just discovered that his monocle could also serve as a magnifying glass for spotting opportunities. The results? A rather impressive waltz of numbers: revenue leapt 44% in the first half of 2025 to $1.89 billion, while net income more than doubled, like a well-brewed tea growing stronger with each steep. By contrast, in 2023, the same period had yielded a modest 15% growth. “A dashedly clever bit of code, what!” one might exclaim, though one suspects the real magic lies in the 140% surge in new orders during Q2-$2.3 billion worth, enough to make even the most stoic investor’s eyes widen.

Palantir’s customer count, now 43% higher than the previous year, suggests he’s not only charming new acquaintances but also convincing old friends to expand their contracts. Indeed, his top 20 customers contributed 30% more in trailing revenue-a feat akin to persuading a roomful of skeptics to dance a quadrille. And let us not overlook the market itself, which is growing at a 40% annual clip, destined to swell to $153 billion by 2028. Palantir, being a leader in this frolicsome field, is likely to corner a larger slice of the pie than the market’s average guest.

Meanwhile, Snowflake has been busy arranging his data cloud into a most agreeable confection. By infusing AI into its platform, the company has enabled customers to transform documents into searchable data, build chatbots, and generally wrangle their information with the precision of a butler polishing silver. Over 6,100 customer accounts are now using Snowflake’s AI solutions weekly-a number that, while impressive, leaves room for further expansion given his total customer base of 12,000. “AI is a core reason why customers are choosing Snowflake,” remarked management, a statement that sounds less like a press release and more like the murmured approval of a satisfied dinner guest.

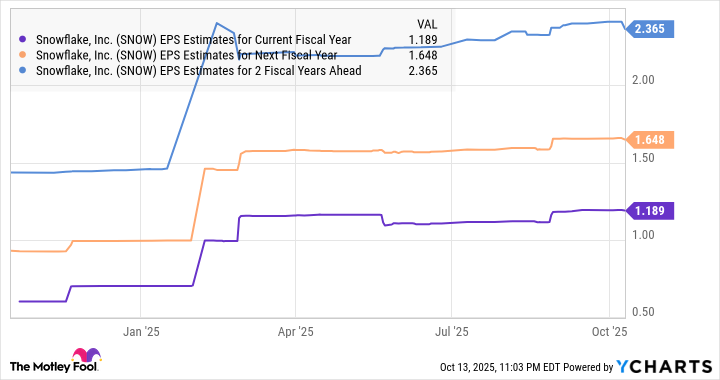

Snowflake’s remaining performance obligations (RPO) have surged 33% to $6.9 billion, a figure that hints at a future where the company’s non-GAAP earnings may nearly double. With an addressable market projected to reach $355 billion by 2029, Snowflake’s prospects are as rosy as a particularly well-blended claret. Analysts, ever the optimists, predict earnings growth of 39% in fiscal 2027 and 44% in 2028-a performance that would make even the most jaded Wall Street pundit raise an eyebrow.

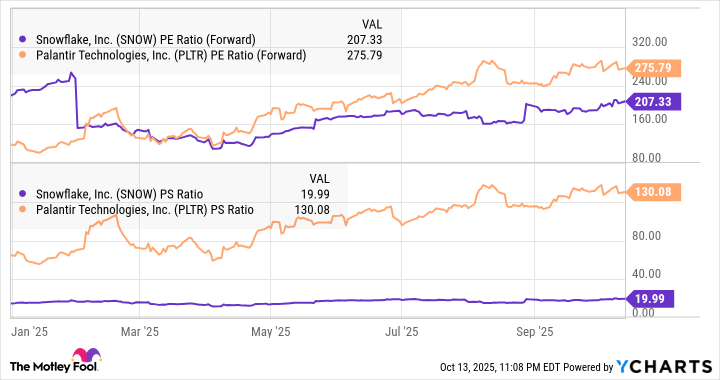

So, which of these two gentlemen is the better bet? Both have danced their way to robust growth, their revenues and earnings blooming like spring flowers after a particularly generous rainfall. Yet, when one considers their valuations, a curious dilemma arises. Palantir, with his sky-high multiples, is the sort of guest who might charm the room but leave one clutching one’s purse a little tighter. Snowflake, by contrast, offers a more measured waltz-its growth prospects no less dazzling, but its price tag a trifle less daunting for those who prefer their investments served with a side of prudence.

In the end, the choice between Palantir and Snowflake is less a matter of right or wrong and more a question of temperament. One is the bold, theatrical performer who thrills with his daring; the other, the quiet craftsman who wins hearts with his steady hand. For those who fancy a dash of risk and a sprinkle of glamour, Palantir offers a feast of potential. For those who prefer their gains served with a touch of decorum, Snowflake’s measured march toward the future may prove the more satisfying choice. Either way, the ballroom of AI is alive with possibility-and the best of it is, we’ve all been invited. 🎩✨

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-10-17 17:47