Behold, gentle readers, a spectacle most diverting! The market, that fickle mistress, doth presently exhibit a slight tremor, a fractional descent from its lofty peak. Yet, beneath this placid surface, a tempest brews, a cloud of uncertainty that threatens to unleash a most boisterous squall. We observe a nervousness, a certain agitation amongst those who traffic in fortunes, and it is not without cause.

The Artificial Wit and its Demands

The current obsession, this ‘Artificial Intelligence’ – a term redolent of hubris, I must confess – hath become a prodigious consumer of capital. These purveyors of digital ingenuity, led by the audacious OpenAI, commit sums that would make Croesus himself blush. They pledge billions to secure the very air that fuels their calculations – computing capacity, leased from the likes of Microsoft and Oracle. A most extravagant enterprise, predicated on the assumption that their clever machines will, in short order, generate revenues sufficient to satisfy these colossal debts.

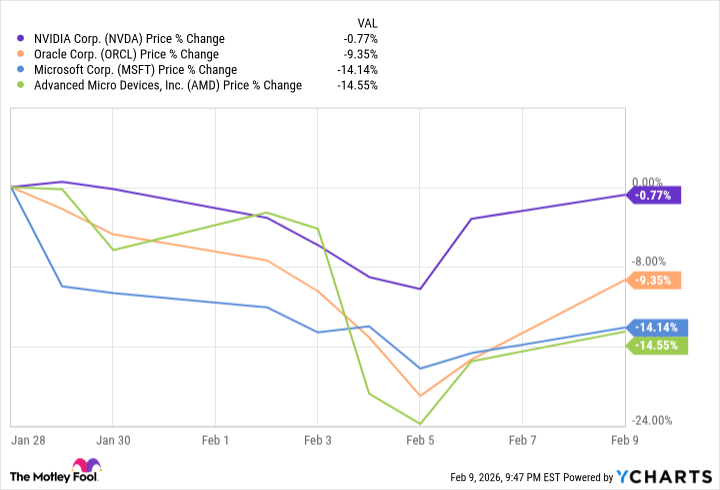

Alas, the arithmetic appears… optimistic. OpenAI, despite its vaunted prowess, currently generates but a pittance compared to its commitments. They rely upon future growth, and the continued generosity of investors. A precarious foundation, indeed. One hears whispers that even Nvidia, a principal supplier of the very chips that power these digital brains, hath paused its courtship of OpenAI. A cooling of affections, shall we say? This, naturally, casts a shadow upon the entire industry, threatening a cascade of disappointment. The chart, as they say, doth tell a tale of woe, revealing the losses suffered by those most closely tied to this ambitious venture.

The Laborious State of Employment

But hark! Another source of disquiet doth present itself. The realm of employment, it seems, is not entirely robust. The number of available positions dwindles, and the recent reports paint a picture of increasing layoffs. Businesses, it appears, are beset by economic headwinds, losing contracts, and even, in some cases, closing their doors entirely. The manufacturing sector, particularly, hath felt the sting of recent policy, a rather blunt instrument intended to foster domestic competition, but which, in practice, seems to have merely raised the cost of doing business. A most curious paradox!

The Inevitable Correction

Now, let us not succumb to undue alarm. These periods of market volatility are as common as springtime showers. The market, like any living creature, experiences cycles of growth and contraction. A decline of 5% or more occurs, on average, once a year. A more substantial correction – a fall of 10% or greater – arrives every two and a half years. And a full-blown bear market – a decline of 20% or more – occurs, thankfully, less frequently.

The market, I confess, appears somewhat overvalued at present, which suggests a correction may be in order. Should such a correction occur, we might anticipate a bottom around 6,300. However, the strength of corporate earnings provides a measure of reassurance. The true danger, in my estimation, lies not in the technological realm, but in the potential for a weakening job market to trigger a broader economic recession. Oracle, already humbled, serves as a cautionary tale.

Therefore, let us regard any forthcoming weakness as an opportunity. History suggests that the market, like a resilient actor, will ultimately recover and reach new heights. The wise investor, therefore, will not panic, but rather, prepare to embrace the inevitable rebound. For in the grand theatre of finance, even the most dramatic downturns are but a prelude to future triumphs.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-10 20:43