It is a truth universally acknowledged, that a prudent investor, possessed of a reasonable fortune, must be in want of a yield. Yet, in these times of frenzied speculation, wherein every knave and fool doth chase the fleeting phantom of ‘growth’, the very notion of a solid, dependable return is oft dismissed as quaint, or worse, unfashionable. We shall, therefore, cast our gaze upon two companies, not for their dazzling innovations, but for the simple, elegant virtue of providing a handsome dividend – a balm to the soul, and a comfort to the purse.

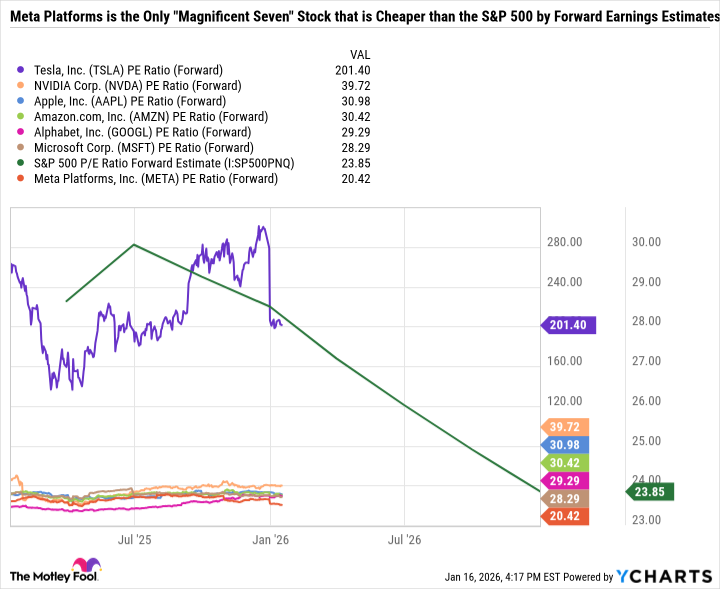

Observe, if you will, the current market. A veritable circus of extravagance! The ‘Magnificent Seven’ – a grandiose title, surely – are lauded as deities, even as their valuations soar to heights that defy all reason. One might be forgiven for suspecting a touch of collective madness. We, however, shall seek out value where others see only hype – a task, I assure you, that requires both patience and a discerning eye.

Meta Platforms: A Player of Shadows

First, we have Meta Platforms, a company that doth amass its wealth by capturing the fleeting attention of the masses. Its ‘Family of Apps’ – Instagram, Facebook, and the like – are, in essence, digital playhouses, wherein humanity doth willingly parade its vanities and vulnerabilities. For the last quarter, these establishments yielded some $50.08 billion in revenue, a sum that would make Croesus himself blush. An operating margin of nearly 50%? A feat of conjuring, I say!

Consider, for a moment, the comparison to Alphabet’s Google. While Google doth command a larger revenue stream, its operating margin of 38.5% pales in comparison. Meta, it seems, is a more ruthless master of its domain, extracting every possible coin from its captive audience. Yet, the market, in its infinite wisdom, hath cast a shadow upon this empire. Why? Because the company, in a fit of ambition, doth dabble in fantastical ventures – the ‘metaverse’, if you will – a realm of virtual illusions that consume capital with alarming speed.

Indeed, the ‘Reality Labs’ division hath already devoured some $13.17 billion, a sum that would suffice to build a small kingdom. The company doth speak of artificial intelligence and augmented reality, but one suspects these are merely excuses to justify the squandering of perfectly good money. Still, the core business remains remarkably robust, and the valuation, at present, is most agreeable. It is the least expensive of the ‘Magnificent Seven’, and the only one trading at a discount to the S&P 500. A most peculiar state of affairs, wouldn’t you agree?

Walt Disney: A Kingdom Restored

Now, let us turn our attention to Walt Disney, a name synonymous with enchantment and merriment. For a time, it seemed the kingdom had lost its way, plagued by lackluster sequels and ill-conceived ventures. But fear not! The company hath rediscovered its magic. The recent film, Zootopia 2, hath surpassed Frozen 2 in global box office earnings, a triumph that doth signal a return to form. The coffers, it appears, are filling once more.

The earnings, though still below pre-pandemic heights, have improved dramatically in recent years. The company is now back in a box office groove, and the upcoming releases of Avengers: Doomsday and Toy Story 5 promise to further swell the treasury. Even the streaming service, Disney+, is now consistently profitable. And let us not forget the Parks and Experiences segment, which continues to boom, despite the prevailing economic headwinds.

At a forward earnings multiple of just 16.8, Disney appears to be an impeccable bargain. The company is investing wisely in both streaming and theatrical releases, expanding its parks, and even planning a new Disneyland in Abu Dhabi. It is a kingdom rebuilding its foundations, and a prudent investor would be wise to partake in its restoration. Throw in a modest dividend yield of 1.3%, and Disney becomes a most attractive proposition.

Thus, we have two companies, each with its own peculiarities, but both offering the prospect of a reliable return. In a world obsessed with fleeting fancies, these are solid, dependable fortunes – a balm to the soul, and a comfort to the purse. Let the speculators chase their illusions; we shall content ourselves with a modest, but assured, prosperity. For, as the playwright wisely observed, “All that glitters is not gold.”

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-20 22:23